Consumer Reports is having a hard time handing out high scores to America’s cable and phone companies after its recent editorial overhaul that replaces simple numeric-only scores with a simpler color code that ranks good companies in green, fair companies in yellow, and downright lousy ones in red.

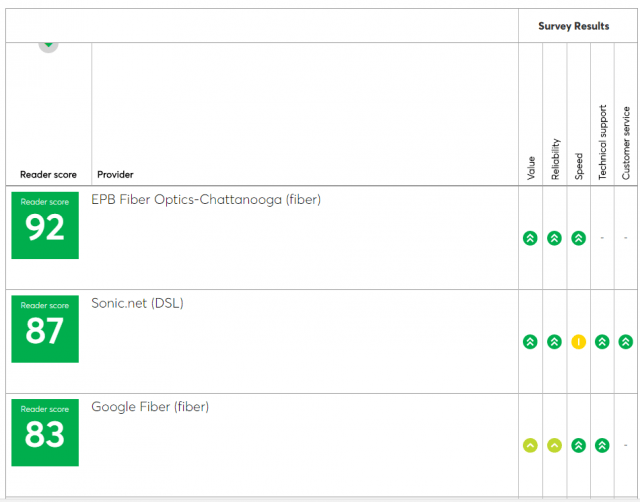

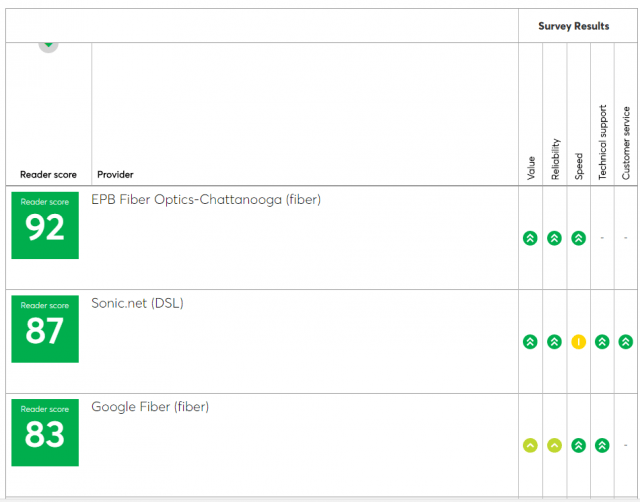

In its most recent rankings (subscription required), only three internet providers managed to win green ratings: a publicly owned municipal utility in Chattanooga, Tenn., a private ISP serving northern California communities in and around San Francisco, and Google Fiber, which shows every sign of stopping further expansion of its fiber to the home network.

EPB Fiber is the runaway winner of Consumer Reports’ ongoing ratings of America’s top telecom providers, scoring 92 and getting excellent ratings for value, reliability and speed. Sonic, which still primarily offers DSL service, achieved second place despite being limited in selling higher speeds available over AT&T’s wireline telephone network. Google Fiber made third place and is a regular favorite for offering affordable gigabit speeds for around $70 a month, not much more expensive than what some ISPs charge for 60Mbps for less.

The fact a public utility like EPB offers America’s best broadband service must give fits to the telecom giants like Comcast, Charter, and AT&T that only dream of achieving similar scores and have a history of opposing public broadband and in some cases have financed lobbying efforts seeking to ban it.

Providers achieving “yellow” ratings were almost exclusively small, regional independent cable operators and overbuilders like WOW and RCN. Verizon and Frontier’s versions of FiOS also made the cut, although it seems both suffered ratings drops attributable to decreased scores for value and customer service. Both companies have eliminated some of their most aggressive promotions that used to lure customers with a very low price for service.

The list of lousy-scoring companies is larger than ever, and encompass all the familiar large operators most Americans have to do business with. Since Stop the Cap! started in 2008, Mediacom is still rated the lousiest of the lousy cable companies, achieving a score of just 51. Only HughesNet, a satellite internet provider, scored worse, and not by much — achieving a 47 score.

DSL providers other than Sonic performed dismally as well: FairPoint (52), Windstream (53), Frontier (53), Verizon DSL (54), TDS (55), AT&T DSL (55), CenturyLink (57), and Cincinnati Bell DSL (57).

Cable companies also live in the ratings basement – Comcast/XFINITY (54), Charter/Time Warner Cable (55), GCI (60), Comporium (60), and Atlantic Broadband (60). Charter Communications just barely made it out of the red section with a score of (61), also shared by Cox and Cable ONE. Altice’s Cablevision, AT&T U-verse, Blue Ridge Communications, and Consolidated Cable managed scores of just 63. Charter/Bright House and Service Electric got a 64, and Altice’s Suddenlink managed a surprising 66.

The consumer magazine’s conclusion – most Americans still loathe their cable and phone companies, their prices, their bundles, and are greatly dissatisfied with the state of competition. That is unlikely to change considering the industry’s current trend of consolidation, which further reduces customer choice.

Subscribe

Subscribe