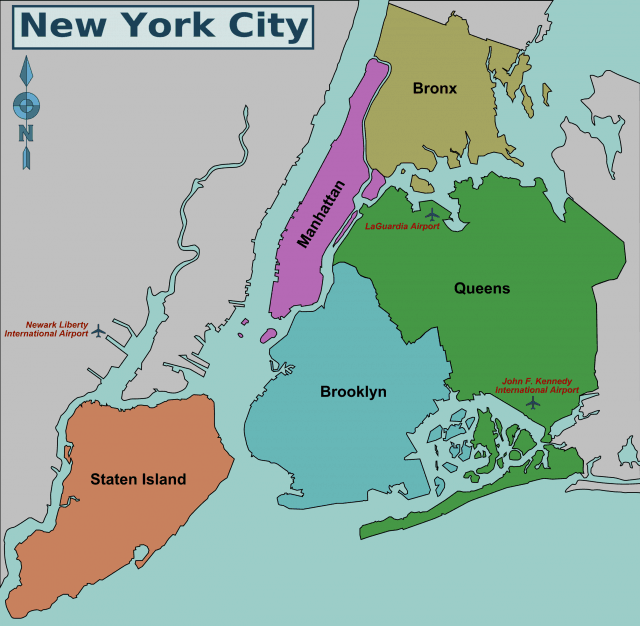

Some residents in eastern Queens, N.Y. have paid tens of thousands of dollars to replace copper water pipes, some damaged beyond repair just three months after being installed, after mysterious stray electric current traced back to Verizon caused the pipes to prematurely deteriorate.

Some residents in eastern Queens, N.Y. have paid tens of thousands of dollars to replace copper water pipes, some damaged beyond repair just three months after being installed, after mysterious stray electric current traced back to Verizon caused the pipes to prematurely deteriorate.

In April, without admitting liability, Verizon reached out to homeowners on 188th Street in the Fresh Meadows area, offering to reimburse costs incurred dealing with leaking, corroded copper water pipes.

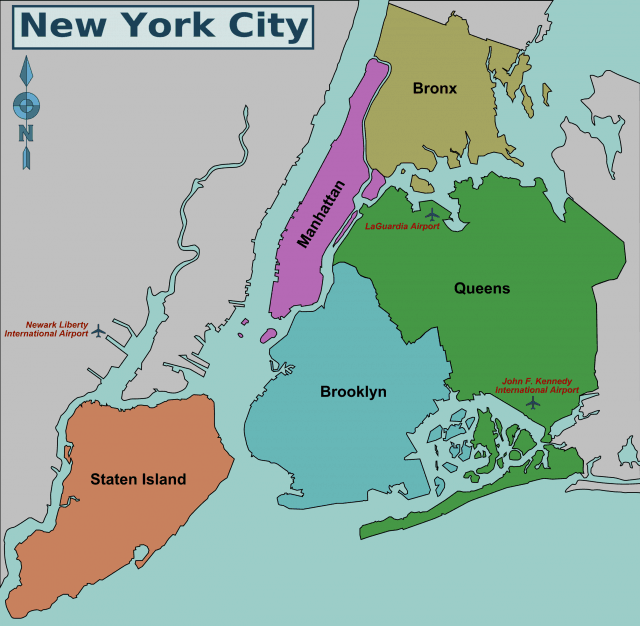

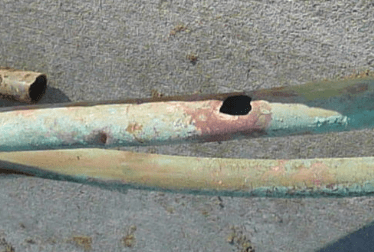

The problems began nearly four years ago, affecting residents of Jamaica Estates, Rosedale, Flushing, and other nearby neighborhoods. An epidemic of water leaks originating in copper pipes that connect homes to the municipal water supply resulted in waterlogged front lawns and small rivers of water running down streets with no rain in sight. Copper water pipes rated for 60 years of service began failing after as little as three months. Inspection found premature corrosion and leaks.

Joe Concannon on 188th Street in Queens demonstrates how quickly water lines in the neighborhood deteriorate as a result of corrosion. (2:00)

What caused the pipes to deteriorate so rapidly, forcing some homeowners to replace their feed lines four times over the course of a few years? An investigation conducted by the New York City Department of Environmental Protection (DEP), which is responsible for supplying water service in the area, discovered the culprit was stray direct current electricity traveling underground. When DC voltage reaches copper pipes, electrolytic corrosion begins. True electrolysis is rare and had not been seen in most cities for decades, primarily because of the retirement of high amperage DC current-fed trolley cars our grandparents and great-grandparents once rode.

