Cablevision may eventually get out of the cable television business.

Cablevision may eventually get out of the cable television business.

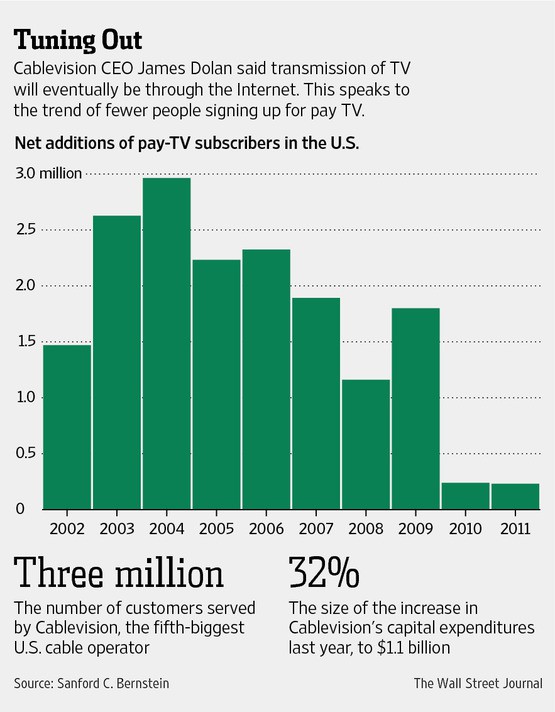

Although industry analysts, consumer advocates, and technology columnists have long proclaimed the era of “cord cutting” is upon us, cable operators have always been in denial the product that got them their multi-billion dollar business — selling packages of television channels — is rapidly becoming obsolete.

But at least one CEO sees the writing on the wall.

If you don’t “ride the wave” you “get eaten by the wave,” declared Cablevision CEO James Dolan.

The Wall Street Journal sat down for a lengthy interview with Dolan, who predicted “there could come a day” when the cable television company quits selling television service, because a growing number of viewers have shifted to online video.

Dolan, like many Americans, isn’t watching television as much as he used to, and admitted that both he and his young children prefer spending their viewing time with Netflix, not Cablevision’s television package.

Jim Dolan

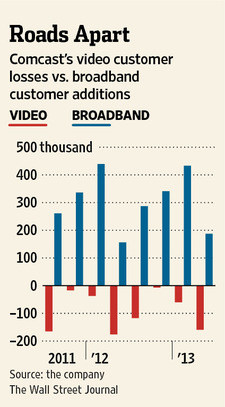

Dolan worries the next generation of television viewers don’t need or want a cable television package with hundreds of video channels. Today’s youth wants fast broadband with on-demand viewing of series, movies, and video clips. The transition may have already started. Cablevision reported Aug. 2 it lost 20,000 video customers over the last three months, many moving to broadband-only service and 11,000 abandoned the cable company altogether.

Dolan believes the industry is setting itself up for obsolescence.

“I don’t want to be saddled with an infrastructure that is as big as the one that I have now,” Dolan told the Journal, fearing the bloated cable television package is becoming too costly and unmanageable.

Instead, Dolan has ordered network upgrades to improve broadband service and help boost the company’s image with customers. Cablevision focused most of its spending on broadband and Wi-Fi service upgrades over the past year, both to meet relentless competition with Verizon’s fiber network FiOS, but also to develop the platform Dolan thinks will eventually be the only product the company sells. Although Cablevision cannot match Verizon’s upload speeds, the cable company offers a free Wi-Fi service for customers Verizon lacks. But the changes and network upgrades have been expensive and noticeable, because few cable operators are spending as much as Cablevision to improve service.

The changes in approach were too much for former chief operating officer Thomas Rutledge, who departed Cablevision to run Charter Cable in December 2011.

One of the primary reasons Rutledge left was Dolan’s increasing involvement in the business, causing a clash of business philosophies. Just a few months before Rutledge departed, the FCC issued a report that exposed Cablevision marketing broadband speeds its network could not sustain, especially during prime usage periods. Rutledge believed this was primarily a marketing problem. Dolan concluded the existing broadband infrastructure was inadequate.

“I felt that we needed to reinvest,” Dolan said. “When we took a hard look at what we were offering, it just wasn’t what we wanted it to be.”

As Rutledge and his allies rapidly departed for Charter Cable, Dolan ordered a 32 percent increase in capital spending to $1.1 billion last year, at least $150 million targeted exclusively on broadband improvements. This year he has already informed Wall Street it will be more of the same, bringing expanded Wi-Fi, new and improved broadband modems for customers, even faster speeds, new outage detection equipment, and an improved cloud-based DVR service.

Existing customers like the changes, but don’t appreciate the price hikes that have accompanied them. Wall Street has the exact opposite point of view, welcoming increased revenue from rate hikes, but concerned about the company’s spending. Investors complain Cablevision’s returns are well below those of other cable operators which don’t face the Verizon FiOS juggernaut.

Existing customers like the changes, but don’t appreciate the price hikes that have accompanied them. Wall Street has the exact opposite point of view, welcoming increased revenue from rate hikes, but concerned about the company’s spending. Investors complain Cablevision’s returns are well below those of other cable operators which don’t face the Verizon FiOS juggernaut.

