Netflix stock lost over 11% of its value late today after the company reported second quarter results that underwhelmed Wall Street, including a surprising loss of 130,000 U.S. customers that left the streaming service during the last three months.

Netflix stock lost over 11% of its value late today after the company reported second quarter results that underwhelmed Wall Street, including a surprising loss of 130,000 U.S. customers that left the streaming service during the last three months.

Netflix added 2.7 million customers in the second quarter, a much smaller number than the 6 million it added during the same period last year. As of the end of June, Netflix now has 151.6 million customers worldwide. Wall Street expected between 153-156 million by that time. The $2/month U.S. rate increase during the first quarter for Netflix’s popular two-concurrent stream plan (was $10.99, now $12.99 in the U.S.) helped keep company revenue up 26%, to $4.92 billion for the quarter. But analysts expected $4.93 billion. Profits also declined to $270 million, compared with $384 million a year ago during the same quarter.

The company blamed the lackluster results on the lack of compelling content during the second quarter. In a letter to shareholders, Netflix claimed the recent price increase slowed growth, but the real problem was overheated growth during the first quarter and not a lot of blockbuster movies and shows to watch.

“We think [the second quarter’s] content slate drove less growth in paid net adds than we anticipated,” Netflix executives said.

The company also noted it is raising prices in several European countries including the United Kingdom, Spain, Ireland, France and Germany.

Netflix does not believe competition with other streaming services had a material impact on its subscriber numbers during the quarter, but analysts suggest Netflix should be concerned about forthcoming streaming competition from AT&T/WarnerMedia (HBO Max) and Walt Disney (Disney+). As more services become available, consumers are likely to take a hard look at the streaming services they are watching and ditch those they are not.

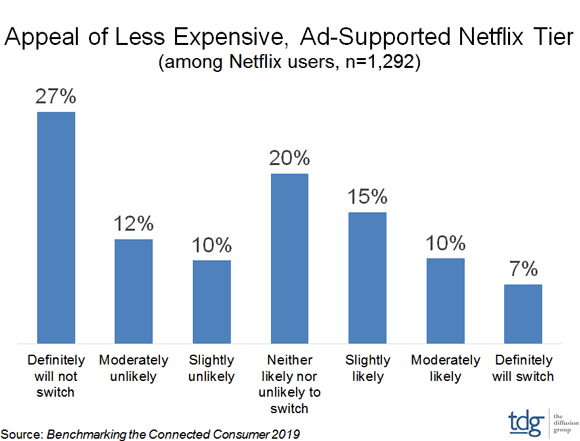

Netflix also declared it will not introduce a cheaper, ad-supported version, despite increasing speculation it would.

“We believe we will have a more valuable business in the long term by staying out of competing for ad revenue and instead entirely focusing on competing for viewer satisfaction.” Netflix told shareholders.

The Wall Street Journal reviews the many challenges to Netflix from forthcoming contenders in the streaming wars. (4:36)

Subscribe

Subscribe While net neutrality in the United States has been neutered by the Republican-controlled FCC, the concept of an online level playing field is alive and well in Germany, and T-Mobile’s parent company Deutsche Telekom (DT) just got called out for a foul ball.

While net neutrality in the United States has been neutered by the Republican-controlled FCC, the concept of an online level playing field is alive and well in Germany, and T-Mobile’s parent company Deutsche Telekom (DT) just got called out for a foul ball.

Comcast premium subscribers began seeing Cinemax dropped from their lineup this morning, replaced with Comcast’s own premium movie network Hitz.

Comcast premium subscribers began seeing Cinemax dropped from their lineup this morning, replaced with Comcast’s own premium movie network Hitz. AT&T is facing a last hour showdown with CBS owned and operated local TV stations in 17 major U.S. cities over a new retransmission consent contract that could mean the third major station blackout for customers of DirecTV, DirecTV Now, and AT&T U-verse. Streaming customers would also lose access to on-demand content. In addition, CBS-owned CW television stations would be dropped from all three AT&T-owned services.

AT&T is facing a last hour showdown with CBS owned and operated local TV stations in 17 major U.S. cities over a new retransmission consent contract that could mean the third major station blackout for customers of DirecTV, DirecTV Now, and AT&T U-verse. Streaming customers would also lose access to on-demand content. In addition, CBS-owned CW television stations would be dropped from all three AT&T-owned services. AT&T has already left customers blacked out from nearly 150 local stations owned by Nexstar and several smaller owners — some effectively front groups for Sinclair Broadcasting — with no end in sight. Both sides are taking heat from public officials and members of Congress upset with the loss of one or more local stations, and the latest blackout of CBS stations could result in even greater scrutiny of AT&T and station owners.

AT&T has already left customers blacked out from nearly 150 local stations owned by Nexstar and several smaller owners — some effectively front groups for Sinclair Broadcasting — with no end in sight. Both sides are taking heat from public officials and members of Congress upset with the loss of one or more local stations, and the latest blackout of CBS stations could result in even greater scrutiny of AT&T and station owners.