Frontier Communications is selling its wireline and fiber assets in Idaho, Montana, Oregon and Washington in a $1.35 billion all-cash deal with two private investment firms.

Frontier Communications is selling its wireline and fiber assets in Idaho, Montana, Oregon and Washington in a $1.35 billion all-cash deal with two private investment firms.

Frontier will continue operating its FiOS and traditional landline networks in the four states until the transaction closes with regulator approval.

The buyers are WaveDivision Capital, a private investment firm run by the founder of Wave Broadband, an independent broadband provider serving the Pacific Northwest and Searchlight Capital Partners, a Wall Street investment firm seeking to “accelerate value creation” for its investors. The new owners plan to launch a new company to service existing Frontier customers and will honor existing contracts and service commitments.

“The sale of these properties reduces Frontier’s debt and strengthens liquidity,” said Dan McCarthy, Frontier’s president and CEO, in a statement. “We are pleased to have a buyer with extensive experience building and operating advanced fiber-based communications assets in these regions. We will be working very closely with the new owners to ensure a smooth, successful transition for our customers and the communities we serve.”

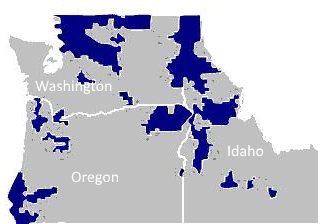

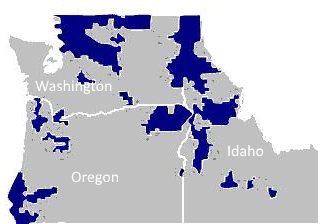

About 150,000 fiber, 150,000 copper and 35,000 fiber video customers are impacted by the sale in the four affected states. Frontier’s service area in the region is made up of large former Verizon service areas, many upgraded to fiber-to-the-home service, and a significant number of rural telephone exchanges operating with traditional copper wire networks. WaveDivision Capital claims it wants to invest in Frontier’s existing network to upgrade service and potentially retire additional copper infrastructure in favor of fiber.

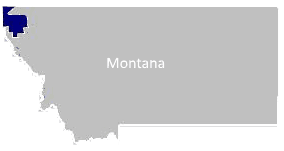

Frontier service areas in Oregon, Washington, and Idaho.

“We are excited to transition these operations to a local ownership team and to invest in building out the network of next generation fiber throughout our region,” said Steve Weed, CEO of WaveDivision Capital, and founder and former CEO of Wave Broadband. “We are big believers in the Northwest’s future growth opportunities and that future runs on broadband. As the former leaders of another successful Northwest internet provider, Wave Broadband, we know what it takes to bring fiber and other advanced services to residential and business customers, give them choices, and keep them happy.”

Frontier, which has been struggling with a tremendous debt load and underinvestment in its network, sees the sale as a way to improve its balance sheet and cut both debt and expenses. The Pacific Northwest is a difficult region to serve because it is sparsely populated and can be a high cost area because of difficult terrain or long distances between customers. Although Frontier had committed to spending on upgrading its fiber customers, it promised little for its copper wireline customers still relying on low-speed DSL. Weed says his company hopes to change that.

“Our plan is to invest further in our markets, specifically by extending fiber to more homes and businesses, to bring them the high speeds they want,” Weed said in a statement.

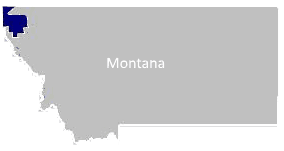

Frontier’s Montana operations are in the northwest corner of the state, near the Kootenai National Forest.

The transaction is subject to regulatory approvals by the Federal Communications Commission, the U.S. Department of Justice, the Committee on Foreign Investment in the United States (CFIUS), applicable state regulatory agencies, and certain local video franchise authorities where Frontier FiOS operates. Frontier expects little opposition to the deal.

Weed’s involvement in Wave Broadband is no more, but at the time he left the company, Wave had reached 140 cities and towns in Washington, Oregon, and California. Wave was formed in 2003 with a series of strategic acquisitions of “distressed” independent cable systems and those owned by pre-bankruptcy Charter Communications, Northland Communications, and Cedar Communications. In May 2017, Wave Broadband was sold to TPG Capital for $2.36 billion, and today operates under TPG’s leadership with its close cousins RCN and Grande Communications.