Still, for some customers, the changes have come too late and Verizon’s promotional offers to switch to fiber have been too good. Cablevision did at least manage to add 1,000 new broadband and 3,000 new voice customers during the second quarter.

“We’re not prepared to starve the business,” said chief financial officer Gregg Seibert. “In terms of upgrades, I think what you’re seeing with the high-speed rollout that we just did is that we feel that our plant is in very good condition. We’re delivering over advertised speeds in every day part. We intend to keep the plant in that type of condition.”

Dolan’s philosophy of upgrading service to improve customer relations also clashes with John Malone, who is rebuilding his cable industry power base at Rutledge’s new home — Charter Cable. Malone believes industry consolidation, not expensive network upgrades, is a better proposition for shareholders.

Dolan told investors Cablevision is, for now, out of the mergers and acquisitions business. It has completed selling off its Optimum West systems to Charter and plans no further expeditionary buyouts in the near future. Instead, the company intends to focus on its business in the northeast. Dolan acknowledged the company is a likely acquisition target, most likely by Charter or Time Warner Cable.

Dolan currently shows little interest in selling out what is and always has been a family affair. Chuck Dolan, 86, founded Cablevision and still offers almost daily advice to his son James, who now runs the business. James also appointed his wife Kristin to lead sales, marketing and product management, with questionable results.

Some other highlights from the second quarter:

- Cablevision has enhanced its Remote Storage DVR product, now providing two tiers: 160GB and 500GB. Customers can record up to 10 channels at the same time. The service is available on customers’ existing set-top boxes;

- Last month, Cablevision announced an increase in our broadband data speeds;

- Wi-Fi remains a major priority for Cablevision and customer usage of its wireless network continues to grow. More than 1 million customers have used the service over more than 90,000 access points;

- Price increases were critical for Cablevision’s revenue growth this year. The company booked increased revenue from a broad-based $5 broadband rate hike implemented in January as well as a “sports programming surcharge” initiated earlier this year. The average subscriber that buys a package including cable television pays $5.49 more this year than last — $162.42 a month.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/WSJ Future of Cable TV 8-5-13.flv[/flv]

The Wall Street Journal sat down with Cablevision CEO James Dolan, discussing the future of the business as the industry watches another cable television programming dispute between Time Warner Cable and CBS. (5 minutes)

Subscribe

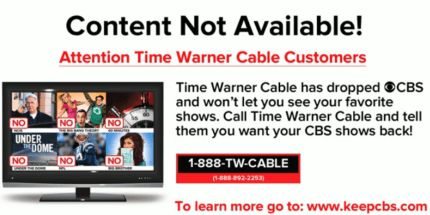

Subscribe CBS has blocked Time Warner Cable and Bright House Networks’ broadband customers from watching CBS online video in a retaliatory move against Time Warner Cable’s decision to pull CBS-owned programming off the lineup because of a contract dispute.

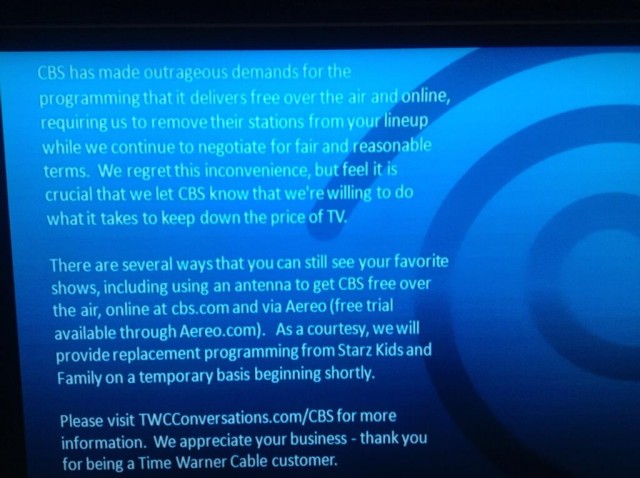

CBS has blocked Time Warner Cable and Bright House Networks’ broadband customers from watching CBS online video in a retaliatory move against Time Warner Cable’s decision to pull CBS-owned programming off the lineup because of a contract dispute. “CBS has shown utter lack of regard for consumers by blocking Time Warner Cable’s customers, including our high-speed data only customers, from accessing their shows on their free website,” the company said in a statement. “CBS enjoys the privilege of using public owned airwaves to deliver their programming – they should not be allowed to abuse that privilege.”

“CBS has shown utter lack of regard for consumers by blocking Time Warner Cable’s customers, including our high-speed data only customers, from accessing their shows on their free website,” the company said in a statement. “CBS enjoys the privilege of using public owned airwaves to deliver their programming – they should not be allowed to abuse that privilege.” After repeated extensions, Time Warner Cable yanked several channels from your cable dial today, and before you ask, you are -not- entitled to any refunds. So don’t ask. (Actually, ask anyway.)

After repeated extensions, Time Warner Cable yanked several channels from your cable dial today, and before you ask, you are -not- entitled to any refunds. So don’t ask. (Actually, ask anyway.)

Time Warner Cable admitted this morning extracting more revenue from existing customers was more important than attracting new ones, and long time subscribers responded by canceling service in above average numbers.

Time Warner Cable admitted this morning extracting more revenue from existing customers was more important than attracting new ones, and long time subscribers responded by canceling service in above average numbers.