The Federal Communications Commission is getting an earful from satellite provider Dish Network, upset with the agency’s proposal to boost regulatory fees covering direct broadcast satellite services by 125% this year.

The Federal Communications Commission is getting an earful from satellite provider Dish Network, upset with the agency’s proposal to boost regulatory fees covering direct broadcast satellite services by 125% this year.

If the FCC adopts its new fee structure, Dish will pay 24 cents per subscriber (up from 12¢) per year to cover the cost of full-time employees at the FCC who spend their days monitoring and regulating satellite television providers. Satellite companies will also pay a one-time fee of 3¢ per subscriber in 2016 to cover the FCC’s downsizing expenses.

The regulator has successfully found a way to cover some of its expenses by charging the companies it oversees “user fees.” In 2015, the FCC collected nearly $340 million in regulatory fees. This year, the FCC wants more, seeking to impose a temporary “facility reduction cost” surcharge that will cover the expenses of moving employees to new, smaller offices, or downsizing the current ones to save money. The FCC says that will cost an extra $44 million. Taxpayers won’t pay those expenses, but pay television customers ultimately will when providers pass both of those fees on.

Dish says the rate hike is unjustified because of its size and scope, and runs contrary to the FCC’s goal of minimizing consumer bill shock. The satellite provider also wants the FCC to explain how it can justify more than doubling user fees while downsizing.

If the FCC doesn’t answer, the American Cable Association, representing small independent cable operators, is willing to share their views on the matter. The ACA complains the FCC isn’t charging DirecTV and Dish enough, noting they are still getting preferential treatment over cable and IPTV providers that are being asked to pay $1 per subscriber this year.

“There is absolutely no basis for keeping the proposed DBS fee levels over 75% below those proposed for other entities in the Cable/IPTV category,” wrote ACA president Matt Polka in comments to the FCC. “DBS providers should be paying the same Media Bureau regulatory fee.”

Polka pointed to AT&T’s acquisition of DirecTV as an example of how disproportionate fees cost small independent cable companies much more on a per-subscriber basis than telecom giant AT&T has to pay for almost 20 million DirecTV satellite customers.

Polka pointed to AT&T’s acquisition of DirecTV as an example of how disproportionate fees cost small independent cable companies much more on a per-subscriber basis than telecom giant AT&T has to pay for almost 20 million DirecTV satellite customers.

“AT&T, now the nation’s largest [pay TV company], operates two types of services – its U-verse IPTV service and its DirecTV DBS service,” noted Polka. “Yet, AT&T will be assessed starkly lower regulatory fees for its approximately 20 million DirecTV subscribers than it will pay for its approximately 6 million IPTV subscribers, even though all of these services make absolutely comparable use of Media Bureau […] resources and AT&T’s advocacy […] is on behalf of all its [pay TV] subscribers.”

Polka wants fee parity – charging the same user fees for all providers, regardless of the technology they use.

“Doing so will avoid the competitive distortions the current fee structure creates by having cable operators and IPTV providers, most of whom are far smaller than the DBS providers, cross-subsidize the fee burden of their primary and direct competitors in the marketplace,” Polka argued.

Whatever fee structure is ultimately approved by the FCC, customers can be certain providers will pad those fees when passing them on to customers. For more than a decade, some providers have used regulatory fee increases amounting to spare change as an excuse to pass on new “regulatory surcharges” that are many times more than what those providers actually pass on to the government.

“It’s a price increase,” bluntly notes Mark Cooper from the Consumer Federation of America back in 2004.

![This spring, The Consumerist broke down a typical AT&T U-verse bill loaded in junk fees and surcharges. (The RED numbers [1, 4-10, 13-14, 17-20, 22] are AT&T-originating fees; BLUE numbers [2-3, 11-12, 15-16, 21, 23-25] are government fees)](https://stopthecap.com/wp-content/uploads/2016/06/att-fees-640x926.png)

This spring, The Consumerist broke down a typical AT&T U-verse bill loaded in junk fees and surcharges. (The RED numbers [1, 4-10, 13-14, 17-20, 22] are AT&T-originated fees, fake surcharges/bill padding, or fees that represent the cost of doing business; BLUE numbers [2-3, 11-12, 15-16, 21, 23-25] are real government fees passed on to local, state, and federal taxing authorities.)

Subscribe

Subscribe

An effort by a House Republican to scale back the FCC’s Lifeline subsidy program failed on a largely party-line vote Tuesday.

An effort by a House Republican to scale back the FCC’s Lifeline subsidy program failed on a largely party-line vote Tuesday.

An AT&T executive casually told an audience attending the Wells Fargo 2016 Convergence & Connectivity Symposium that a significant part of

An AT&T executive casually told an audience attending the Wells Fargo 2016 Convergence & Connectivity Symposium that a significant part of

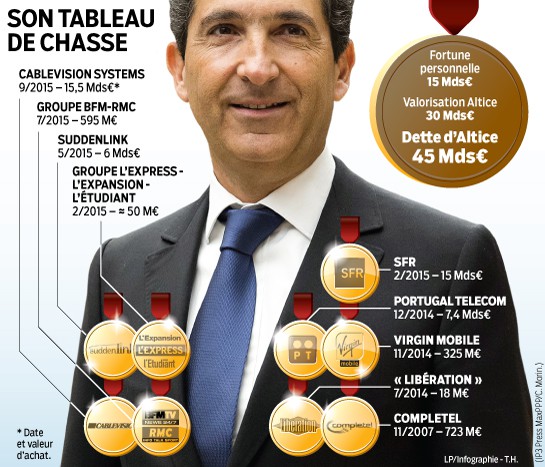

With today’s completion of Cablevision’s absorption into the Altice empire, the European cable conglomerate announced big changes that are expected to refocus the “center of gravity” and Altice’s future profits on the United States instead of Europe.

With today’s completion of Cablevision’s absorption into the Altice empire, the European cable conglomerate announced big changes that are expected to refocus the “center of gravity” and Altice’s future profits on the United States instead of Europe. “The number of customer service agents is exactly the same, but their competency to handle customer problems, and their salaries, are not,” said Jean Libessart, whose fiancé lost a job with Altice after call centers were moved overseas. “They stayed within the competition authority’s rules by exploiting the loopholes.”

“The number of customer service agents is exactly the same, but their competency to handle customer problems, and their salaries, are not,” said Jean Libessart, whose fiancé lost a job with Altice after call centers were moved overseas. “They stayed within the competition authority’s rules by exploiting the loopholes.” “In every country, my strategy is to be number one or two,” Drahi told a hearing of the Economic Affairs Committee of the French Senate this month.

“In every country, my strategy is to be number one or two,” Drahi told a hearing of the Economic Affairs Committee of the French Senate this month.