THE Internet Overcharger

Cable One, one of the nation’s most notorious, usage-capped broadband providers, has left thousands of Columbus, Miss. subscribers without phone, Internet, and cable television service since 6pm Sunday night, unable to repair the problem until a part arrives at the local cable office.

The Dispatch reports a steady stream of people, unable to get answers from Cable One over the phone, have been showing up at the company’s local cable office from the time it opened for business this morning, all looking for answers.

Cable One General Manager David Lusby said he had no idea how many customers were affected by the outage or when the cable system would be back up and running. Those are not the answers customers want to hear, particularly for customers depending on Cable One for their local businesses. Local shops have been unable to process credit card transactions, cannot make or receive calls, and are relying on personal cell phones for basic connectivity with the outside world.

New Hope resident Walter Worthy is fed up with Cable One’s bad service, calling the company’s broadband service “spotty” for more than a month. Worthy told the newspaper he would rather have AT&T’s DSL service if he could, but AT&T has shown no interest extending service in his neighborhood.

One ex-customer named Matt told the newspaper he finally dropped Cable One Internet service that cost $65 a month for the same reason.

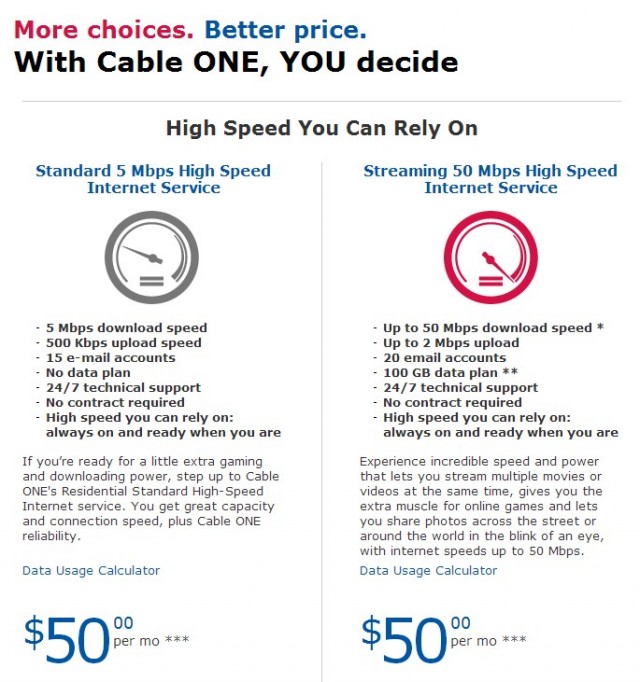

Cable One maintains one of the most arcane Internet “Fair Use” policies in the country, with broadband usage limits that apply to both daily and monthly usage:

Excessive Use Daily Threshold

(combined upstream & downstream) |

| Tier |

Economy |

Standard

(5 mbps only) |

Standard (Preferred or Elite Plans w/ 50 Meg Upgrade) |

Premium

(10 mbps) |

Ultra

(12 mbps) |

| Threshold |

Not applicable |

3 Gigabytes |

Data Plan Applies |

5 Gigabytes |

10 Gigabytes |

Another limit applies to monthly usage:

Data Plans for Elite & Preferred Packages

(Subscribed under Contract Offerings or Post Contract Rollover only) |

| Data Plan |

Base Speed |

Upgraded Speed during Contract Period |

Gigabyte Allocation per Month |

Measurement Period |

| Preferred |

5 Mbps |

50 Mbps |

50 Gigabytes |

8 am – 12 Midnight |

| Elite |

5 Mbps |

50 Mbps |

100 Gigabytes |

8 am – 12 Midnight |

Data Plans for 50Mbps Internet

(Does NOT apply to Contract Offerings or Post Contract Rollover) |

| Package Type |

Data Speed |

Gigabyte Allocation per Month |

Measurement Period |

50Mbps Internet

(A-La-Carte) |

50 Mbps |

100 Gigabytes |

8 am – 12 Midnight |

| 3 Pack Elite Promotion/Bundle |

50 Mbps |

100 Gigabytes |

8 am – 12 Midnight |

| 2 Pack Preferred Promotion/Bundle |

50 Mbps |

50 Gigabytes |

8 am – 12 Midnight |

The combination of poor service and a confusing Internet Overcharging scheme resulted in the cable operator experiencing a loss in broadband customers, almost unprecedented for cable companies. Cable One said goodbye to 1,017 high-speed Internet and 9,610 basic video subscribers during the second quarter, according to its owner, The Washington Post.

Communities like Natchez, Miss. are responding by attempting to shorten its franchise renewal with the company, which typically runs 10 years.

Ward 3 Alderwoman Sarah Smith foresees the contract being renewed but isn’t certain she wants the city’s digital future tied to Cable One for the next decade.

“Technology is changing so fast, I just don’t see us having any contract for as long as 10 years,” Smith told the Natchez Democrat.

Smith notes local residents have regularly complained about Cable One’s service, and the city has considered the possibility of letting another operator take over in the area, but has found no takers.

“We’re not going to be on the top of the radar for every service to be here,” Smith said.

More importantly, it is unprecedented for another major cable provider to displace a current operator, no matter how poorly they provide service.

Cable One has announced it will invest $60 million in network upgrades across 42 cable systems in its mostly rural footprint to enhance reliability and deliver faster Internet service.

Cable One has announced it will invest $60 million in network upgrades across 42 cable systems in its mostly rural footprint to enhance reliability and deliver faster Internet service.

Subscribe

Subscribe Cable One is preparing what it calls a $500,000 “reinforcement project” to replace and update wires and other equipment.

Cable One is preparing what it calls a $500,000 “reinforcement project” to replace and update wires and other equipment.