This week’s revelation that a Comcast-controlled enterprise deliberately and consciously removed news content critical of Comcast and its public policy lobbying practices speaks to the impact media concentration has on news dissemination.

It also exposes the close relationship Comcast maintains with non-profit groups it financially supports, encouraging the kinds of positive letters about its operations the New York Public Service Commission can now find on file in this case.[1]

The group involved in the current controversy reportedly received $350,000 from Comcast and promptly began a vocal opposition campaign against Net Neutrality, an open Internet policy Comcast still opposes being enacted as official FCC policy.[2]

The group involved in the current controversy reportedly received $350,000 from Comcast and promptly began a vocal opposition campaign against Net Neutrality, an open Internet policy Comcast still opposes being enacted as official FCC policy.[2]

Professor Todd Gitlin of Columbia University called Comcast’s close relationship with the Minority Media and Telecommunications Council (MMTC) the “closest thing I can imagine to a political quid pro quo. The fact NewsOne saw fit to delete a report that they previously posted without any claim that anything was mistaken in the report tells you something about their commitment to open discourse.”

Jeff Cohen, an associate professor of journalism at Ithaca College, also commented on the NewsOne decision. “Just as corporate cash can corrupt civil rights groups, this incident shows how corporate power can corrupt and censor the news.”[3]

Time Warner Cable operates local news channels in most of the major New York cities it serves. These channels will also come under the umbrella of Comcast, giving it an even greater news voice through its NBC and Telemundo networks, MSNBC, local cable news operations, and owned and operated local broadcast affiliate stations in New York City.

In closing, as a reminder to the Commission, Comcast’s list of broadcast, cable and digital media assets is already enormous and will grow even larger if a merger with Time Warner Cable is approved.[4]

Comcast-NBCUniversal

Broadcast Television

NBC Television Network

NBC Entertainment

NBC News

NBC Sport Group

Universal Television (UTV)

Universal Cable Productions

NBCUniversal Domestic Television Distribution

NBCUniversal International Television Distribution

NBC Local Media Division

NBC New York (WNBC)

NBC Los Angeles (KNBC)

NBC Chicago (WMAQ)

NBC Philadelphia (WCAU)

NBC Bay Area (KNTV)

NBC Dallas/Fort Worth (KXAS)

NBC Washington (WRC)

NBC Miami (WTVJ)

NBC San Diego (KNSD)

NBC Connecticut (WVIT)

NBC Everywhere

LX TV

Skycastle Entertainment

Telemundo

KVEA (Los Angeles)

WNJU (New York)

WSCV (Miami)

KTMD (Houston)

WSNS (Chicago)

KXTX (Dallas/Fort Worth)

KVDA (San Antonio)

KSTS (San Francisco/San Jose)

KTAZ (Phoenix)

KNSO (Fresno)

KDEN (Denver)

KBLR (Las Vegas)

WNEU (Boston/Merrimack)

KHRR (Tucson)

WKAQ (Puerto Rico)

KWHY (Los Angeles) (Independent)

Television Channels

Bravo

Chiller

CNBC

CNBC World

Comcast Charter Sports Southeast

Comcast Sports Group

Comcast SportsNet Bay Area

Comcast SportsNet California

Comcast SportsNet Chicago

Comcast SportsNet Houston

Comcast SportsNet Mid-Atlantic

Comcast SportsNet New England

Comcast SportsNet Northwest

Comcast SportsNet Philadelhpia

SNY

The Mtn.-Mountain West Sports Network

CSS

Comcast Sports Southwest

New England Cable News (Manages)

NBC Sports Network

The Comcast Network

E! Entertainment Television

G4

Golf Channel

MSNBC

mun2

Oxygen Media

Cloo

Sprout

The Style Network

Syfy

Universal HD

USA Network

The Weather Channel Companies

Syfy Universal (Universal Networks International)

Diva Universal (Universal Networks International)

Studio Universal (Universal Networks International)

Universal Channel (Universal Networks International)

13th Street Universal (Universal Networks International)

Movies 24 (Universal Networks International)

Hallmark Channel (non-U.S.) (Universal Networks International)

KidsCo (Interest) (Universal Networks International)

Film

Universal Pictures

Focus Features

Universal Studios Home Entertainment

Parks and Resorts

Universal Parks and Resorts

Digital Media

DailyCandy

Fandango

Hulu (32%)

iVillage

NBC.com

CNBC Digital

Plaxo

Communications

XFINITY TV

XFINITY Internet

XFINITY Voice

Sports Management

Comcast-Spectator

Philadelphia Flyers

Wells Fargo Center

Global Spectrum (Public Assembly Management)

Ovations Food Services

Front Row Marketing Services

Paciolan

New Era Tickets (ComcastTIX)

Flyers Skate Zone

Other

Comcast Ventures, which is invested in numerous companies.