Weed has a reputation for successfully deploying fiber networks in a region where capital can be difficult to find and easy returns on investment are rare, so there is considerable good will he will successfully upgrade Frontier service areas that have been neglected for years.

Although the transaction could deliver temporary fiscal relief for Frontier, shareholders remain displeased with the current leadership team at the company, and there are still significant signs Frontier remains in serious financial and operational distress, especially because of its ongoing customer losses. Frontier is likely to be pressured to find other sales opportunities, assuming it can find willing buyers.

Telecom companies that receive Connect America Fund (CAF) dollars to deploy rural broadband service will not have to prove suitable internet speed and performance until early next year, after the FCC’s Wireline Bureau today announced it is delaying mandatory testing because of telecom industry objections.

Telecom companies that receive Connect America Fund (CAF) dollars to deploy rural broadband service will not have to prove suitable internet speed and performance until early next year, after the FCC’s Wireline Bureau today announced it is delaying mandatory testing because of telecom industry objections.

Subscribe

Subscribe Frontier Communications is

Frontier Communications is

T-Sprint’s argument is that this transaction will accelerate the deployment of 5G technology in a war for 5G supremacy with China. But exactly what technology is deployed, on what spectrum, using small cells or macro cell towers, makes a lot of difference. China’s wireless companies are owned and controlled by the Chinese government, which is also underwriting some of the costs. America’s networks are financed with private capital (and customer bills). T-Sprint’s 5G plans are also far less ambitious than those from AT&T and Verizon, and the cost to long-term competition is too high. The FCC should know that.

T-Sprint’s argument is that this transaction will accelerate the deployment of 5G technology in a war for 5G supremacy with China. But exactly what technology is deployed, on what spectrum, using small cells or macro cell towers, makes a lot of difference. China’s wireless companies are owned and controlled by the Chinese government, which is also underwriting some of the costs. America’s networks are financed with private capital (and customer bills). T-Sprint’s 5G plans are also far less ambitious than those from AT&T and Verizon, and the cost to long-term competition is too high. The FCC should know that.

AT&T could sell a fixed 5G broadband service similar to Verizon Wireless, confine its network to mobile applications, or offer fixed wireless service to commercial and manufacturing users in selected areas. Or it could offer a combination of all the above. AT&T will also need to consider the implications of a fiber buildout outside of its current landline service area. Building fiber optic networks to provide backhaul connectivity to AT&T’s mobile network would not antagonize its competitors nearly as much as the introduction of residential fixed 5G wireless as a home broadband replacement. The competitive implications of that would be dramatic, especially in communities skipped by Verizon FiOS or stuck with DSL from under-investing independent telephone companies like CenturyLink, Frontier, and Windstream. Should AT&T start selling 300+ Mbps fixed 5G wireless in these territories, it would cause significant financial distress for the big three independent phone companies, and could trigger a competitive war with Verizon.

AT&T could sell a fixed 5G broadband service similar to Verizon Wireless, confine its network to mobile applications, or offer fixed wireless service to commercial and manufacturing users in selected areas. Or it could offer a combination of all the above. AT&T will also need to consider the implications of a fiber buildout outside of its current landline service area. Building fiber optic networks to provide backhaul connectivity to AT&T’s mobile network would not antagonize its competitors nearly as much as the introduction of residential fixed 5G wireless as a home broadband replacement. The competitive implications of that would be dramatic, especially in communities skipped by Verizon FiOS or stuck with DSL from under-investing independent telephone companies like CenturyLink, Frontier, and Windstream. Should AT&T start selling 300+ Mbps fixed 5G wireless in these territories, it would cause significant financial distress for the big three independent phone companies, and could trigger a competitive war with Verizon. Cable One has the highest average revenue per customer of any publicly traded cable company in the United States, with

Cable One has the highest average revenue per customer of any publicly traded cable company in the United States, with