Frontier Communications is taking its lemon-of-a-legacy-copper-network and attempting to squeeze some lemonade with a new national radio advertising campaign promoting the company’s legacy DSL internet service with a $100 gift card and “free” Amazon Echo Dot.

Frontier Communications is taking its lemon-of-a-legacy-copper-network and attempting to squeeze some lemonade with a new national radio advertising campaign promoting the company’s legacy DSL internet service with a $100 gift card and “free” Amazon Echo Dot.

Get Frontier Copper is Frontier’s latest promotion for customers who do not live in its fiber-to-the-home service areas. Much of Frontier’s legacy network that predates its acquisitions of former Verizon FiOS and AT&T U-verse customers in Indiana, the Pacific Northwest, California, Texas, Florida, and Connecticut is still dependent on copper wiring that may have been on utility poles since the Johnson Administration.

The new promotion is among the first created under the leadership of Robert Curtis, Frontier’s latest senior vice president and chief marketing officer. Curtis is abandoning Frontier’s old marketing policies that eliminated a lot of fine print, sneaky fees/surcharges, and term contracts. The two-year contract with $120 early cancellation fee is the hallmark of Curtis’ commitment to reduce Frontier’s substantial customer churn, as customers abandon Frontier for competitors. A $120 sting in a customer’s wallet may convince many not to switch providers.

Frontier’s latest surcharges are also designed to extract more revenue from customers. A $10 per month compulsory equipment rental fee and recently increased “Internet Infrastructure Surcharge” will be applied to all customers in the future. Frontier previously allowed some customers to avoid the $10 monthly equipment rental fee by buying equipment outright from Frontier for $200. That option may be going away as Frontier gets serious about collecting $14 a month in surcharges from their internet customers.

Most legacy copper customers will be pitched up to three speed tiers ranging from 1, 6, and 12 Mbps, but not all customers will qualify for 6 or 12 Mbps plans if wiring in the neighborhood cannot support those speeds. There are Frontier service areas in metro areas that cannot achieve better than 3 Mbps, and plenty more in rural areas that top out at 1-3 Mbps. Those slower speed customers may not qualify for some promotions now available.

If you try to order faster internet speed not available in your neighborhood, you will likely see this error message.

Current promotions claim to offer up to 12 Mbps internet service for $12 a month for two years when bundled with voice service and/or a choice of packages that bundle internet and DISH satellite TV for $88 a month or a triple play of internet, voice, and satellite TV for $102 a month. Customers ordering online can get a $100 prepaid Visa card. But there are plenty of price-changing fees found in the terms and conditions, including an extra $14 a month in fees for that $12 a month internet offer. Customers that cancel any service in a promotional package automatically forfeit all promotional pricing and will be a charged an early termination fee up to $120.

Frontier charges a number of hidden fees on internet service, which increases the advertised price by at least $14 a month:

- Broadband router fee ($10/mo.) (Frontier used to allow customers to waive this fee by buying Frontier’s $200 equipment package up front.)

- Internet Infrastructure Surcharge ($3.99/mo.) (the fee was $1.99 a month)

- A $9.99 equipment delivery/handling fee.

- A $9.99 broadband processing fee upon disconnection of service.

- A $75 installation fee applies to broadband-only service, waived if a customer chooses to bundle another service with internet.

Frontier claims it offers the speeds “you need” on a “reliable” network.

But there is plenty more fine print to consider, the most important we’ve underlined below:

Visa Gift Card: Limit one VISA Reward Card per household. Customer must submit (2) paid bill statements and follow the redemption instructions to receive VISA Reward Card, subject to Frontier verification. Customer agrees to share billing information with Frontier’s fulfillment partners. Limited-time offer for new Internet residential customers. Must subscribe to a qualifying package of new High-Speed Internet. Visit internet.Frontier.com/terms.html for details. VISA Reward Card offer is provided by Internet.frontier.com and is not sponsored by Frontier.