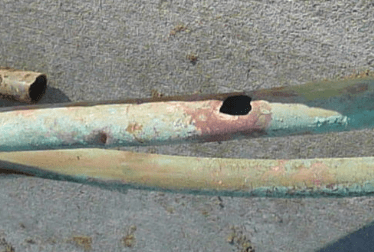

This copper pipe survived five months underground before deteriorating with a substantial corrosion hole. (Image courtesy: Joe Concannon)

As some homeowners continued to face thousands in repair bills, a classic game of finger-pointing ensued over where the excess leaking voltage was coming from. Con Ed was a natural suspect, except for the fact it supplies alternating current (AC) voltage, which was not responsible for the corrosion problem. Con Ed blamed Verizon, claiming the source of the stray electricity was coming from Verizon equipment on a pole in Rosedale. Verizon called Con Ed’s investigation flawed because that particular pole carried fiber optic FiOS cables. Besides, it was highly unlikely leaking voltage traced to a single overhead pole could cause the kind of damage being found in Queens.

In 2017, the DEP commissioned Corr-Tech, an independent consultant, to find the source of the stray voltage, and verify if city infrastructure was responsible. In a 2018 report, the consultant stated that the leaks were not caused by city infrastructure but rather by a private utility, namely Verizon.

Corr-Tech found that although Verizon had commissioned FiOS fiber optic service in Queens years earlier, its older network remained in service. Verizon’s copper infrastructure is powered by DC voltage and if allowed to fall into disrepair, could leak DC voltage from buried phone cables. In this part of Queens, Verizon used lead-sheathed communications cable in terracotta ducts in the immediate vicinity of the deteriorated copper piping. Terracotta is the same material used to make clay flower pots, and is relatively fragile and subject to cracking and breaking.

After the 2018 report was issued, Verizon announced some results of its own investigation, concluding “when homeowners disconnect traditional copper telephone wires, by either going to FiOS or removing phone service altogether, Verizon continues to emit a current through those lines.”

But Verizon did not accept direct responsibility, and for the rest of 2018 into 2019, copper pipe failures persisted. At least 32 private water service lines along the east side of 188th Street and between 73rd Avenue and the Grand Central Parkway have failed since 2017.

“We’re not talking about one or two or five or ten, were talking about dozens,” said City Councilmember Barry Grodenchik. “Let me do the math for you, one person having a broken water main into their house is bad luck on one block, two of them is a coincidence, 32 in such a short stretch of 188th Street is a statistical impossibility unless there is an intervening force.”

In January, fed up residents were joined by members of the City Council and New York Assembly at a press conference calling on Verizon and the DEP to resolve the situation and reimburse homeowners. Assemblyman David Weprin proposed a bill in the New York State legislature that would put the onus on DEP to replace damaged water pipes at their expense, and then chase Verizon for reimbursement.

In January, fed up residents were joined by members of the City Council and New York Assembly at a press conference calling on Verizon and the DEP to resolve the situation and reimburse homeowners. Assemblyman David Weprin proposed a bill in the New York State legislature that would put the onus on DEP to replace damaged water pipes at their expense, and then chase Verizon for reimbursement.

“The homeowners should not be responsible,” Weprin said in January. “I will be introducing a bill tomorrow in Albany, hopefully with the support of my Assembly member colleagues, to not require the homeowners to lay out the money. DEP is in a better position to layout the money, in the thousands of dollars, and then go after the third-party, in this case Verizon, rather than the homeowners.”

Because Verizon may ultimately be found financially liable, the company is now disconnecting line voltage from unused landlines, but despite reducing stray DC current, it remains present underground. Verizon will likely have to decommission its copper landline network or replace it to fully eliminate the excess voltage. In the meantime, Verizon recently sent letters to all affected homeowners stating it hired Sedgwick Claim Management Services “to evaluate claims for reimbursement for monetary expenses incurred as a direct result of the leak of your corroded copper water pipes.”

In return for signing a release of all claims against Verizon for damage, the phone company says it will begin reimbursing valid claim holders. Some neighborhood activists have little trust in Verizon or its motives, and questioned whether that signed release would prevent future claims from being processed. Verizon denied that would be the case and said it would continue to reimburse impacted homeowners in the future. Many would prefer not having to cover the costly repairs out-of-pocket and then wait for reimbursement. Some have proposed a fund paid for by utility companies to cover replacement costs directly.

