Next generation cable or a spray-on solution to a really bad quarter?

Time Warner Cable has a plan for multi-gigabit broadband speeds over a state of the art network that, for the first time, might include fiber to the home service.

TWC Max is Time Warner Cable’s code name for selected markets where customers will be given first class treatment and provided what incoming CEO Rob Marcus calls “best-in-class reliability and service.”

Marcus made it clear in a conference call to investors this morning that TWC Max will only be available in specially chosen markets, most likely those facing intense competition from Google Fiber (Austin, Kansas City), Verizon FiOS (New York, parts of Dallas, etc.) or upgraded AT&T U-verse.

TWC Max might also be offered in cities where community-owned fiber-to-the-home providers best TWC’s broadband speeds and prices. North Carolina, in particular, would be a logical choice as Time Warner Cable recently acquired DukeNet, a major commercial fiber broadband provider headquarted in Charlotte, also a major hub for Time Warner Cable’s data services. Wilson, Salisbury, Mooresville, Davidson and Cornelius are all served by publicly-owned broadband providers.

Beginning next year and over the next several years, those chosen will get major broadband speed upgrades — up to several gigabits, totally new customer equipment, and an all-digital experience.

“We will replace modems with state-of-the-art DOCSIS 3 modems and advanced wireless gateways, so we can meaningfully increase broadband speeds,” said Marcus. “And by the way, we’re not talking about tweaks here but rather quantum changes to our speed tiers. We’ll also replace standard definition and older HD set-top boxes and roll out new DVRs, better user interfaces and more advanced versions of our TWC TV apps to fundamentally improve the video experience.”

If the competition is DSL, you may have a really long wait to be considered a TWC Max city.

Marcus added that in some mixed business/residential areas, fiber to the home service is increasingly possible because of declining costs and pre-existing fiber infrastructure already serving commercial customers and cell towers.

But Marcus was quick to stress that his philosophy about upgrades is to provide them in focused markets, not share them with every city where Time Warner Cable provides service.

“The goal here is, really, to fundamentally change the customer experience in a given market, said Marcus. “So rather than spread our efforts like peanut butter throughout the footprint, I’m very anxious to deliver a complete experience.”

“That means not only going all-digital but also ensuring that we have state-of-the-art modems in every customer’s home, ensuring that they have the best video and that the overall experience is really optimal,” Marcus added.

“So we’re going to concentrate market by market rather than take individual components and run them through the entire footprint.”

So what are the chances your city will be designated a TWC Max target area?

After reviewing the transcript for this morning’s conference call, Stop the Cap! has created this handy-dandy, simple to use guide:

- If your community has or was chosen for Google Fiber: A VIRTUAL CERTAINTY!

- If your community is served by Verizon FiOS or AT&T’s Next Generation U-verse: EXCELLENT

- If your community has a fiber to the home provider competing with Time Warner Cable: VERY GOOD

- If your community is served by copper-based DSL from the phone company with no prospect of getting U-verse or FiOS: WHEN PIGS FLY!

Subscribe

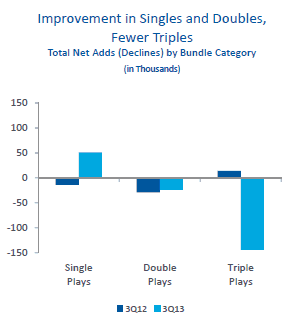

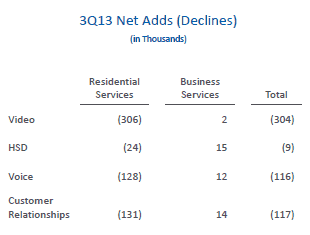

Subscribe Time Warner Cable’s summer was “horrible,” to quote one analyst, after three percent of customers left over programming disputes and increasing prices for broadband and telephone service, with more likely to follow as price promotions expire and rates increase further.

Time Warner Cable’s summer was “horrible,” to quote one analyst, after three percent of customers left over programming disputes and increasing prices for broadband and telephone service, with more likely to follow as price promotions expire and rates increase further.

Comcast is also moving forward with plans to share your in-home Wi-Fi with other customers, configuring company-supplied gateways to offer a second, open access Wi-Fi channel. Comcast currently charges customers $7 a month for the XFINITY Wireless Gateway, combining a DOCSIS 3 cable modem, a telephone eMTA, and a wireless router.

Comcast is also moving forward with plans to share your in-home Wi-Fi with other customers, configuring company-supplied gateways to offer a second, open access Wi-Fi channel. Comcast currently charges customers $7 a month for the XFINITY Wireless Gateway, combining a DOCSIS 3 cable modem, a telephone eMTA, and a wireless router. Millenicom customers have had their ups and downs over the last two weeks coping with e-mail notifications they would lose, keep, and once again lose their unlimited wireless data plan.

Millenicom customers have had their ups and downs over the last two weeks coping with e-mail notifications they would lose, keep, and once again lose their unlimited wireless data plan. We will be shipping out Hotspot devices to those clients who had opted for that solution and BMI.net is ready to fulfill orders for those choosing to go with them.

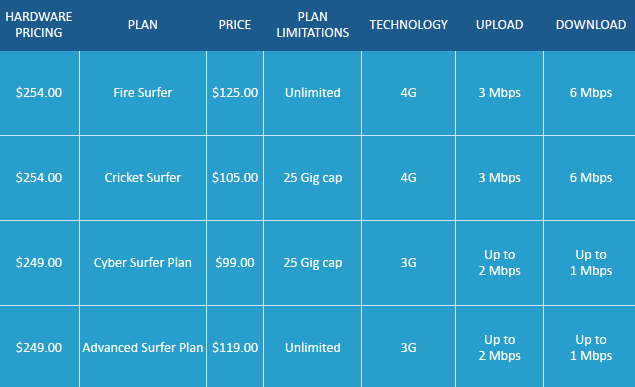

We will be shipping out Hotspot devices to those clients who had opted for that solution and BMI.net is ready to fulfill orders for those choosing to go with them. Blue Mountain Internet (BMI) offers an “unlimited plan” that isn’t along with several usage allowance plans. BMI strongly recommends the use of their Mobile Broadband Optimizer software that compresses web traffic, dramatically improving speeds and reducing consumption:

Blue Mountain Internet (BMI) offers an “unlimited plan” that isn’t along with several usage allowance plans. BMI strongly recommends the use of their Mobile Broadband Optimizer software that compresses web traffic, dramatically improving speeds and reducing consumption: There is a $100 maximum on overlimit fees, but BMI reserves the right to suspend accounts after running 3-5GB over a plan’s allowance to limit exposure to the penalty rate. The compression software is for Windows only and does not work with MIFI devices or with video/audio streaming. BMI warns its wireless service is not intended for video streaming. Customers are not allowed to host computer applications including continuous streaming video and webcam posts that broadcast more than 24 hours; automatic data feeds; automated continuous streaming machine-to-machine connections; or peer-to-peer (P2P) file-sharing.

There is a $100 maximum on overlimit fees, but BMI reserves the right to suspend accounts after running 3-5GB over a plan’s allowance to limit exposure to the penalty rate. The compression software is for Windows only and does not work with MIFI devices or with video/audio streaming. BMI warns its wireless service is not intended for video streaming. Customers are not allowed to host computer applications including continuous streaming video and webcam posts that broadcast more than 24 hours; automatic data feeds; automated continuous streaming machine-to-machine connections; or peer-to-peer (P2P) file-sharing.

Wireless ‘n Wifi

Wireless ‘n Wifi