Analysts were surprised at the premium price AT&T agreed to pay when it announced last month it was acquiring Leap Wireless — owner of the Cricket brand prepaid cell phone service — for $1.2 billion plus assuming $2.8 billion in net debt. But newly released documents show AT&T will win significant tax concessions allowing it to shelter hundreds of millions in revenue from the tax man.

Analysts were surprised at the premium price AT&T agreed to pay when it announced last month it was acquiring Leap Wireless — owner of the Cricket brand prepaid cell phone service — for $1.2 billion plus assuming $2.8 billion in net debt. But newly released documents show AT&T will win significant tax concessions allowing it to shelter hundreds of millions in revenue from the tax man.

In fact, the more Leap Wireless piles up debt and hemorrhages customers, the more AT&T’s taxes go down.

If AT&T wins approval for its deal to take over Cricket’s dwindling customer base, wireless spectrum, and the company’s existing wireless network, it will receive 20 years of tax savings from “pre-change” losses, offering AT&T a tax shelter worth $155 million in taxable income a year. That means AT&T will see at least a $60 million reduction in its tax bill each of the first five years after the deal is approved. Then the savings decrease somewhat for the next 15 years as AT&T gets to write off $35 million annually.

Despite Cricket’s efforts to promote its bundled music and prepaid cell services as an industry game-changer, customers did not agree.

On Thursday, Leap admitted Cricket lost $163 million, or $2.09 per share, on revenue of $731 million for the quarter ended June 30. The company also saw 18 percent of its customers leave over the past year, with 4.8 million remaining. Leap management admitted it was becoming increasingly difficult to compete because its network was smaller than its larger competitors and Cricket had trouble acquiring the hottest smartphones to sell to customers.

Leap has been peddling Cricket on the wireless market since 2009 with no takers, even after it began to slowly pursue a network upgrade to 4G LTE service that was more promise than reality. Recent disclosures show the company lacked the money to expand more quickly.

AT&T still showed little interest in the little carrier that couldn’t over the course of 2012.

In May, as T-Mobile closed in on its takeover of similarly sized MetroPCS, things changed. AT&T ended up being the sole bidder for Cricket, offering $9.50 a share.

In May, as T-Mobile closed in on its takeover of similarly sized MetroPCS, things changed. AT&T ended up being the sole bidder for Cricket, offering $9.50 a share.

AT&T raised its offer to a whopping $15 a share after Leap executives promoted Cricket as a useful brand for AT&T to improve its standing in the prepaid market. But executives also sold AT&T on the fact Leap was lousy in debt, which opened up significant tax savings opportunities for AT&T.

BTIG Research’s Walter Piecyk thinks AT&T is shelling out a lot for Leap, even after considering the tax and spectrum benefits. But more than anything else, AT&T may have been willing to pay a premium for Cricket just to make sure none of its competitors, particularly T-Mobile, got there first.

The deal still requires approval by the Federal Communications Commission with a likely weigh-in from the Department of Justice’s Antitrust Division.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/Bloomberg ATT Buys Leap Wireless Who Wins 7-15-13.flv[/flv]

Moffett Research senior research analyst Craig Moffett tells Bloomberg News AT&T’s acquisition of Leap Wireless sticks it to competitors, in particular T-Mobile. AT&T’s purchase blocks T-Mobile and other carriers from getting access to Cricket’s wireless spectrum. Moffett also talks about the trend towards wireless mergers and acquisitions and how Verizon and AT&T got stuck with unwanted, unsold iPhones that could cost the companies millions. (6 minutes)

Subscribe

Subscribe

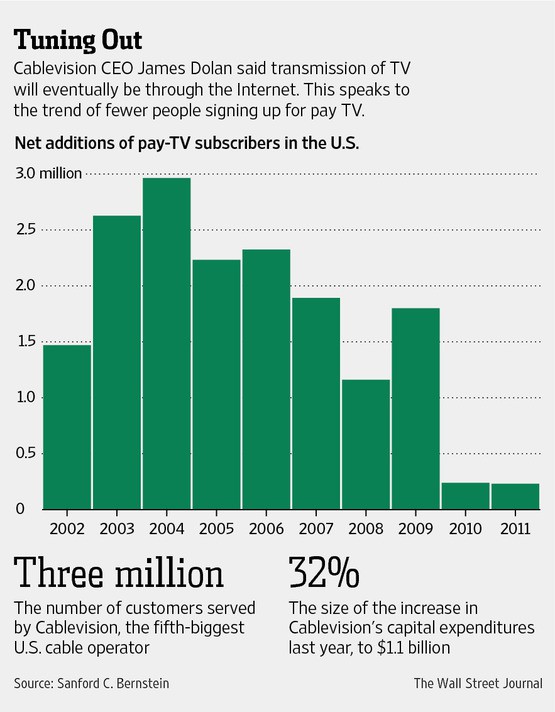

Cablevision may eventually get out of the cable television business.

Cablevision may eventually get out of the cable television business.

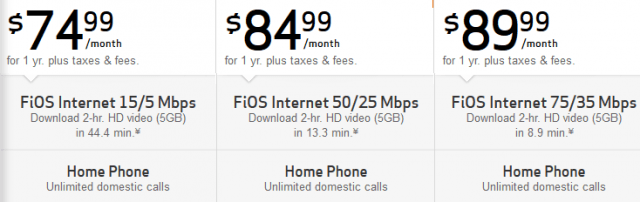

Existing customers like the changes, but don’t appreciate the price hikes that have accompanied them. Wall Street has the exact opposite point of view, welcoming increased revenue from rate hikes, but concerned about the company’s spending. Investors complain Cablevision’s returns are well below those of other cable operators which don’t face the Verizon FiOS juggernaut.

Existing customers like the changes, but don’t appreciate the price hikes that have accompanied them. Wall Street has the exact opposite point of view, welcoming increased revenue from rate hikes, but concerned about the company’s spending. Investors complain Cablevision’s returns are well below those of other cable operators which don’t face the Verizon FiOS juggernaut. CBS has blocked Time Warner Cable and Bright House Networks’ broadband customers from watching CBS online video in a retaliatory move against Time Warner Cable’s decision to pull CBS-owned programming off the lineup because of a contract dispute.

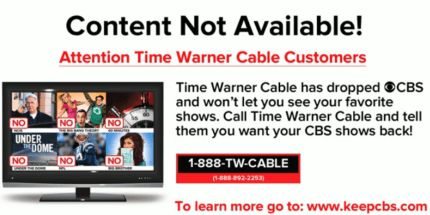

CBS has blocked Time Warner Cable and Bright House Networks’ broadband customers from watching CBS online video in a retaliatory move against Time Warner Cable’s decision to pull CBS-owned programming off the lineup because of a contract dispute. “CBS has shown utter lack of regard for consumers by blocking Time Warner Cable’s customers, including our high-speed data only customers, from accessing their shows on their free website,” the company said in a statement. “CBS enjoys the privilege of using public owned airwaves to deliver their programming – they should not be allowed to abuse that privilege.”

“CBS has shown utter lack of regard for consumers by blocking Time Warner Cable’s customers, including our high-speed data only customers, from accessing their shows on their free website,” the company said in a statement. “CBS enjoys the privilege of using public owned airwaves to deliver their programming – they should not be allowed to abuse that privilege.”