“Free” Amazon Echo Dot: Requires a two-year agreement with $120 maximum early termination fee on new internet and qualifying voice services. Maximum $120 Frontier early termination fee associated with Amazon Echo Dot offer is in addition to DISH early termination fee described below. The Amazon Echo Dot is given away by Frontier Communications. Amazon is not a sponsor of this promotion.

$12 Internet offer: New residential Internet customers only. Must subscribe to a two-year agreement on new High-Speed Internet with maximum speed range of 6.1 Mbps to 12 Mbps download and qualifying Voice service. After 24-month promotional period, promotional discount will end and the then-current everyday monthly price will apply to Internet and voice services and equipment.

$88 Internet and DISH TV offer: Limited-time offer for new residential Internet and new TV customers. Must subscribe to a two-year agreement on new High-Speed Internet with maximum speed range of 6.1 Mbps to 12 Mbps download and new DISH® AT120 service. After 24-month promotional period, promotional discount will end and the then-current everyday monthly price will apply to Internet service and equipment. A $34.99 Frontier video setup fee applies.

Frontier’s new marketing chief is returning the company to gotcha fees, surcharges, and contracts.

$102 Internet, DISH TV and Voice offer: Limited-time offer for new TV, new Internet and new Voice customers. Must subscribe to a two-year agreement on new High-Speed Internet with maximum speed range of 6.1 Mbps to 12 Mbps download, new qualifying Voice service and new DISH® AT120 service. After 24-month promotional period, promotional discount will end and the then-current everyday monthly price will apply to Internet and voice services and equipment. A $34.99 Frontier video setup fee applies. Unlimited calling is based on normal residential, personal, noncommercial use. Calls to 411 incur an additional charge.

Important DISH Terms and Conditions. Qualification: Advertised price requires credit qualification and 24-month commitment. Upfront activation and/or receiver upgrade fees may apply based on credit qualification. Offer ends 7/10/19. Early termination fee of $20/mo. remaining applies if you cancel early. America’s Top 120 programming package, local channels, HD service fees, and Hopper Duo Smart DVR for 1 TV. Programming package upgrades ($79.99 for AT120+, $89.99 for AT200, $99.99 for AT250), monthly fees for upgraded or additional receivers ($5-$7 per additional TV, receivers with additional functionality may be $10-$15). Taxes & surcharges, add-on programming (including premium channels), DISH Protect, and transactional fees. 3 Mos. Free: After 3 mos., you will be billed $20/mo. for Showtime and DISH Movie Pack unless you call or go online to cancel. All packages, programming, features, and functionality and all prices and fees not included in price lock are subject to change without notice. After 6 mos., if selected, you will be billed $9.99/mo. for DISH Protect Silver unless you call to cancel. After 2 years, then-current everyday prices for all services apply.

All Offers: Offer not valid in select areas of CT, NC, SC, MN, IL, OH, NY. Check promotion availability for your address. Maximum service speed is not available to all locations and the maximum speed for service at your location may be lower than the maximum speed in this range. Service speed is not guaranteed and will depend on many factors. Your ability to stream may be limited by speeds available in your area. Cannot be combined with other promotional offers on the same services. Equipment, taxes, governmental surcharges, and fees including broadband router fee ($10/mo.), Internet Infrastructure Surcharge ($3.99/mo.), and other applicable charges extra, and subject to change during and after the promotional period. A $9.99 equipment delivery/handling fee applies. A $9.99 broadband processing fee upon disconnection of service applies. Service and promotion subject to availability. $75 Installation fee waived on new Frontier Double and Triple plays. Standard charges apply for jack installation, wiring and other additional services. Frontier reserves the right to withdraw this offer at any time. Other restrictions apply. Subject to Frontier’s fair use policy and terms of service.

Comcast and Charter Communications have no real interest in competing head-to-head in wireless with AT&T, Verizon, T-Mobile, or Sprint. Instead, the two cable companies hope to trap you in a bundled package of services too inconvenient to cancel.

Comcast and Charter Communications have no real interest in competing head-to-head in wireless with AT&T, Verizon, T-Mobile, or Sprint. Instead, the two cable companies hope to trap you in a bundled package of services too inconvenient to cancel.

