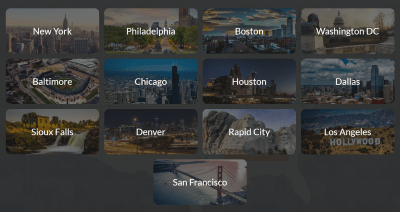

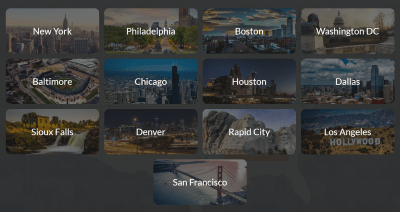

Locast, the not-for-profit cooperative that has successfully streamed local, over the air stations without running afoul of copyright law and attorneys, has announced a big expansion into the cities of Los Angeles, San Francisco, Sioux Falls and Rapid City (South Dakota).

Locast, the not-for-profit cooperative that has successfully streamed local, over the air stations without running afoul of copyright law and attorneys, has announced a big expansion into the cities of Los Angeles, San Francisco, Sioux Falls and Rapid City (South Dakota).

The free, donation-supported service now covers (in addition to the aforementioned) New York City, Philadelphia, Boston, Washington, D.C., Baltimore, Chicago, Houston, Dallas, and Denver.

In each city, Locast streams all the major network stations, almost all independents, some low power outlets, and a host of digital sub-channels featuring digital multicast networks like MeTV, Grit, Comet, and many others. It skips home shopping outlets and some minority language stations. Viewers get a program grid to know what to watch, and picture quality is generally very good to excellent.

Locast has staked its position as a “virtual translator” operation. FCC rules allow independent groups to pick up and rebroadcast television stations without the permission of the stations involved, as long as the operation is not-for-profit:

Before 1976, under two Supreme Court decisions, any company or organization could receive an over-the-air broadcast signal and retransmit it to households in that broadcaster’s market without receiving permission (a copyright license) from the broadcaster. Then, in 1976, Congress passed a law overturning the Supreme Court decisions and making it a copyright violation to retransmit a local broadcast signal without a copyright license. This is why cable and satellite operators, when retransmitting a broadcast signal, either must operate under a statutory “compulsory” copyright license, or receive permission from the broadcaster.

Before 1976, under two Supreme Court decisions, any company or organization could receive an over-the-air broadcast signal and retransmit it to households in that broadcaster’s market without receiving permission (a copyright license) from the broadcaster. Then, in 1976, Congress passed a law overturning the Supreme Court decisions and making it a copyright violation to retransmit a local broadcast signal without a copyright license. This is why cable and satellite operators, when retransmitting a broadcast signal, either must operate under a statutory “compulsory” copyright license, or receive permission from the broadcaster.

But Congress made an exception. Any “non-profit organization” could make a “secondary transmission” of a local broadcast signal, provided the non-profit did not receive any “direct or indirect commercial advantage” and either offered the signal for free or for a fee “necessary to defray the actual and reasonable costs” of providing the service. 17 U.S.C. 111(a)(5).

Sports Fans Coalition NY is a non-profit organization under the laws of New York State. Locast.org does not charge viewers for the digital translator service (although we do ask for contributions) and if it does so, will only recover costs as stipulated in the copyright statute. Finally, in dozens of pages of legal analysis provided to Sports Fans Coalition, an expert in copyright law concluded that under this particular provision of the copyright statute, secondary transmission may be made online, the same way traditional broadcast translators do so over the air.

For these reasons, Locast.org believes it is well within the bounds of copyright law when offering you the digital translator service.

Earlier efforts to stream over the air stations without the permission of the networks or stations involved quickly resulted in lawsuits and eventual forced closedowns. Locast is the exception, at least so far, having launched first in New York City in January 2018. Since that time, no lawsuits have been filed against the service despite its rapid expansion.

Locast suggests viewers donate $5 a month to help cover its costs and is soliciting donations to launch in more cities. Currently, Seattle, San Diego, Alexandria, La., and Albany, N.Y. are the top contenders.

The service is geofenced, so only those present in a Locast-serviced city can access the service.

AT&T today announced it was donating $500,000 to the non-profit group behind Locast, the online streaming service offering free access to local TV stations in more than a dozen U.S. cities.

AT&T today announced it was donating $500,000 to the non-profit group behind Locast, the online streaming service offering free access to local TV stations in more than a dozen U.S. cities.

Subscribe

Subscribe As some Netflix shareholders grumble about

As some Netflix shareholders grumble about

Locast, the not-for-profit cooperative that has successfully streamed local, over the air stations without running afoul of copyright law and attorneys, has announced a big expansion into the cities of Los Angeles, San Francisco, Sioux Falls and Rapid City (South Dakota).

Locast, the not-for-profit cooperative that has successfully streamed local, over the air stations without running afoul of copyright law and attorneys, has announced a big expansion into the cities of Los Angeles, San Francisco, Sioux Falls and Rapid City (South Dakota). Before 1976, under two Supreme Court decisions, any company or organization could receive an over-the-air broadcast signal and retransmit it to households in that broadcaster’s market without receiving permission (a copyright license) from the broadcaster. Then, in 1976, Congress passed a law overturning the Supreme Court decisions and making it a copyright violation to retransmit a local broadcast signal without a copyright license. This is why cable and satellite operators, when retransmitting a broadcast signal, either must operate under a statutory “compulsory” copyright license, or receive permission from the broadcaster.

Before 1976, under two Supreme Court decisions, any company or organization could receive an over-the-air broadcast signal and retransmit it to households in that broadcaster’s market without receiving permission (a copyright license) from the broadcaster. Then, in 1976, Congress passed a law overturning the Supreme Court decisions and making it a copyright violation to retransmit a local broadcast signal without a copyright license. This is why cable and satellite operators, when retransmitting a broadcast signal, either must operate under a statutory “compulsory” copyright license, or receive permission from the broadcaster. Discovery Networks has signed a new contract with streaming TV service fuboTV that will bring 13 more channels to its lineups and allow subscribers to access on-demand content from Discovery’s suite of networks.

Discovery Networks has signed a new contract with streaming TV service fuboTV that will bring 13 more channels to its lineups and allow subscribers to access on-demand content from Discovery’s suite of networks. WarnerMedia’s forthcoming streaming service will showcase HBO and Cinemax at the heart of a one-size-fits-all streaming package priced at $16-17 a month, featuring premium movies and Warner Bros. vast movie and TV show collection. We wanted to enjoy those streams.

WarnerMedia’s forthcoming streaming service will showcase HBO and Cinemax at the heart of a one-size-fits-all streaming package priced at $16-17 a month, featuring premium movies and Warner Bros. vast movie and TV show collection. We wanted to enjoy those streams.