Cable ONE’s boost in cable infrastructure investment is paying dividends for its broadband customers with new upstream speed upgrades.

“Our customers have expressed a need for faster upload speeds and we’re committed to listening to our customers and delivering the latest products and technical advancements while maintaining the highest level of reliability and customer care,” said Joe Felbab, Cable ONE vice president of marketing.

The details:

- 50/2Mbps Streaming Plan gets a slight bump to 3Mbps upload speed;

- 60/2Mbps Premier Plan gets upload speed doubled to 4Mbps;

- 70/2Mbps Ultra Plan gets a triple boost to 6Mbps.

To activate the new upload speeds, reset your cable modem by briefly unplugging it.

Cable ONE’s promotions often only last three months before increasing to the regular, undisclosed a-la-carte price. Modem lease or purchase is extra.

In June, Cable ONE scrapped its confusing consumption billing scheme and replaced it with standard usage caps that our readers report are unevenly enforced.

The 1.5Mbps, 5Mbps, 8Mbps, 10Mbps, 12Mbps, & 50Mbps services (some plans grandfathered for existing customers) have a cap of 300GB per billing cycle, while the 60Mbps and 70Mbps services respectively have 400 and 500GB data caps per billing cycle. Surfing Internet has a 50GB cap.

The 1.5Mbps, 5Mbps, 8Mbps, 10Mbps, 12Mbps, & 50Mbps services (some plans grandfathered for existing customers) have a cap of 300GB per billing cycle, while the 60Mbps and 70Mbps services respectively have 400 and 500GB data caps per billing cycle. Surfing Internet has a 50GB cap.

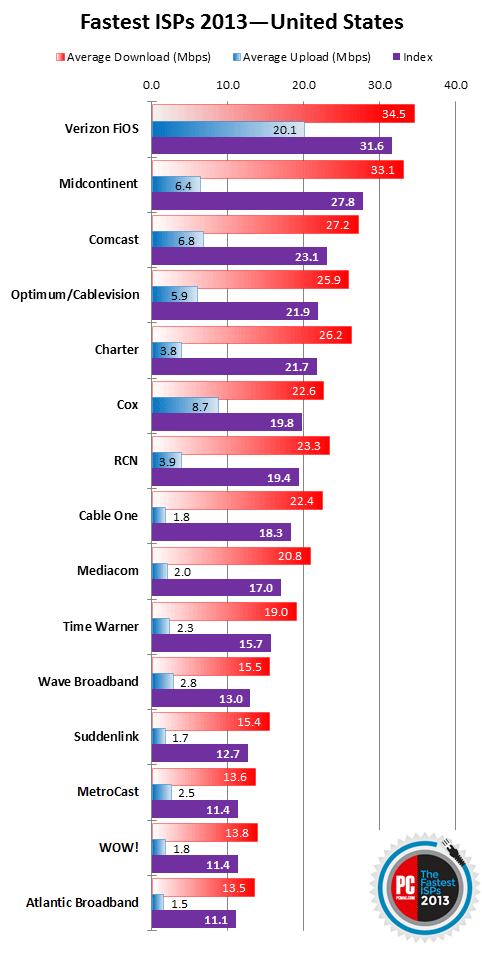

While 6Mbps upload speed is slightly better than what Time Warner Cable and AT&T U-verse customers get, Cable ONE remains well behind companies like Comcast and Verizon FiOS.

Cable ONE in April announced a two-year, $60 million network upgrade across 42 cable systems in its mostly rural footprint to enhance reliability and deliver faster Internet service. Upstream speeds are the most difficult to increase for cable broadband providers because the DOCSIS standard was designed to deliver fast download speeds.

Earlier this month, Cable ONE adopted TiVo for its new Whole Home DVR, which offers 650 hours of recording time with four built-in tuners and an Advanced TiVo on-screen guide.

In large parts of its national service area, Cable ONE competes with telephone companies AT&T, CenturyLink, and Windstream.

Subscribe

Subscribe Cable ONE customers nationwide lost eight Turner Networks channels yesterday, despite the fact the cable company has a signed contract with Turner to pay for some of the networks that have gone dark.

Cable ONE customers nationwide lost eight Turner Networks channels yesterday, despite the fact the cable company has a signed contract with Turner to pay for some of the networks that have gone dark. “We signed contracts for TBS, TNT and the Cartoon Network through the National Cable Television Cooperative (NCTC), which allows for the purchase of individual channels rather than the entire bundle of eight,” said Might. “In a disgraceful punitive reaction, Turner Networks refused to recognize the NCTC contracts and immediately de-authorized all Cable ONE systems in order to ‘teach’ Cable ONE a lesson about the power of cable programmers to tie and bundle channels together and force carriage of unwanted bundles. They refuse to give cable operators or their customers any choice about what they can or cannot buy.”

“We signed contracts for TBS, TNT and the Cartoon Network through the National Cable Television Cooperative (NCTC), which allows for the purchase of individual channels rather than the entire bundle of eight,” said Might. “In a disgraceful punitive reaction, Turner Networks refused to recognize the NCTC contracts and immediately de-authorized all Cable ONE systems in order to ‘teach’ Cable ONE a lesson about the power of cable programmers to tie and bundle channels together and force carriage of unwanted bundles. They refuse to give cable operators or their customers any choice about what they can or cannot buy.” Verizon FiOS is the fastest nationwide broadband service available.

Verizon FiOS is the fastest nationwide broadband service available. One of America’s lowest-rated cable companies and an industry legend labeled by consumer advocates as the “Darth Vader of cable” may be joining forces to buy Time Warner Cable, according to Bloomberg News.

One of America’s lowest-rated cable companies and an industry legend labeled by consumer advocates as the “Darth Vader of cable” may be joining forces to buy Time Warner Cable, according to Bloomberg News.

But the most obvious foreshadowing of a big deal with Time Warner would most likely come if Charter first successfully acquires always-rumored-for-sale Cablevision, where the controlling Dolan family is rumored to be holding out for an exceptionally attractive buyout package other cable companies aren’t willing to offer. Time Warner itself has been rumored as a buyer, but current management has repeatedly stressed it will not pay a premium price for acquisition targets.

But the most obvious foreshadowing of a big deal with Time Warner would most likely come if Charter first successfully acquires always-rumored-for-sale Cablevision, where the controlling Dolan family is rumored to be holding out for an exceptionally attractive buyout package other cable companies aren’t willing to offer. Time Warner itself has been rumored as a buyer, but current management has repeatedly stressed it will not pay a premium price for acquisition targets.