![]() If you want better Canadian broadband with fewer tricks and traps and live in Ontario or Quebec: put the house up for sale, pack up your things, and head west.

If you want better Canadian broadband with fewer tricks and traps and live in Ontario or Quebec: put the house up for sale, pack up your things, and head west.

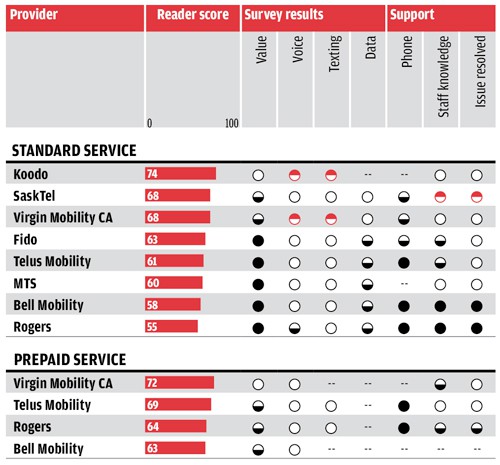

Canada’s heavily metered and capped broadband is ubiquitous in the country’s two most-populated provinces where a convenient duopoly of Bell and Rogers in Ontario and Bell and Videotron in Quebec control the vast majority of the broadband market. But cross west into Saskatchewan and things start to look a lot better.

Canadians telecommunications consultancy The Seaboard Group praised SaskTel, the provincial phone company, for refusing to slap usage caps on its customers. SaskTel does not deliver the cheapest Internet access by any means, but the company is investing heavily in fiber optic upgrades to turn the page on aging copper wire infrastructure. Stringing fiber through Regina, Saskatoon and beyond may seem counterintuitive to other providers. Saskatchewan, one of Canada’s “prairie provinces,” is hardly packed with people. With more than 20 million Canadians living in Ontario and Quebec, Saskatchewan gives its 1 million residents a lot of open space. Sparser populations usually translate into higher costs per customer for upgrades, but SaskTel persists.

SaskTel has historically relied on traditional DSL and has competition in larger communities from Shaw Cable, western Canada’s largest cable operator. Although SaskTel’s DSL delivers lower speeds than Shaw can provide, it does so with no usage limits.

SaskTel has historically relied on traditional DSL and has competition in larger communities from Shaw Cable, western Canada’s largest cable operator. Although SaskTel’s DSL delivers lower speeds than Shaw can provide, it does so with no usage limits.

Shaw’s decision to provide considerably more generous usage allowances has kept the pressure on SaskTel to upgrade its infrastructure to compete.

SaskTel CEO Ron Styles told the Leader-Post its fiber optic network will give cable a run for its money, and until then, it is satisfied undercutting cable pricing for broadband, delivering a far better experience than either Rogers or Bell provides eastern Canadians, Styles says.

Seaboard president Iain Grant found that what customers are willing to pay for service can also influence what prices providers charge.

“The price is more based on what you’re prepared to pay,” Grant said.

People in western Canada evidently are not willing to hand over as much money as their friends in Ontario and Quebec.

West of Saskatchewan lies Alberta and British Columbia — Telus territory. Telus is western Canada’s largest phone company and also principally competes with Shaw Cable.

Shaw has forced Telus to back down on fueling enhanced revenue with usage caps of its own, and has been aggressively upgrading its network with additional fiber optics and DOCSIS 3 technology, forcing Telus to embark on its own upgrade effort.

Macleans reports western Canada’s more-competitive broadband market has been good for consumers, but has also exposed a difference in priorities for providers.

With Shaw breathing down its neck, Telus has committed to a $3 billion fiber optic network expansion in B.C., improved wireless coverage, and more IPTV service. Macleans notes Telus is the only major telecom or cable company in Canada that hasn’t purchased a television asset, focusing instead on its core businesses of connecting customers.

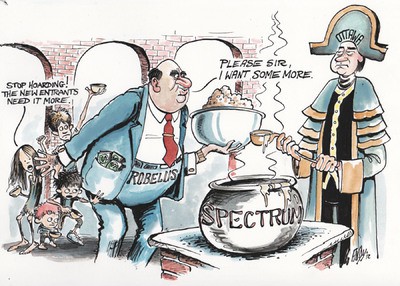

In eastern Canada, Bell faces Rogers and Videotron. Critics contend Bell sees no imminent threats there, and the phone giant is spending its money elsewhere, announcing a $3.4 billion acquisition of Astral Media — an entertainment company owning 24 specialty cable channels and pay-TV networks, including the Movie Network and HBO Canada.

In eastern Canada, Bell faces Rogers and Videotron. Critics contend Bell sees no imminent threats there, and the phone giant is spending its money elsewhere, announcing a $3.4 billion acquisition of Astral Media — an entertainment company owning 24 specialty cable channels and pay-TV networks, including the Movie Network and HBO Canada.

Bell’s latest “investment” follows its 2010 $1.3 billion buyout of CTV and last year’s $1.32 billion co-purchase of Maple Leafs Sports and Entertainment (the other buyer was their ‘arch-competitor’ Rogers Communications).

While Telus spends money on upgrading its broadband and video services to customers, Bell is positioning itself to control 34% of Canada’s TV universe. Bell is also the same company that advocated slapping nationwide usage-based pricing on Canadian broadband consumers to pay for the “network upgrades” it contends were needed to handle increasing demand.

Subscribe

Subscribe