Time Warner Cable

Local channels`

Time Warner Cable News[5]

NY1: Manhattan, Bronx, Brooklyn, Queens, Staten Island

NY1 Noticias: Spanish language news for New York City

NY State of Politics Blog

TWC News Capital Region (Albany, Amsterdam, Saratoga and Berkshire counties)

TWC News Central NY (Syracuse, Ithaca/Cortland, Utica/Rome)

TWC News Hudson Valley

TWC News Northern NY (Watertown/Ft. Drum)

TWC News Southern Tier (Elmira/Corning, Binghamton/Oneonta)

TWC News Western NY (Buffalo, Finger Lakes Region, Jamestown, Rochester, and Batavia)

Regional Sports Networks

Metro Sports

Time Warner Cable Sports

Time Warner Cable SportsNet

Time Warner Cable Deportes

TWC Sports 32

SNY

Other Holdings

Adelphia — former cable television company in PA

NaviSite — cloud and hosting services company

Insight Communications — cable operator

DukeNet Communications — Fiber optic network

Time Warner Cable Internet

Time Warner Cable Media (advertising)

—

[1]http://documents.dps.ny.gov/public/MatterManagement/CaseMaster.aspx?MatterCaseNo=14-m-0183

[2]http://www.publicintegrity.org/2013/06/06/12769/civil-rights-groups-fcc-positions-reflect-industry-funding-critics-say

[3]http://www.republicreport.org/2014/comcast-affiliated-newsite-censored-my-article-about-net-neutrality-lobbying/

[4]https://archives.cjr.org/resources/index.php

[5]http://spectrumlocalnews.com/

Subscribe

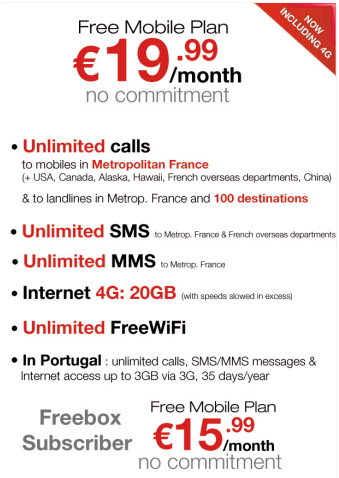

Subscribe The French Revolution in wireless could be spreading across the United States if Paris-based Iliad is successful in its surprise $15 billion bid to acquire T-Mobile USA (right out from under Sprint and Japan-based Softbank). Wall Street hopes it isn’t true.

The French Revolution in wireless could be spreading across the United States if Paris-based Iliad is successful in its surprise $15 billion bid to acquire T-Mobile USA (right out from under Sprint and Japan-based Softbank). Wall Street hopes it isn’t true. Free’s customer care center is run on Ubuntu-based, inexpensive notebook and desktop computers. Free’s wired broadband, television, and phone service is powered by set-top boxes and network devices custom-developed inside Iliad to keep costs down. Its creative spirit has been compared to Google, much to the chagrin of its “business by the book” competitors.

Free’s customer care center is run on Ubuntu-based, inexpensive notebook and desktop computers. Free’s wired broadband, television, and phone service is powered by set-top boxes and network devices custom-developed inside Iliad to keep costs down. Its creative spirit has been compared to Google, much to the chagrin of its “business by the book” competitors.

If a high-profile phone or cable company moves to enact an REIT, that might be enough to provoke Congress to act, warned Moffett.

If a high-profile phone or cable company moves to enact an REIT, that might be enough to provoke Congress to act, warned Moffett. AT&T couldn’t have gotten a better deal for itself if it tried.

AT&T couldn’t have gotten a better deal for itself if it tried. The state contract comes at a significant cost to taxpayers if Marvin Adams’ figures are correct. Adams, who works for the Columbia School District, suspects a lot of money has been frittered away because of the lack of competitive bidding. Only the state’s schools and libraries have the option of either securing a contract with AT&T or requesting bids from competitors like Ridgeland-based C-Spire, which supplies fiber and wireless connectivity.

The state contract comes at a significant cost to taxpayers if Marvin Adams’ figures are correct. Adams, who works for the Columbia School District, suspects a lot of money has been frittered away because of the lack of competitive bidding. Only the state’s schools and libraries have the option of either securing a contract with AT&T or requesting bids from competitors like Ridgeland-based C-Spire, which supplies fiber and wireless connectivity.