Rosenworcel

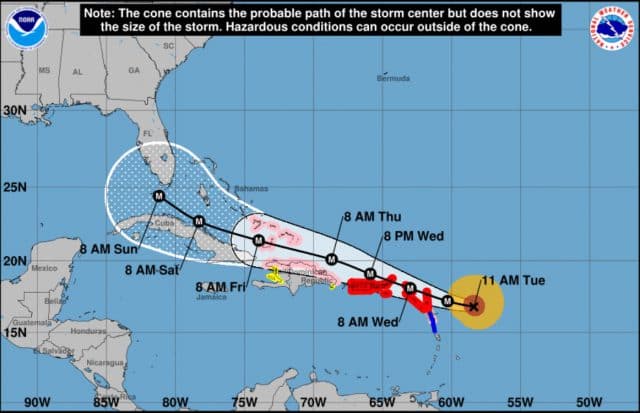

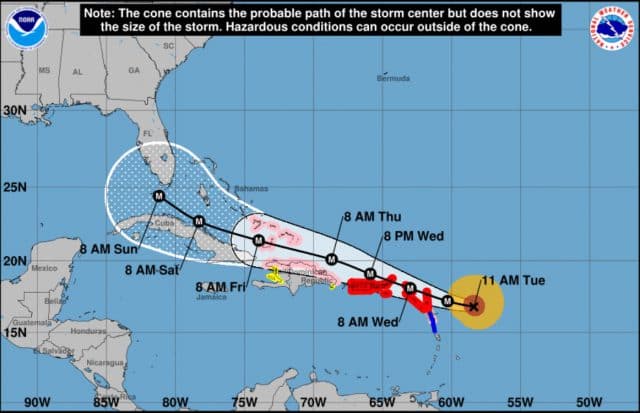

Significant, days-long outages of wireless cell, wireline, and 911 service in the aftermath of Hurricane Harvey are prompting a FCC commissioner to ask how things could go better the next time, even as Category 5 Irma is expected to head for Florida this week.

Democratic Commissioner Jessica Rosenworcel believes the FCC should look closely at the impact of Harvey on telecommunications networks in southeastern Texas and Louisiana and see what improvements can be made.

“As we begin to assess Harvey’s horrible toll on human life and property, we will need to take stock of what worked, what didn’t, and how we can improve when it comes to our communications infrastructure,” Rosenworcel said. “As we have done in disasters in the past, the Commission will need to study this hurricane and issue a report. That report must include a full plan for fixing the vulnerabilities that we are finding, from overloading 911 systems to out-of-service cell sites.”

Rosenworcel is also urging the Commission to insist that providers replace damaged telecommunications networks with better, more capable networks.

“[The study] should also include a framework for rebuilding so that the communities that have been impacted are not permanently relegated to the wrong side of the digital divide,” Rosenworcel urged. “Above all, we need to get started. We don’t have time to waste, because we know that weather emergencies can occur anywhere at any time, and learning from what happened with Harvey can help strengthen our communications networks and save lives.”

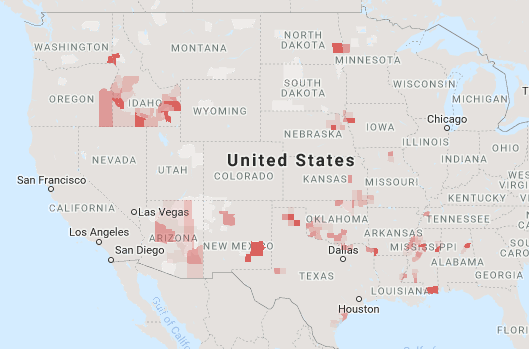

A week after the storm, telecommunications networks in the area affected by Harvey are still experiencing problems, although most cell service has been restored. The worst affected areas are in Aransas, Tex., where four of 19 cell towers are out of service and Orange, Tex., where 13 out of 85 cell towers are not working as of this morning.

Category 5 Irma projected to affect Florida.

There are at least 153,850 subscribers (down from at least 158,086 yesterday) out of service in the affected area. This includes users who get service from cable system or wireline providers.

Cable ONE announced last week that it will be waiving billing for its Texas Coast customers impacted by Hurricane Harvey for the duration of the storm until services are restored. The company also will not be charging customers for equipment damaged during the hurricane.

“Our thoughts and prayers are with the Texas and Louisiana communities that have been ravaged by Hurricane Harvey,” said Julie Laulis, president and CEO of Cable ONE. “We urge all of our customers to stay safe and continue following the directives of local public safety officials as response and recovery efforts begin.”

Cable ONE’s disaster recovery plan is underway as teams review and map fiber breaks, assess damage to impacted plant and equipment, and assist and coordinate with other organizations to begin the process of repairing and rebuilding.

“We will do everything we can to restore service to every one of our affected customers as quickly as possible, including deploying additional technicians and resources,” Laulis said. “Our priority, after first ensuring the safety of our associates, is to continue to serve our residential and business customers during and after the hurricane.”

There are 5 (2 down from yesterday) radio stations out of service. Those are all in Texas – KFNC, KTXB, KKWV, KRVT, and KAYK.

Two television stations went off the air over the weekend but have now been restored as of this morning. KBTV is back at reduced power and KFDM is operating from a backup transmitter.

Emergency 911 service is back up and working normally in most parts of the region with these exceptions:

- 911 Calls Rerouted With No Automatic Location Information (ALI): Refugio County SO, Tex.

- 911 Calls Rerouted With ALI: Harris County Neutral SO, Tex.; Houston EC Training, Tex.; Port Aransas PD, Tex.; and West Columbia PD, Tex.

Cable ONE today announced it has acquired family owned cable operator Fidelity Communications, in a $525.9 million cash deal.

Cable ONE today announced it has acquired family owned cable operator Fidelity Communications, in a $525.9 million cash deal. Louisiana

Louisiana

Subscribe

Subscribe Cable One will

Cable One will