Phillip “I got whiplash just watching” Dampier

A former policy director at the Federal Trade Commission and antitrust attorney at the U.S. Justice Department has managed an impressive 180 in just a few short months regarding the merger of Time Warner Cable and Comcast.

In February, David Balto told TheDeal the proposed takeover of Time Warner Cable “is a bad deal for consumers.” Today, Mr. Balto’s panoply of guest editorials, media appearances and columns — suddenly in favor of the merger — are turning up in the New York Times, the Orlando Sentinel, Marketplace, WNYC Radio, and elsewhere.

Balto’s arguments are based on “research” which, in toto, appears to have been limited to thumbing through Comcast’s press releases and merger presentation. That was enough:

First, this deal should create benefits for Time Warner customers, who will gain a significantly faster Internet and more advanced television service.

Second, competition is increasing in both the pay-TV and broadband businesses. Ninety-eight percent of viewers have a choice of three or more multichannel services, plus growing options online. Yahoo just announced a new video service, joining Netflix, Amazon and YouTube. In the last five years, cable has lost about seven million customers, satellite has gained nearly two million, and the telecommunications companies have gained six million.

Third, Comcast’s post-merger share of broadband falls closer to 20 percent when including LTE wireless and satellite providers. Over all, 97 percent of households have at least two competing fixed broadband providers — three or more if mobile wireless is included.

We used to wonder why government officials and regulators were so easily fooled by the corporate government relations people sent into their offices armed with press releases, talking points, cupcakes, and empty promises. We understand everyone isn’t a Big Telecom expert, but too often regulators’ reflexive acceptance of whatever companies bring to their table threatens to win them rube-status. We’d like to think Mr. Balto isn’t Comcast’s sucker, and we certainly hope there are no unspoken incentives on the table in return for his recent, very sudden conversion to celebrate all-things Comcast. Maybe he’s simply uninformed.

Balto

Although our regular readers — nearly all consumers and customers — are well-equipped to debunk Mr. Balto’s arguments, for the benefit of visitors, here is our own research.

First, Comcast’s Internet service is not faster than Time Warner Cable. Mr. Balto needs to spend some time away from Comcast’s merger info-pack and do some real research. He’ll find Time Warner Cable embarked on a massive upgrade program called TWC Maxx that is more than tripling broadband speeds for customers at no extra charge. Those speeds are faster than what Comcast offers the average residential customer, and come much cheaper as well. Oh, and TWC has no compulsory usage limits and overlimit penalties. Comcast’s David Cohen predicts every Comcast customer will face both within five years.

Second, that “advanced TV platform” Balto raves about requires a $99 installation fee… for an X1 set-top box. It also means equipment must be attached to every television in the house, because Comcast encrypts everything. At a time when customers want to pay for fewer channels, Comcast wants to shovel even more unwanted programming and boxes at customers. Older Americans who want their Turner Classic Movies have another nasty surprise. They will need to buy Comcast’s super deluxe cable TV package to get that network, at a cost exceeding $80 a month just for television. Ask Time Warner customers what they want, and they’ll tell you they’d prefer old and decrepit over an even higher cable TV bill Comcast has already committed to deliver.

Has competition truly increased? Not in the eyes of most Americans who at best face a duopoly and annual rate hikes well in excess of inflation. Even worse, for most consumers there is only one choice for 21st century High Speed Internet service – the cable company. Mr. Balto conveniently ignores the fact cable’s primary competitor is still DSL which is simply not available at speeds of 30+Mbps for most consumers. In some areas, like suburban Rochester, N.Y., the best the local phone company can deliver some neighborhoods like ours is 3.1Mbps. That isn’t competition. Verizon and AT&T have both stopped expanding DSL. Verizon has ended FiOS expansion and AT&T’s U-verse still maxes out at around 24Mbps for most customers. AT&T’s promised fiber upgrades have proven to be more illusory than reality, available primarily in a handful of multi-dwelling units and new housing developments. In rural areas, both major phone companies are petitioning to do away with landline service and DSL altogether.

Raise your hands if you want Comcast’s “benefits.” In New York, out of 2,300 comments before the PSC, we can’t find a single one clamoring for Comcast’s takeover. The public has spoken.

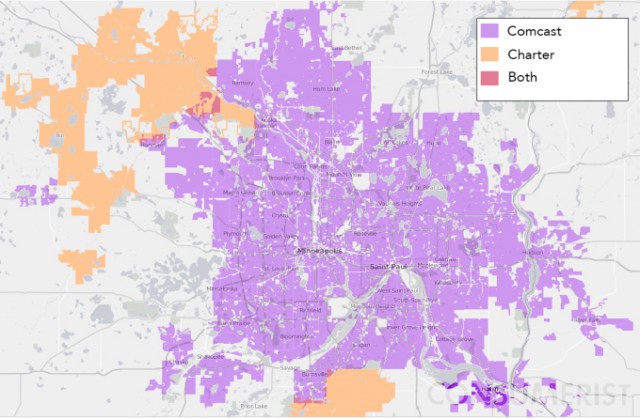

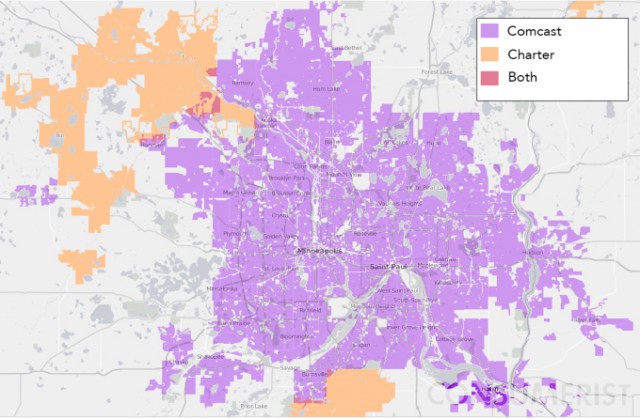

Cable “competition” in Minneapolis. Charter and Comcast have also teamed up to trade cable territories as part of the Time Warner Cable merger package deal.

