Spectrum Mobile customers who sign up for cell service can expect an inquiry about their creditworthiness, and some customers with near-perfect FICO scores are embarrassed to discover Spectrum considers them too risky, thanks to an Experian credit scoring model developed specifically for utilities, phone and cable companies.

Spectrum Mobile customers who sign up for cell service can expect an inquiry about their creditworthiness, and some customers with near-perfect FICO scores are embarrassed to discover Spectrum considers them too risky, thanks to an Experian credit scoring model developed specifically for utilities, phone and cable companies.

When you inquired about our device(s) and mobile service(s), we evaluated your credit score of 797 and determined we can only offer you a limited number of our available devices for purchase.

This decision was made solely by Spectrum Mobile though such decision was based on the information supplied by Experian, a consumer reporting agency. The terms we are offering may be less favorable than the terms offered to customers who have a better credit score. Experian will not be able to provide you with any information relating to Spectrum Mobile’s decision or any other Spectrum policies, devices, and/or services.

In practical terms, the letter means this Reddit contributor will be limited to just one line of service on his account.

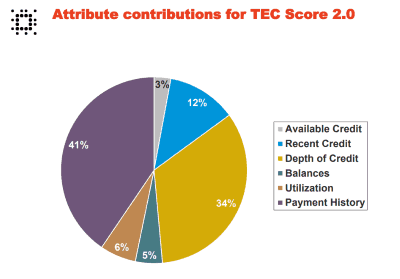

Spectrum Mobile is relying on a special credit risk management product to score its customers. The TEC Connect 2.0™ “risk model” stands for “T”elecommunications, “E”nergy, and “C”able, and was created exclusively for utility and telecommunications companies. It was designed to predict the likelihood you will pay utility and cable bills on time and in full. During times of economic distress, telecom and energy bills often get paid later than mortgages, auto loans, and credit cards. Still, with a score range of 400-900, the recipient’s 797 ranking represents a low credit risk, probably undeserving of a one line limit.

What counts the most towards your TEC Score?

Experian cited four adversities on this individual’s TEC Connect 2.0 report:

00011 – The date you opened your oldest joint revolver is too recent

00070 – Lack of sufficient relevant real estate/HELOC account information

00003 – Credit amount on your open first mortgage account is too low

00058 – Your most recently opened account is too new

That would seem to imply the customer is a relatively young borrower, or someone who closes older credit lines, which can count against your credit score. The report also seems to include conflicting information about any owned property and if it is mortgaged, which might mean the applicant is actually a renter. Recently opened credit accounts will diminish a TEC Score, and having a recent history of opening multiple new accounts could signal you are potentially over applying for credit or are overextended. Even if your FICO score reflects a good credit history, if you are a late-payer of energy or telecommunications bills, your TEC Score will reflect that and expose you to rejection of your application, line limits, and advance deposits.

Critics of Experian’s TEC Connect score note many utility companies do not report or report incomplete payment histories, many accounts are often missing from credit reports, and even those with perfect payment histories and a high FICO score can still run afoul of TEC Connect’s scoring model.

If you receive notice of an adverse credit decision, always take advantage of the opportunity to receive and review your report, free of charge. You are entitled to correct errors and have those corrections sent on to companies like Spectrum Mobile for a credit re-evaluation.

Subscribe

Subscribe

It is SO annoying that there are 2 Fico models one that goes to 850 and one that goes to 900, you can be perfect on one and risky on another, so annoying because you spend time and energy on building your credit.

There are industry specific fico scores for mortgage and auto as well. The latest model isn’t always what is used either. For mortgage the standard is model fanny and Freddie use.