Altice President Patrick Drahi at the French National Assembly in Paris, May 27, 2015. REUTERS/Philippe Wojazer

PARIS (Reuters) – Altice NV, one of the most acquisitive European telecoms groups, made a major move into the U.S. market on Thursday with a deal to buy fourth-largest operator Cablevision Systems Corp for $17.7 billion including debt.

Altice founder Patrick Drahi, who built a telecoms and cable empire via debt-fueled acquisitions in France, Portugal and Israel, is expected to apply his cost-cutting zeal to achieve a target of $900 million in annual synergies at Cablevision.

Drahi told a Goldman Sachs conference in New York that more than 300 Cablevision employees earn pay checks of over $300,000.

“This we will change,” said the French-Israeli billionaire.

Drahi entered the United States in May by buying a small, St Louis-based cable group called Suddenlink for $9.1 billion. He declared at the time that Altice would look for more acquisitions and eventually earn half its revenue from the United States.

In talks that began in June, Drahi convinced Charles Dolan, the patriarch of the Irish-American family that owns Cablevision, to sell. Cablevision has 3.1 million customers in New York, Connecticut and New Jersey, but it has struggled with declining video subscribers like other cable companies.

“This deal takes us into the most affluent part of the United States and will be a good basis for further expansion,” said Altice Chief Executive Dexter Goei on a conference call. “We think there are significant ways to improve profitability by pooling purchasing and other costs between Cablevision and Suddenlink.”

Altice will pay $34.90 in cash per share, a 22 percent premium to Wednesday’s closing price of $28.54, giving Cablevision an equity value of $10 billion.

Altice will pay $34.90 in cash per share, a 22 percent premium to Wednesday’s closing price of $28.54, giving Cablevision an equity value of $10 billion.

Shares in Altice closed up 0.68 percent at 24.5 euros, after gaining nearly 13 percent at the open. Cablevision shares rose 13.9 percent to $32.51, close to the offer price and a sign that few investors expect another bidder for Cablevision to emerge.

Altice’s bid for Cablevision will face scrutiny from the Federal Communications Commission and the Department of Justice, but analysts at Jefferies said they expected “little pushback.”

‘LITTLE PUSHBACK’ SEEN

Investors who back Drahi’s acquisition spree have made Altice the best-performing telecom stock in Europe this year, up more than 50 percent before Thursday’s deal, compared with an 8.4 percent rise in the sector index .

It is unclear what other assets Altice may target in the United States, where it will have to deal with fast-changing competition as cable groups consolidate and cope with subscriber losses to video streaming services such as Netflix.

Drahi has said Altice may look at properties to be sold under Charter Communications Inc’s takeover of Time Warner Cable Inc. Another target could be Cox Communications, but the closely held company has repeatedly said it is not for sale.

Drahi has said Altice may look at properties to be sold under Charter Communications Inc’s takeover of Time Warner Cable Inc. Another target could be Cox Communications, but the closely held company has repeatedly said it is not for sale.

Drahi has also said that Altice could buy a U.S. wireless carrier “someday” to offer subscribers a “quadruple play” of Internet, television, and fixed and mobile telecoms.

Altice, which has been snapping up television and radio targets in Europe in recent months, will become the owner of the Newsday newspaper and local news channel News 12 Networks as part of the Cablevision deal.

Goei said the company would not interfere in the editorial side of the loss-making media businesses but would aim to run them more efficiently. He ruled out divesting the units.

He said the goal was to improve Cablevision’s margins to the “low 40s range” compared with current level of 28 percent, which lags the sector average of 35 percent.

Jim Dolan

Allan Nichols, analyst at investment research firm Morningstar, said he was “somewhat skeptical” that Altice could deliver on the savings since content costs were higher in the United States than in Europe.

“That said, Altice has an impressive record of cost reduction, and we expect it will be much more aggressive than the Dolan family in cutting expenses, including reducing employee count,” he wrote in a note.

To finance the deal, Altice will raise $8.6 billion in new debt mostly at Cablevision and none at its European holding, which is already highly leveraged. It will also raise $3.3 billion in equity, 70 percent by issuing shares at Altice and 30 percent from private equity fund BC Partners and Canadian investment fund CPP Investment Board, backers of Suddenlink.

Altice, whose corporate headquarters are in the Netherlands, said it would issue Class A shares, which have fewer voting rights than the B shares held largely by Drahi. Altice created the dual-class structure in June to allow more stock deals without Drahi losing control.

Cablevision CEO James Dolan said in a statement the time was right for new ownership and he and his family “believe that Patrick Drahi and Altice will be truly worthy successors.”

The Dolans will continue to own media and sports assets through AMC Networks and The Madison Square Garden Company — owner of the New York Rangers and New York Knicks — which are not part of the deal.

