Viacom, which owns cable networks including Comedy Central, Nickelodeon, MTV, BET, and TV Land, will launch a cheap non-sports bundle of entertainment cable networks viewable online for $10-20 a month this year.

Viacom, which owns cable networks including Comedy Central, Nickelodeon, MTV, BET, and TV Land, will launch a cheap non-sports bundle of entertainment cable networks viewable online for $10-20 a month this year.

Viacom has lost basic cable viewers at an accelerating rate as cable operators drop their networks or repackage them in more expensive basic tiers as Viacom raises wholesale rates cable companies pay to carry the channels.

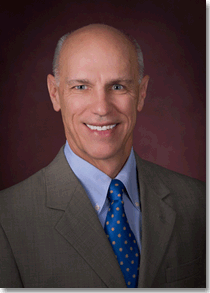

Viacom CEO Bob Bakish talked about the new service this morning at the J.P. Morgan Global Technology, Media and Telecom Conference in Boston. Bakish said most of the current “skinny cable TV” bundles were priced at around $40 a month, which is too expensive to attract “cord-never millennials” that frequently don’t subscribe to cable television.

“The transformational opportunity is to bring in a new entry segment at a much lower price point,” Bakish said. The cable industry needs “a path to bring in someone who wants high-quality entertainment” but has no interest in expensive sports networks.

That is why Bakish wants to create a cheap entertainment-oriented bundle of networks that omits sports-related channels. But Bakish has also repeatedly stressed he has no intention of giving consumers a comprehensive online alternative to traditional cable TV, telling investors Viacom is “not creating inexpensive opportunities to serve as an alternative.”

Bloomberg News reported Viacom was talking to Discovery and AMC Networks about participating in the new service. The only complication may be a backlash from sports programmers like Walt Disney’s ESPN and 21st Century Fox, Inc., which have contracts requiring providers to include the sports networks in their most popular bundles. Some contracts even limit how many customers are permitted to sign up for a sports-free TV package, according to Michael Nathanson, an analyst at MoffettNathanson LLC.

Bloomberg News reported Viacom was talking to Discovery and AMC Networks about participating in the new service. The only complication may be a backlash from sports programmers like Walt Disney’s ESPN and 21st Century Fox, Inc., which have contracts requiring providers to include the sports networks in their most popular bundles. Some contracts even limit how many customers are permitted to sign up for a sports-free TV package, according to Michael Nathanson, an analyst at MoffettNathanson LLC.

“It’s meant to dissuade distributors from doing something like this,” Nathanson told Bloomberg. “The issue is how many subscribers they can have before the legal questions appear.”

Bakish may also be trying to remind cable and satellite companies that Viacom can always go direct-to-consumers if operators banish Viacom’s networks off the cable dial or move them to a more expensive tier, although there is no guarantee the new service will bundle all of Viacom’s networks.

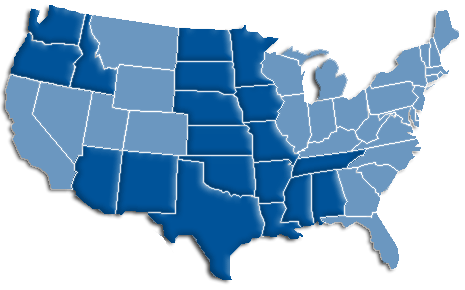

Viacom has seen its relationships with cable and satellite providers deteriorate over the last few years under prior management. Some smaller cable companies including Cable One dropped Viacom channels from their cable systems over cost issues in 2014, and many more subscribers have seen Viacom networks temporarily dropped as a result of contract renewal disputes. Bakish has made repairing relations with cable and satellite customers a priority since taking over as CEO in December, but he still has a way to go.

Viacom has seen its relationships with cable and satellite providers deteriorate over the last few years under prior management. Some smaller cable companies including Cable One dropped Viacom channels from their cable systems over cost issues in 2014, and many more subscribers have seen Viacom networks temporarily dropped as a result of contract renewal disputes. Bakish has made repairing relations with cable and satellite customers a priority since taking over as CEO in December, but he still has a way to go.

Recently, Charter Communications moved Viacom networks out of its Select basic cable TV package and moved them to its most expensive Gold package for new customers. With only a minority of customers signed up for Gold service, Viacom networks could eventually lose millions of viewers as Time Warner Cable and Bright House customers adopt Spectrum packages in the next few years. If those customers do not subscribe to Gold or refuse to pay extra for a “digipak” of Gold’s basic channels without the premium networks, they will lose access to Viacom channels when they change TV plans.

That issue also concerns Wall Street analysts who believe it could eventually erode Viacom’s viewer base. Bakish made certain to tell investors Viacom was not surrendering to Charter’s “re-tiering.”