![]() “The problem is, the sticky bundle is not a low-cost solution,” Kagan offered. “With that said, the higher cost to the cable television companies is less than that of losing their customer base. So, the cost makes sense as simply a cost of doing business.”

“The problem is, the sticky bundle is not a low-cost solution,” Kagan offered. “With that said, the higher cost to the cable television companies is less than that of losing their customer base. So, the cost makes sense as simply a cost of doing business.”

Subscribe

Subscribe Epix, the newest premium movie channel on the block, is giving up on exclusive pay television distribution and has launched a new $5.99/mo direct-to-consumer subscription service, beating anticipated services from AT&T WarnerMedia and Disney.

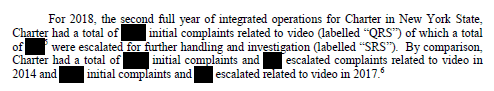

Epix, the newest premium movie channel on the block, is giving up on exclusive pay television distribution and has launched a new $5.99/mo direct-to-consumer subscription service, beating anticipated services from AT&T WarnerMedia and Disney. Stop the Cap! today appealed to New York’s Freedom of Information Law Officer to force Charter Spectrum to unredact customer complaint statistics on Charter Communication’s performance in New York since its 2016 merger with Time Warner Cable.

Stop the Cap! today appealed to New York’s Freedom of Information Law Officer to force Charter Spectrum to unredact customer complaint statistics on Charter Communication’s performance in New York since its 2016 merger with Time Warner Cable.

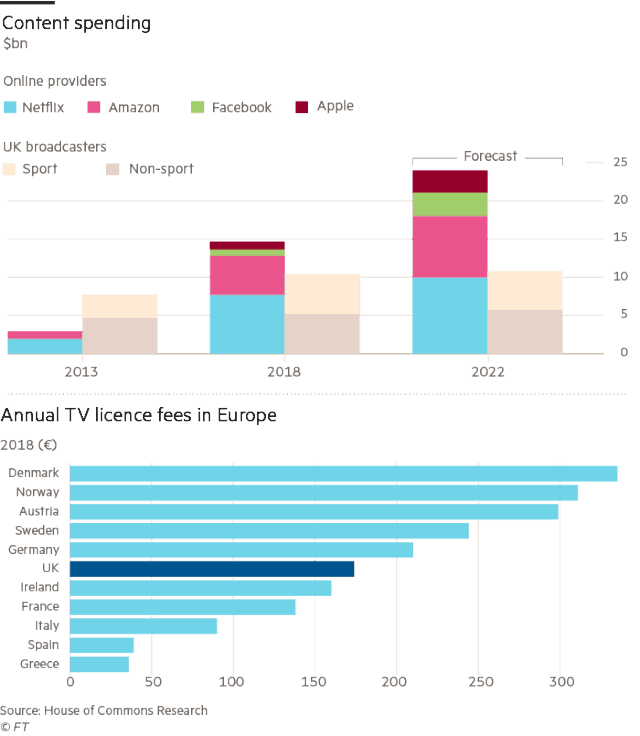

European broadcasters are frightened at the prospect of seeing viewers and crucial mandatory TV license fees erode away as an invasion of American on-demand streaming from Netflix and Amazon takes its toll on traditional television.

European broadcasters are frightened at the prospect of seeing viewers and crucial mandatory TV license fees erode away as an invasion of American on-demand streaming from Netflix and Amazon takes its toll on traditional television.

Frontier Communications is taking its lemon-of-a-legacy-copper-network and attempting to squeeze some lemonade with a new national radio advertising campaign promoting the company’s legacy DSL internet service with a $100 gift card and “free” Amazon Echo Dot.

Frontier Communications is taking its lemon-of-a-legacy-copper-network and attempting to squeeze some lemonade with a new national radio advertising campaign promoting the company’s legacy DSL internet service with a $100 gift card and “free” Amazon Echo Dot.