Verizon Communications has held no talks with Netflix about a possible acquisition, despite frenzied media reports to the contrary.

Verizon Communications has held no talks with Netflix about a possible acquisition, despite frenzied media reports to the contrary.

Deal Reporter, a trade publication, was the source of the original rumor, but Bloomberg News reports the story is premature after talking with two sources who should know.

The rumored takeover did wonders for Netflix stock, which jumped more than six percent on the news. That’s a boost the streaming and DVD-rental service needed after a year of public relations missteps and subscriber losses.

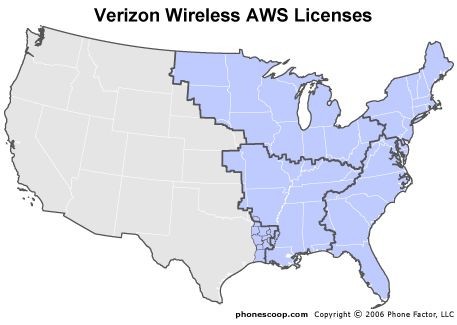

Verizon’s recent move towards launching its own streaming entertainment service outside of its FiOS fiber-to-the-home service areas made the rumor more credible, but other analysts think Verizon’s interest is on different company that shares Netflix’s love of the color red.

“Verizon’s not interested in Netflix, they see Redbox as a much better fit,” Sam Greenholtz, an analyst with Telecom Pragmatics in Westminster, Maryland, who has consulted for Verizon and was briefed by its employees about its plan, told Bloomberg.

It’s not the ubiquitous network of Redbox kiosks Verizon is after, it is the content distribution deals the company has with Hollywood studios. Those deals are becoming quite lucrative for production companies — so lucrative in fact Time Warner’s chief entertainment mogul has cut back on his personal bashing of Netflix. With Amazon, Time Warner’s own HBO Go, and Verizon entering the online video fray, Netflix CEO Reed Hastings declared there is now an “arms race” among the behemoths to dominate online viewing, and jack up licensing fees.

It’s not the ubiquitous network of Redbox kiosks Verizon is after, it is the content distribution deals the company has with Hollywood studios. Those deals are becoming quite lucrative for production companies — so lucrative in fact Time Warner’s chief entertainment mogul has cut back on his personal bashing of Netflix. With Amazon, Time Warner’s own HBO Go, and Verizon entering the online video fray, Netflix CEO Reed Hastings declared there is now an “arms race” among the behemoths to dominate online viewing, and jack up licensing fees.

Hastings sees only the deepest-pocketed players as having a chance to make a stand in the online streaming marketplace, because content costs are increasing dramatically. Hastings says Verizon and Amazon are bit players because they don’t offer a deep catalog of content and their offerings are more difficult to view on the family television set.

“The competitor we fear most is HBO Go,” Hastings said. “HBO is becoming more Netflix-like and we’re becoming more HBO-like. The two of us will compete for a very long time.”

HBO Go is part of the cable industry’s TV Everywhere project, delivering online video services to authenticated cable-TV subscribers. Although HBO Go is typically included for free with an HBO subscription, the premium movie channel’s price has increased dramatically in the last three years. In many areas, a monthly subscription for HBO now runs just shy of $15 a month.

CNN Money pondered whether Netflix can ultimately stay independent in a country where vertically and horizontally integrated super-sized entertainment companies control programming, distribution, and the Internet providers consumers use to access the content. Netflix may still be an acquisition target:

Verizon. On the one hand, Verizon appears to be showing stronger interest in Redbox, which is planning to launch a streaming-video service in May 2012. On the other hand, Redbox is likely to face the same onerous licensing costs that plague Netflix, and Verizon might be better off buying a company experienced in licensing streaming rights. And besides, by hinting of a Redbox deal, Verizon can push down Netflix’ price – making a deal that much cheaper.

But if a Verizon deal makes sense on the face of it, it could become problematic over time. The two companies’ cultures are incompatible. Netflix takes risks that often (but not always) pay off, and builds its products around the customer’s experience. Verizon is risk-averse and builds its strategies on wringing fees from customers. If Netflix members staged a revolt over of the subscription fiasco, imagine how they’d react if Verizon raised fees further or demanded Netflix users sign up with its Internet service.

Microsoft. Netflix could give Microsoft the popular online service it’s never been able to build on its own. The Xbox has gone from gaming console to a well-received smart TV device, and integrating Netflix’ streaming-video service could put it ahead of Apple and Google. Plus, Reed Hastings could bring Microsoft a seasoned executive who instinctively understands where digital content is going.

Google. If the search giant can buy a phone maker, why not a video service? At $42.6 billion Google’s cash stockpile is 116 times the size of Netflix’s. Google already owns the only other digital-video property that has been embraced by the masses: YouTube. Combining the best features of both could lead to the only site you’d need to visit to get your video fix. Google’s recent comments on a controversial anti-piracy bill, however, could strain relations with studios that Netflix must license from.

Apple. As with Google, Apple’s $45 billion in cash will not only buy Netflix but sign many content deals and still leave tens of billions in the coffers. Thanks to iTunes, Apple has longstanding relationships with TV and movie studios, which could secure better terms for Netflix. And like iTunes, Netflix could spur enough sales of Apple devices that Apple doesn’t need to worry about making the profit that Netflix investors expect today.

Amazon. For as long as Netflix has been around, someone has been suggesting a merger with Amazon. Consumers have been buying DVDs from Amazon for years, and with IMDB, the best single film database on the planet, finding and researching movies to watch would be a cinch. The catch has been that owning Netflix’s mailing facilities would open it up to taxes in many states. But that may change now that Netflix seems ready to sell off its shrinking DVD-rental business.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/Bloomberg Bibb on Verizons Possible Bid for Netflix 12-12-11.flv[/flv]

Porter Bibb, managing partner at Mediatech Capital Partners LLC, talks about Verizon Communications Inc.’s possible offer for Neflix Inc. and the outlook for the streaming video industry. He was widely cited as one of the primary sources of the Verizon acquisition rumor. He speaks with Jon Erlichman on Bloomberg Television’s “Bloomberg West.” (5 minutes)

Subscribe

Subscribe