Satellite television’s days of providing the cable industry with robust competition have long since peaked. AT&T is seeking to further reduce that competition by purchasing DirecTV, not because it believes in satellite television, but because it wants the benefits of DirecTV’s lucrative volume discounts.

Any antitrust attorney worth his salt should be well aware of what kind of impact volume discounting can have on restraining and discouraging competition. Comcast’s deal for Time Warner will let it acquire programming at a substantial discount (one they have already said won’t be passed on to customers) so significant that any would-be competitors would be in immediate financial peril trying to compete on price.

Frontier Communications learned that lesson when it acquired a handful of Verizon FiOS franchises in Indiana and the Pacific Northwest. After losing Verizon’s volume discounts, Frontier was so alarmed by the wholesale renewal rates it received, it let loose its telemarketing force to convince customers fiber was no good for television and they should instead switch to a satellite provider they partnered with. It’s telling when a company is willing to forfeit revenue in favor of a third party marketing agreement with an outside company.

So what does this mean for a potential start-up looking to get into the business? Since programming is now a commodity, most customers buy on price. The best triple-play deals will go to the biggest national players with volume discounts – all cable operators that have long agreed never to compete directly with each other.

In the Orlando Sentinel, Mr. Balto seemed almost relieved when he concluded Comcast and Time Warner don’t compete head-to-head, somehow easing any antitrust concerns. It is precisely that fact why this deal must never be approved. Comcast has been free to compete anywhere Time Warner provides service, but has never done so. Letting Comcast, which has even worse approval ratings than Time Warner, become the only choice for cable broadband is hardly in the public interest and does nothing for competition. Instead, it only further consolidates the marketplace into a handful of giant companies that can raise prices and cap usage without restraint.

If Mr. Balto truly believes AT&T and Verizon will ride to the rescue with robust wireless broadband competition, his credibility is in peril. Those two companies, among others, are completely incapable of meeting the growing broadband demands (20-50GB) of the home user. With punishing high prices and staggeringly low usage caps, providers are both controlling demand and profiting handsomely from rationing service at the same time. Why change that?

No 3G/4G network under current ordinary traffic loads can honestly deliver a better online experience than DSL, and customers who attempt to replace their home broadband connection in favor of wireless will likely receive a punishing bill for the attempt at the end of the month. The only players who want to count mobile broadband as a serious competitor in the home broadband market are the cable and phone companies desperately looking for a defense against charges they have a broadband monopoly or are part of a comfortable duopoly.

One last point, while Mr. Balto seems impressed that Comcast would continue to voluntarily abide by the Net Neutrality policies he personally opposes, he conveniently omits the fact Comcast was the country’s biggest violator of Net Neutrality when it speed limited peer-to-peer traffic, successfully sued the government over Net Neutrality after it was fined by the FCC for the aforementioned violation, and only agreed to temporarily observe Net Neutrality as part of its colossal merger deal with NBCUniversal. It’s akin to a mugger promising to never commit another crime after being caught red-handed stealing. A commitment like that might be good enough for Mr. Balto, but it isn’t for us.

Subscribe

Subscribe As

As

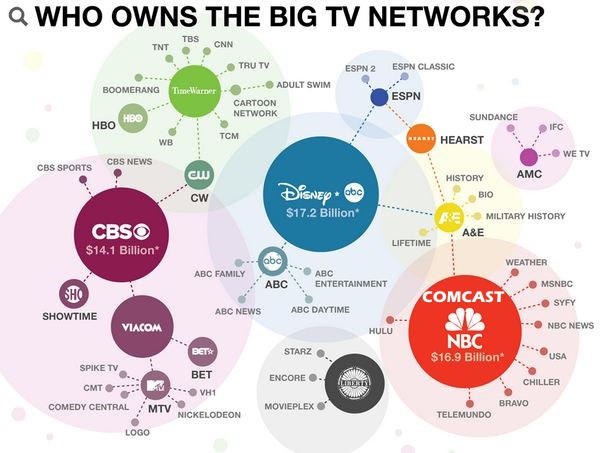

Time Warner effectively sold off its in-house distribution platform: Time Warner Cable systems that could be easily convinced to carry every Time Warner-owned network. Comcast didn’t and has become a larger content and distribution company because of its ownership interests in cable networks and its acquisitions like NBC and Universal Studios.

Time Warner effectively sold off its in-house distribution platform: Time Warner Cable systems that could be easily convinced to carry every Time Warner-owned network. Comcast didn’t and has become a larger content and distribution company because of its ownership interests in cable networks and its acquisitions like NBC and Universal Studios.

Nearly two million people have listened to the

Nearly two million people have listened to the  Setting aside all that, we decided to investigate why Mr. Block was willing to subject himself to 18 minutes of phone hell to cancel his service.

Setting aside all that, we decided to investigate why Mr. Block was willing to subject himself to 18 minutes of phone hell to cancel his service.