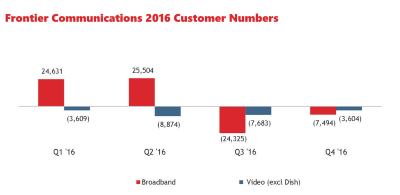

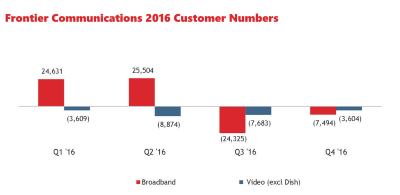

Frontier Communications employees continue to send unsolicited news tips and insider gossip about a phone company in decline, not only losing customers but middle management that have either left voluntary or been asked to leave in a frantic effort to cut costs.

Frontier Communications employees continue to send unsolicited news tips and insider gossip about a phone company in decline, not only losing customers but middle management that have either left voluntary or been asked to leave in a frantic effort to cut costs.

Earlier this year, Frontier CEO Dan McCarthy ended a long-term effort heralded by former CEO Maggie Wilderotter that gave significant autonomy to local and regional managers to handle problems in their respective service areas without having to consult a centralized bureaucracy. McCarthy elected instead to adopt more rigid company-wide policies and practices that often require consultation with senior management. For many mid-level managers already frustrated with the company, that change proved a bridge too far that and several are now working for Frontier’s cable competition.

One of the senior managers responsible for Frontier’s web presence became so frustrated with Frontier’s corporate roadblocks, he dropped his Frontier service in favor of the competition because accomplishing almost anything on Frontier’s website proved frustrating and often impossible.

“Instead of focusing their leadership on ways to turn the company around they seem to be doubling down on their efforts to get as many employees to leave the company as possible,” a Frontier insider tells Stop the Cap!

Some of the employees likely to leave are Frontier’s telecommuting workforce. Senior executives now want many of those workers back in the office.

Some of the employees likely to leave are Frontier’s telecommuting workforce. Senior executives now want many of those workers back in the office.

“[The new policy says] if we live less than 50 miles from a Frontier Office, we have to be in the office every day and could no longer work at home,” our source tells us. “There are employees who had Permanent Work At Home status by HR who are [now] being told they have to relocate to another city [or] come into an office or they will be let go.”

Frontier’s network continues to be criticized as great for some, lousy for everyone else. Our source notes a few years ago Frontier was speed-limiting some of its DSL customers in congested areas because they were using too much broadband and slowing down the network for others. While Frontier’s legacy copper areas continue to endure copper-based DSL with its inherent capacity and speed limitations, Frontier is planning a feast for its acquired FiOS fiber customers, including free automatic speed upgrades.

Less technically conscious customers pay more. In addition to a $4.50 convenience fee that now applies to customers phoning customer care centers to make a payment, our source warns Frontier is about to launch a paper billing fee, reportedly $1 a month, in an attempt to convert customers to electronic paperless billing.

“We are so at a loss as to the direction this company is taking and there is zero vision from senior leadership that is being passed down,” our source said, noting executives are preoccupied with their compensation plans and bonuses. “The directions we’re given change daily, projects and promotions only seem to be reactionary to try to stop the bleeding, but Frontier is in need of major surgery starting with the CEO and every single member of our executive leadership.”

British cable subscribers are getting a taste of American bill shock, courtesy of another dramatic rate hike from cable giant Virgin Media, now owned and operated by John Malone’s Liberty Broadband.

British cable subscribers are getting a taste of American bill shock, courtesy of another dramatic rate hike from cable giant Virgin Media, now owned and operated by John Malone’s Liberty Broadband.

Subscribe

Subscribe