“We firmly don’t believe they have the rights to do that,” Bakish said. “We’ve been in discussions with them. We’ve got to get that resolved.”

If it is resolved, those networks may again be available to Select TV customers.

Viacom, AMC, and Discovery are partnering up to offer a $10-20 entertainment-only package on streaming basic cable networks for consumers, as this Bloomberg News story reports. (2:58)

Subscribe

Subscribe

Fido Cable (which has no relationship with the Canadian prepaid mobile provider “Fido,” owned by Rogers Communications), says internet and voice plans start at $39.99 a month, but not for TWC or Charter customers.

Fido Cable (which has no relationship with the Canadian prepaid mobile provider “Fido,” owned by Rogers Communications), says internet and voice plans start at $39.99 a month, but not for TWC or Charter customers. First credit cards were tied to your credit score, then auto insurance, and now how much you pay for cable television and what kind of support you receive from customer service may also depend on your creditworthiness, at least at Cable One.

First credit cards were tied to your credit score, then auto insurance, and now how much you pay for cable television and what kind of support you receive from customer service may also depend on your creditworthiness, at least at Cable One. Cable One has even stopped direct marketing its cable service, even though it was winning nine percent of new customer sign-ups. The customers Cable One attracted were so low quality, Might claims the company didn’t make a penny from the marketing effort.

Cable One has even stopped direct marketing its cable service, even though it was winning nine percent of new customer sign-ups. The customers Cable One attracted were so low quality, Might claims the company didn’t make a penny from the marketing effort.

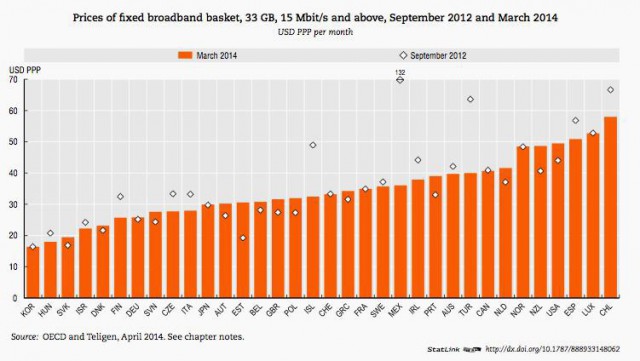

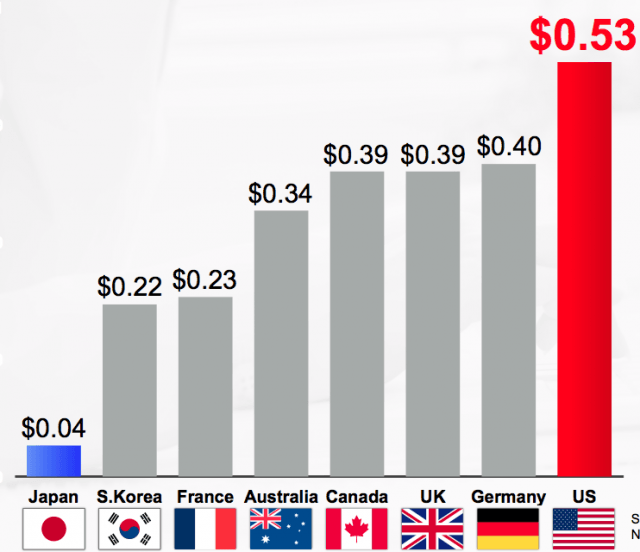

In the last three years, several Wall Street analysts have called on cable and telephone companies to raise the price of broadband service to make up for declining profits selling cable TV. As shareholders pressure executives to keep profits high and costs low, dramatic price changes may be coming for broadband and television service that will boost profits and likely eliminate one of their biggest potential competitors — Sling TV.

In the last three years, several Wall Street analysts have called on cable and telephone companies to raise the price of broadband service to make up for declining profits selling cable TV. As shareholders pressure executives to keep profits high and costs low, dramatic price changes may be coming for broadband and television service that will boost profits and likely eliminate one of their biggest potential competitors — Sling TV.

“Our work suggests that cable companies have room to take up broadband pricing significantly and we believe regulators should not oppose the re-pricing (it is good for competition & investment),”

“Our work suggests that cable companies have room to take up broadband pricing significantly and we believe regulators should not oppose the re-pricing (it is good for competition & investment),”  Neither would Sling CEO Roger Lynch, who has a package of 23 cable channels to sell broadband-only customers for $20 a month.

Neither would Sling CEO Roger Lynch, who has a package of 23 cable channels to sell broadband-only customers for $20 a month.