Effective today, Hulu is now under the full control of the Walt Disney Company, ending a decade of a sometimes-uneasy partnership between rivals NBC-Universal, 21st Century Fox, Disney-ABC and Time Warner (Entertainment).

Effective today, Hulu is now under the full control of the Walt Disney Company, ending a decade of a sometimes-uneasy partnership between rivals NBC-Universal, 21st Century Fox, Disney-ABC and Time Warner (Entertainment).

This morning, Disney and Comcast, the last two partners in the streaming venture, reached an agreement that will give full operational control of Hulu to Disney, in return for either company having the right to force Disney to buy out Comcast’s remaining 33% interest in the service beginning in 2024. In effect, with Comcast giving up its three seats on Hulu’s board and its veto power, the cable company now becomes a passive partner in the venture. At a Disney-guaranteed value of at least $27.5 billion five years from now, Comcast could eventually walk away from Hulu with at least $9 billion in compensation.

Today’s agreement means Disney will own and control multiple streaming services. Disney today announced it has big plans for Hulu, despite preparing to launch its own Disney+ streaming service and already operating its own streaming platform for ESPN. Disney CEO Robert Iger said Disney+ will now be focused on kids and family-friendly entertainment, while Hulu will be Disney’s platform for adult-focused movies and series. Disney’s recent acquisition of the 20th Century Fox content library and FX’s suite of cable channels gives it plenty of additional content to bring to both of its general entertainment streaming services.

To make sure of a smooth transition, both companies have agreed to a lucrative extension of Hulu’s license to stream NBC-Universal content and networks, as well as a retransmission consent agreement to allow Hulu Live to continue carrying NBC-Universal networks and TV channels until the end of 2024. That will deliver a significant revenue boost to Comcast, which can use the money to help build its own forthcoming streaming platform, launching in 2020.

“We are now able to completely integrate Hulu into our direct-to-consumer business and leverage the full power of The Walt Disney Company’s brands and creative engines to make the service even more compelling and a greater value for consumers,” said Iger in a statement.

NBC-Universal chief executive Steve Burke said in a statement that the deal is “a perfect outcome for us” because the “extension of the content-licensing agreement will generate significant cash flow for us, while giving us maximum flexibility to program and distribute to our own direct-to-consumer platform.”

For consumers, Iger is expected to consider offering a discounted bundled package to Hulu subscribers who also sign up for Disney+. With a combination of Hulu and Disney+, Netflix’s biggest U.S. rival is about to get considerably bigger.

Subscribe

Subscribe CenturyLink is considering getting out of the consumer landline and broadband business and instead focusing on its profitable corporate-targeted enterprise and wholesale businesses.

CenturyLink is considering getting out of the consumer landline and broadband business and instead focusing on its profitable corporate-targeted enterprise and wholesale businesses. HBO

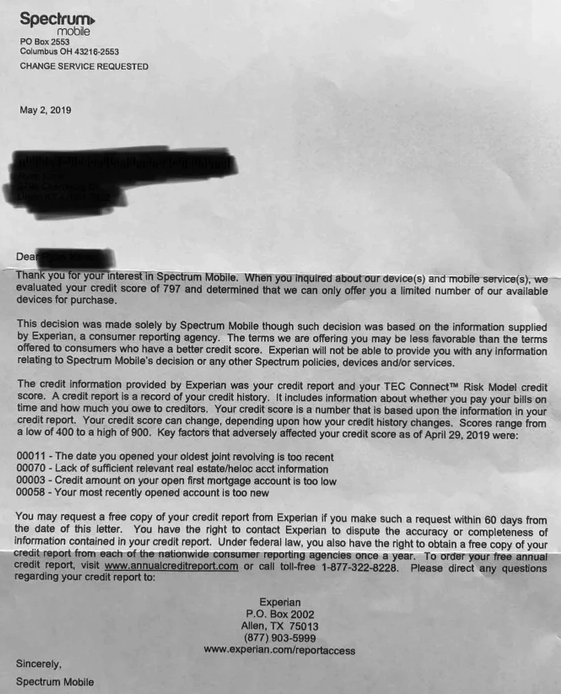

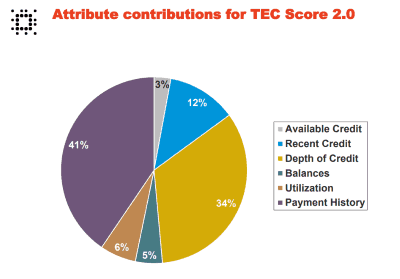

HBO Spectrum Mobile customers who sign up for cell service can expect an inquiry about their creditworthiness, and some customers with near-perfect FICO scores are embarrassed to discover Spectrum considers them too risky, thanks to an Experian credit scoring model developed specifically for utilities, phone and cable companies.

Spectrum Mobile customers who sign up for cell service can expect an inquiry about their creditworthiness, and some customers with near-perfect FICO scores are embarrassed to discover Spectrum considers them too risky, thanks to an Experian credit scoring model developed specifically for utilities, phone and cable companies.

Your cable or streaming TV bill will increase once again as Fox executives told cheering investors this morning it would hike prices for carrying Fox TV stations and its suite of cable networks, including Fox News Channel, Fox Business, Fox Sports 1 and 2, and the Big Ten Network.

Your cable or streaming TV bill will increase once again as Fox executives told cheering investors this morning it would hike prices for carrying Fox TV stations and its suite of cable networks, including Fox News Channel, Fox Business, Fox Sports 1 and 2, and the Big Ten Network.