Residents of a handful of multi-dwelling apartments and condos in Boston, Washington, and Los Angeles will be able to kick the phone and cable company out of their units and switch to a fixed wireless provider offering 200 Mbps internet access for $50 a month.

Starry Wireless, from the man who brought you Aereo, the now defunct streaming service that used to offer local over the air stations but was sued out of existence, has spent more than a year testing its millimeter wave wireless technology in Cambridge, Mass. apartment buildings and is ready to expand.

A company promotional video explains Starry’s internet service. (1:53)

Starry is considered a startup, but is relying on budget-conscious pre-existing technology to deliver point-to-multipoint wireless internet service over a limited area. Using pre-standard 5G technology that relies on unlicensed millimeter wave spectrum, Starry’s service is provided from antennas mounted on multi-story buildings.

Because the technology isn’t revolutionary, Starry can utilize equipment already for sale in the marketplace. Some commercial fixed-wireless services already exist using a similar approach, and Google itself is developing a wireless gigabit internet service that is likely to eventually overtake its limited fiber rollouts.

Because the technology isn’t revolutionary, Starry can utilize equipment already for sale in the marketplace. Some commercial fixed-wireless services already exist using a similar approach, and Google itself is developing a wireless gigabit internet service that is likely to eventually overtake its limited fiber rollouts.

Starry currently offers one plan – 200/200 Mbps with no data caps or contracts for $50 a month. The company claims it can deliver gigabit service using the same technology, but has chosen not to offer it at this time.

Reviews in the Boston area give the service high marks for performance, even in bad weather that was expected to create some problems for the line-of-sight technology. But the service also has its skeptics who believe the technology’s downsides limit its scale.

The biggest con to millimeter wave internet is that its range is extremely limited. Starry is only expected to serve multi-dwelling units in dense urban areas, where its mounted rooftop antennas can reach enough customers to cover the company’s costs. Neither Google or Starry have targeted their services to residential customers living in single home neighborhoods. Starry also must find receptive landlords willing to offer or lease space for its antenna equipment and tolerate mounted equipment, as needed.

Starry’s technology approach offers a concentrated signal with extensive bandwidth available to customers. Because its reach is so limited, each antenna will reach a smaller number of customers, making it unlikely the company will oversell its wireless capacity. Starry’s decision to not get into the gigabit business yet may be a way of ensuring it has enough capacity to deliver the speeds it advertises to customers before speeding things up.

Customers are strongly encouraged by the company to use its included Starry Station, a triangular Wi-Fi hub with a built-in Android-powered touchscreen controller to manage in-home Wi-Fi. This device normally retails for around $300, so bundling it with internet service makes it a good deal. But the device gets mixed reviews. Some criticized it as over-engineered and unstable. Many reviewers complained about poor Wi-Fi coverage and randomly dropped wireless signals. Others complained it tends to lock up, which may be the result of overheating. Many noticed the unit generates a lot of heat, presumably from its built-in power supply and Android touchscreen interface. It requires a noticeably loud built-in fan, which runs continuously, to manage cooling duty.

The Starry Station did not get great reviews for its performance or the amazing amount of heat it generates. (2 minutes)

Despite the expansion into Los Angeles and Washington, Starry can still be considered a beta level service and availability will remain spotty for some time. During 2018, Starry expects to begin limited service in: New York, Cleveland, Chicago, Houston, Dallas, Denver, Seattle, Detroit, Atlanta, Indianapolis, San Francisco, Philadelphia, Miami and Minneapolis.

Subscribe

Subscribe Despite clamoring for more competition in the cable industry, FCC chairman Thomas Wheeler is reportedly ready to circulate a draft order granting Charter Communications’ $55 billion dollar buyout of Time Warner Cable, with conditions.

Despite clamoring for more competition in the cable industry, FCC chairman Thomas Wheeler is reportedly ready to circulate a draft order granting Charter Communications’ $55 billion dollar buyout of Time Warner Cable, with conditions. Critics of the deal contend that might be an effective strategy… if Charter was the only cable company in the nation. Many cable operators include similar restrictive terms in their contracts, which often also include an implicit threat that offering cable channels online diminishes their value in the eyes of cable operators. Programmers fear that would likely mean price cuts as those contracts are renewed.

Critics of the deal contend that might be an effective strategy… if Charter was the only cable company in the nation. Many cable operators include similar restrictive terms in their contracts, which often also include an implicit threat that offering cable channels online diminishes their value in the eyes of cable operators. Programmers fear that would likely mean price cuts as those contracts are renewed. Most of the other deal conditions will likely formalize Charter’s voluntary commitments not to impose data caps, modem fees, interconnection fees (predominately affecting Netflix) or violate Net Neutrality rules for the first three years after the merger is approved. As readers know, Stop the Cap!

Most of the other deal conditions will likely formalize Charter’s voluntary commitments not to impose data caps, modem fees, interconnection fees (predominately affecting Netflix) or violate Net Neutrality rules for the first three years after the merger is approved. As readers know, Stop the Cap!

Smit also promised major broadband speed upgrades and other improvements for Time Warner Cable customers, but nobody mentioned Comcast’s gradual reintroduction of usage caps on residential broadband accounts.

Smit also promised major broadband speed upgrades and other improvements for Time Warner Cable customers, but nobody mentioned Comcast’s gradual reintroduction of usage caps on residential broadband accounts. A Wall Street analyst has urged Time Warner Cable’s competitors to deny promotional pricing to new customers switching providers because of the CBS blackout.

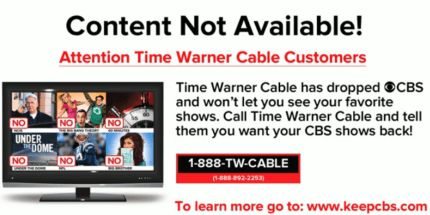

A Wall Street analyst has urged Time Warner Cable’s competitors to deny promotional pricing to new customers switching providers because of the CBS blackout. DirecTV is among the first to express solidarity with its cable competitor, issuing a statement last weekend:

DirecTV is among the first to express solidarity with its cable competitor, issuing a statement last weekend: CBS has blocked Time Warner Cable and Bright House Networks’ broadband customers from watching CBS online video in a retaliatory move against Time Warner Cable’s decision to pull CBS-owned programming off the lineup because of a contract dispute.

CBS has blocked Time Warner Cable and Bright House Networks’ broadband customers from watching CBS online video in a retaliatory move against Time Warner Cable’s decision to pull CBS-owned programming off the lineup because of a contract dispute. “CBS has shown utter lack of regard for consumers by blocking Time Warner Cable’s customers, including our high-speed data only customers, from accessing their shows on their free website,” the company said in a statement. “CBS enjoys the privilege of using public owned airwaves to deliver their programming – they should not be allowed to abuse that privilege.”

“CBS has shown utter lack of regard for consumers by blocking Time Warner Cable’s customers, including our high-speed data only customers, from accessing their shows on their free website,” the company said in a statement. “CBS enjoys the privilege of using public owned airwaves to deliver their programming – they should not be allowed to abuse that privilege.”