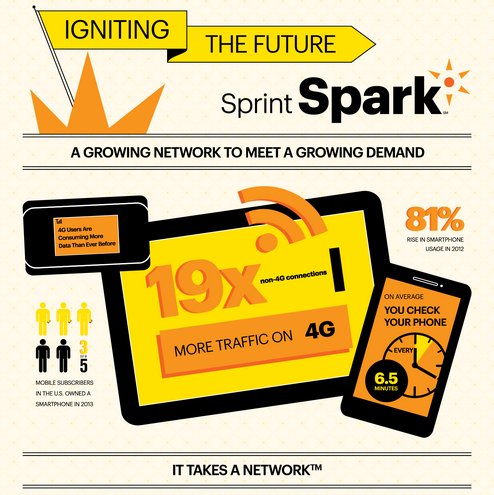

Waiting for an upgrade… Sprint Spark is the latest and fastest, but it’s only in 24 cities.

Sprint may be feeling the music is about to stop and it doesn’t have a chair at the table.

While AT&T and Verizon Wireless divide up the premium market and T-Mobile goes for the aggressive price championship, Sprint is muddling along with its glacially paced upgrade to 4G LTE and a barely usable 3G experience that has a lot of customers pondering a switch. This spring Sprint lost 364,000 pre-paid and 231,000 valuable postpaid customers.

CNET reports Sprint is now seeking to follow other carriers with a shared family data plan and better pricing on both its Framily and individual plans.

Sprint may be America’s least exciting wireless carrier. While T-Mobile’s CEO gets into hot water with bombastic rhetoric about Verizon and AT&T, he largely ignores Sprint. To more than a few in the wireless industry, Sprint seems to be just plodding along.

“I will be collecting Social Security before Sprint upgrades to 4G around here,” writes suburban Sacramento resident Danny Chiang. “You just keep holding out for something better from Sprint just around the corner, but they never seem to actually get there.”

Chiang and others have endured a heavily congested 3G network while Sprint initially focused on rural and small market 4G network upgrades — hardly intuitive for loyal Sprint customers in urban areas. Today, all Sprint can claim is that it has America’s “newest network.”

Some investment analysts believe Sprint is being more conservative about spending as it navigates towards a potential merger with T-Mobile. Its Japanese owners — Softbank, have argued a combined Sprint and T-Mobile is the only way America’s third and fourth largest carriers can possibly hope to compete toe to toe with Verizon and AT&T.

Sprint’s latest network innovation — Spark — which combines spectrum in three different frequency bands to deliver a larger data pipe, is only available in two dozen cities. Spark would be a natural showcase for Sprint’s enormous spectrum holdings. Sprint Spark combines 4G FDD-LTE at 800MHz and 1.9GHz and TDD-LTE at Clearwire’s old WiMAX 2.5GHz spectrum.

But network upgrades do no good if your customers are headed out the door to the competition. While Sprint continues to upgrade its network, it is testing a variety of new plans in different cities for a possible wider release later this year.

Shared/Family Mobile Data Plan Trials — San Diego, Portland, Ore. and Las Vegas

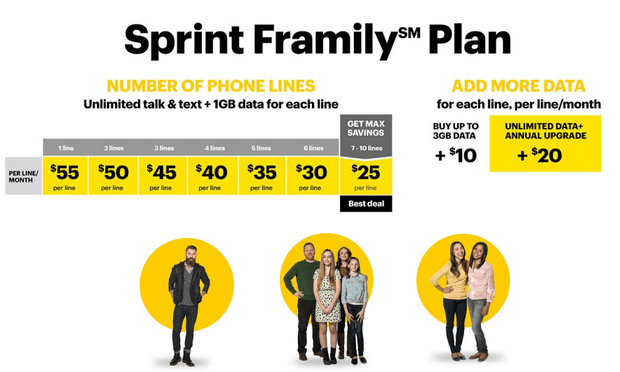

Sprint believes its Framily Plan might be too expensive.

Data Allowance Options

- 1GB – $20

- 2GB – $30

- 4GB – $40

- 6GB – $50

- 10GB – $60

- 20GB – $100

- 30GB – $130

- 40GB – $150

- 60GB – $225

- No unlimited shared data option

- Unlimited Talk/Text Phone Access Charge (required charge per phone): $25 for 1-10GB data plans, $15 for 20+GB data plans

- Annual Device Upgrade included at no extra charge for all customers with 20+GB shared data plans (San Diego and Portland only)

- Annual Device Upgrade Option: $5/month (Las Vegas only)

CNET points out Sprint’s plans are a better deal for heavy data users. The $20 plan for 1GB, for instance, is only $5 cheaper than a comparable AT&T plan. But the 30GB plan is $75 cheaper than AT&T’s $225 version.

Discounted Framily Plan Trials – Buffalo, Philadelphia, and Providence, R.I.

- Starting price reduced $10 to $45/month. Add five people to your “framily” and the price drops to $25/month (two fewer people now required to get the largest discount).

- Selecting the $20 unlimited data option automatically enrolls you in an annual upgrade plan (Buffalo and Philadelphia only).

- Customers can choose to pay $5 extra a month for an annual upgrade option (Providence only).

New Bring Your Own Device Option for Individual Plan Trials — Chicago, Minneapolis, and West Michigan

- Customers paying full price for a smartphone, those paying in monthly installments, or who bring their own device to Sprint are eligible for a $50 unlimited plan or a $40 for 3GB of data per month plan. Unlimited Framily data plans usually cost $75 a month.

- Unlimited data customers in Chicago and Minneapolis are automatically eligible for annual upgrades.

- West Michigan customers will have to pay a $5 fee each month for their annual upgrade.

Subscribe

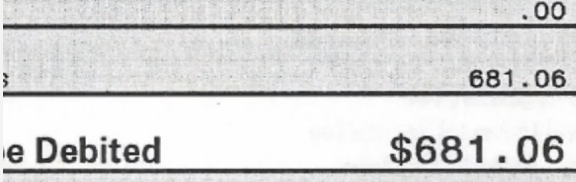

Subscribe A Mill Valley, Calif. woman was overcharged by more than $3,000 after AT&T removed her company retiree discount and refused to reimburse her for its own billing mistake.

A Mill Valley, Calif. woman was overcharged by more than $3,000 after AT&T removed her company retiree discount and refused to reimburse her for its own billing mistake. Tes is a victim of autobill complacency. The convenience of automatic bill payments has too often given people an excuse not to scrutinize their monthly bills, as long as the amount seems somewhat reasonable. It is only after an unexpectedly high bill arrives when customers finally begin to investigate.

Tes is a victim of autobill complacency. The convenience of automatic bill payments has too often given people an excuse not to scrutinize their monthly bills, as long as the amount seems somewhat reasonable. It is only after an unexpectedly high bill arrives when customers finally begin to investigate. The phone company says it’s the customer’s fault if they don’t analyze their AT&T bill and promptly call attention to billing errors.

The phone company says it’s the customer’s fault if they don’t analyze their AT&T bill and promptly call attention to billing errors.