A few lawmakers wonder if Verizon’s deteriorating underground infrastructure could be a ticking time bomb waiting to go off in other neighborhoods and in other states.

“Homeowners have been affected, and yet again we’ve seen a huge corporation just shirk their responsibility for doing the right thing by each and every homeowner,” said Assemblywoman Nily Rozic. “It is incumbent upon the city it’s incumbent on the state the Public Service Commission, to make Verizon step up and really deliver for homeowners.”

WABC-TV’s consumer reporter visited Queens to report on the sudden deterioration of copper water pipes in the neighborhood in July, 2018. Impacted homeowners endured flooded basements and thousands of dollars in unreimbursed expenses. (2:54)

Effective today, Hulu is now under the full control of the Walt Disney Company, ending a decade of a sometimes-uneasy partnership between rivals NBC-Universal, 21st Century Fox, Disney-ABC and Time Warner (Entertainment).

Effective today, Hulu is now under the full control of the Walt Disney Company, ending a decade of a sometimes-uneasy partnership between rivals NBC-Universal, 21st Century Fox, Disney-ABC and Time Warner (Entertainment).

Subscribe

Subscribe CenturyLink is considering getting out of the consumer landline and broadband business and instead focusing on its profitable corporate-targeted enterprise and wholesale businesses.

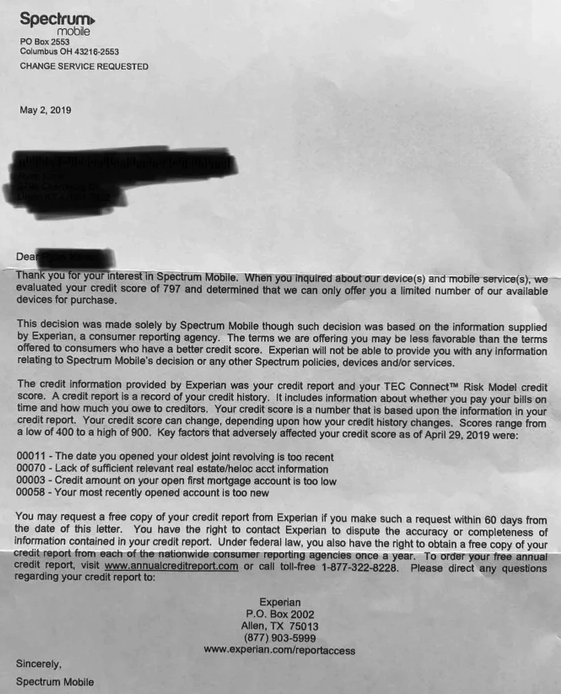

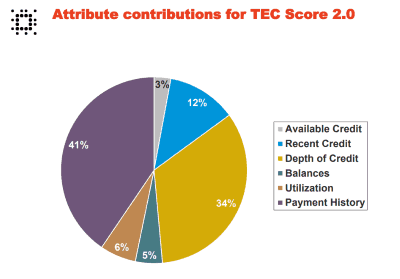

CenturyLink is considering getting out of the consumer landline and broadband business and instead focusing on its profitable corporate-targeted enterprise and wholesale businesses. Spectrum Mobile customers who sign up for cell service can expect an inquiry about their creditworthiness, and some customers with near-perfect FICO scores are embarrassed to discover Spectrum considers them too risky, thanks to an Experian credit scoring model developed specifically for utilities, phone and cable companies.

Spectrum Mobile customers who sign up for cell service can expect an inquiry about their creditworthiness, and some customers with near-perfect FICO scores are embarrassed to discover Spectrum considers them too risky, thanks to an Experian credit scoring model developed specifically for utilities, phone and cable companies.

Some residents in eastern Queens, N.Y. have paid tens of thousands of dollars to replace copper water pipes, some damaged beyond repair just three months after being installed, after mysterious stray electric current traced back to Verizon caused the pipes to prematurely deteriorate.

Some residents in eastern Queens, N.Y. have paid tens of thousands of dollars to replace copper water pipes, some damaged beyond repair just three months after being installed, after mysterious stray electric current traced back to Verizon caused the pipes to prematurely deteriorate.

In January, fed up residents were joined by members of the City Council and New York Assembly at

In January, fed up residents were joined by members of the City Council and New York Assembly at  The top 10 service providers in the United States collectively lost over 1.25 million paid television customers in the first three months of 2019, providing further evidence that cord-cutting is accelerating.

The top 10 service providers in the United States collectively lost over 1.25 million paid television customers in the first three months of 2019, providing further evidence that cord-cutting is accelerating.