JP Morgan, BNP Paribas and Barclays have committed to finance the deal and also advised Altice on it. Cablevision was advised by Bank of America Merrill Lynch, Guggenheim Securities and PJT Partners.

[flv]http://phillipdampier.com/video/CNBC A deal 20 years in the making Altice to buy Cablevision 9-17-15.flv[/flv]

CNBC reports Cablevision has finally sold out… to Altice NV a cable operator that dominates in France. (2:51)

[flv]http://phillipdampier.com/video/CNBC Mergers in telecoms sector not over yet 9-17-15.flv[/flv]

Neil Campling, global TMT analyst at Aviate Global, says there could be further mergers in the telecoms market following Altice’s acquisition of U.S. provider Cablevision. (3:20)

(By Leila Abboud. Additional reporting by Rob Smith in London and Liana B. Baker and Malathi Nayak in New York; Writing by Christian Plumb; Editing by Andrew Callus and Mark Potter)

Subscribe

Subscribe Despite

Despite

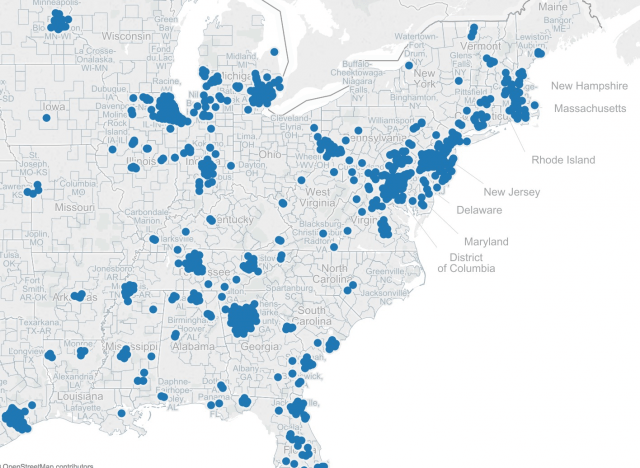

The FCC under the leadership of Thomas Wheeler has targeted anti-municipal broadband laws in the states of North Carolina and Tennessee for federal pre-emption, effectively invalidating laws ghost-written by telecommunications industry lobbyists working for the states’ dominant telecom companies — Time Warner Cable in North Carolina and AT&T and Comcast in Tennessee. The laws are designed to restrict or discourage municipal broadband competition.

The FCC under the leadership of Thomas Wheeler has targeted anti-municipal broadband laws in the states of North Carolina and Tennessee for federal pre-emption, effectively invalidating laws ghost-written by telecommunications industry lobbyists working for the states’ dominant telecom companies — Time Warner Cable in North Carolina and AT&T and Comcast in Tennessee. The laws are designed to restrict or discourage municipal broadband competition. A tiny cable company serving communities around the Blue Mountain in eastern Pennsylvania has a big appetite for rationing Internet usage by imposing data caps and overlimit fees on their 170,000 customers.

A tiny cable company serving communities around the Blue Mountain in eastern Pennsylvania has a big appetite for rationing Internet usage by imposing data caps and overlimit fees on their 170,000 customers.

To complete an acquisition of landline assets in California, Florida, and Texas from Verizon Communications, Frontier Communications is hoping to raise

To complete an acquisition of landline assets in California, Florida, and Texas from Verizon Communications, Frontier Communications is hoping to raise  Californian consumers are among those most concerned about a Frontier takeover of landline and FiOS service. Verizon ventured far beyond its original service area extending from Maine to Virginia after it acquired independent telephone networks operated by General Telephone (GTE) and Continental Telephone (Contel) in 2000. In 2015, the company wants to return to its core landline service area in the northeast.

Californian consumers are among those most concerned about a Frontier takeover of landline and FiOS service. Verizon ventured far beyond its original service area extending from Maine to Virginia after it acquired independent telephone networks operated by General Telephone (GTE) and Continental Telephone (Contel) in 2000. In 2015, the company wants to return to its core landline service area in the northeast. David Lazarus, a consumer reporter for the Los Angeles Times,

David Lazarus, a consumer reporter for the Los Angeles Times,  As AT&T and Verizon ponder ditching high-cost landline customers, so long as there are companies like Frontier willing to buy, the deal works for both. Verizon gets a tax-free transaction that benefits both executives and shareholders. An already debt-laden Frontier satisfies shareholders by growing the business, which usually makes the balance sheet look good each quarter.

As AT&T and Verizon ponder ditching high-cost landline customers, so long as there are companies like Frontier willing to buy, the deal works for both. Verizon gets a tax-free transaction that benefits both executives and shareholders. An already debt-laden Frontier satisfies shareholders by growing the business, which usually makes the balance sheet look good each quarter. Those losses have to be reflected somewhere, and customers complain they are paying the highest price.

Those losses have to be reflected somewhere, and customers complain they are paying the highest price.