The satellite and app-based radio service SiriusXM has announced a broad-based rate increase for its customers that will take effect Nov. 13, 2019. Most customers will see a rate hike of $1 per month.

The satellite and app-based radio service SiriusXM has announced a broad-based rate increase for its customers that will take effect Nov. 13, 2019. Most customers will see a rate hike of $1 per month.

The company made the announcement with little fanfare, announcing the rate changes in private e-mails sent to customers.

Sirius and XM Radio used to be separate, competing satellite radio services. But in the waning days of the George W. Bush Administration, regulators approved a merger between the two entities after a 57-week review process, establishing a satellite radio monopoly.

The Bush Justice Department approved the Sirius and XM Radio merger on March 24, 2008, after being persuaded that satellite radio faced significant competition from traditional AM and FM radio, online streaming services, and the growing use of MP3 players. The FCC under Chairman Kevin Martin followed with a 3-2 approval on a party-line vote favoring the Republican commissioners. Martin said the internet delivered all the competition a combined SiriusXM could handle.

“The merger is in the public interest and will provide consumers with greater flexibility and choices,” Martin said of the merger at the time.

Martin’s predictions turned out to be largely untrue, as the combined company quickly merged into a single satellite radio service, began a series of rate increases, and faced the wrath of state attorneys general for its poor customer service and difficulty processing subscriber cancellations. For years as competing providers, Sirius and XM charged $12.99 a month, with substantial discounts for customers agreeing to multiple-month subscriptions. Lifetime subscriptions were also available. As of November 11th, the most popular subscription options — XM Select will cost $16.99/mo and XM All Access will cost $21.99/mo.

SiriusXM also now charges a range of fees customers may face:

- Activation Fee: For each radio on your account, SiriusXM may charge a fee to activate, reactivate, upgrade or modify your subscription package.

- U.S. Music Royalty Fee: Package pricing does not include the U.S. Music Royalty Fee, now 21.4% of the price of most audio packages which include music channels.

- Invoice Administration Fee: If you request to receive a paper invoice, SiriusXM will charge you an invoice administration fee on each paper invoice rendered, except where prohibited.

- Late Fee: If payment is not received in a timely manner, a late fee may apply.

- Returned Payment Fee: If any financial institution or credit card refuses to honor your payment, a fee may be charged.

- A La Carte Channel Change Fee: If you have an “A La Carte” Package, for each subsequent transaction to change your initial channel selections, you may be charged a fee.

- Transfer Fee: If you transfer a Subscription from one radio to another you may be charged a transfer fee.

- Cancellation Fee: Cancellation fees may be applied to Subscriptions activated in combination with a device purchased directly from SiriusXM.

SiriusXM customers can always get a much lower rate by threatening to cancel service. To cancel, call 1-866-635-2349 Monday through Friday 8:00 AM through 10:00 PM, ET, Saturday and Sunday 8:00 AM through 8:00 PM, ET. Tell the representative you are canceling because the service costs too much. You should be offered a retention rate of $30-35 for the next 5-6 months of service or around $60-100 a year (the lower end for Select, the higher end for All-Access). Just set a calendar reminder to repeat the cancellation threat a week or two before your retention rate is scheduled to expire and you can usually get that offer renewed. Note that the Music Royalty Fee will continue to be charged separately. A credit card is often required to get retention pricing, and service will automatically rebill at the prevailing rate after the promotional rate expires.

November 13, 2019 SiriusXM Subscription Rate Change

When will the subscription rates change?

For packages that are impacted by the rate adjustment, the new subscription rates will be effective November 13, 2019. The new rates will apply to subscription purchases made on and after that date, or renewals of existing subscriptions that are processed on and after that date.

Which packages will be impacted by the rate change on November 13, 2019?

The standard monthly rates for Select, Select Family Friendly, All Access, All Access Family Friendly, Premier, Premier Family Friendly packages will increase. The standard monthly rates for A La Carte, A La Carte + Howard, A La Carte + Sports, A La Carte + Howard + Sports, and A La Carte Gold packages will increase.

The standard monthly rates for additional radios that are eligible for the Family Discount for these same packages will also increase.

By how much will the rates change?

The standard monthly rates for Select, Select Family Friendly, All Access, All Access Family Friendly, Premier, Premier Family Friendly packages, and A La Carte packages for a primary radio will increase by $1 per month. The standard rates for additional radios that are eligible for the Family Discount will also increase by $1 per month.

Which packages or plans are not impacted by the November 13, 2019 rate change?

The standard rate adjustment does not apply to the following packages: SiriusXM Premier Streaming, SiriusXM Essential Streaming, Mostly Music, News, Sports & Talk, Basic, Basic Plus, Español, Español Plus, MiRGE All-in-One, Traffic, and Travel Link, as well as Aviation weather packages.

My current subscription plan does not renew until November 13, 2019 or later. When will I be billed at the new rates?

You will be billed the new rate the next time your plan renews on and after November 13, 2019.

I have a plan for the Lifetime of my radio. Does the rate adjustment on November 13, 2019 impact the Lifetime plan?

No. Lifetime plans are not impacted by the rate adjustment.

Will the rate adjustment affect my trial subscription?

No. Trial subscriptions are not impacted by the rate adjustment.

I’m still on a trial subscription but I’ve already ordered a new subscription that will start when my trial subscription ends. Will you charge me the new rate?

If you have already purchased a Select, Select Family Friendly, All Access, All Access Family Friendly, Premier, Premier Family Friendly, or A La Carte package in a plan that will start when your trial ends (or if you purchase it before November 13, 2019), you will be charged the current rates for your first billing period, even if your trial does not end until after November 13, 2019. Then, whenever your plan bills again, you will be charged the new rates (or the rates in effect at that time) for those packages.

Examples:

If you chose a monthly billing plan to follow your trial, the first month will not be impacted by the adjustment. The new rates will apply to the second and subsequent months of your plan.

If you chose a quarterly billing plan to follow your trial, the first three months of your service will be at the current rates. You will not be billed at the new rate until your plan bills again (after the first three months).

Will the subscription rates for my ‘infotainment’ services from SiriusXM, such as traffic, Travel Link, Aviation, or Marine weather change on November 13, 2019?

The rates for traffic, Travel Link, and Aviation services will not change on November 13, 2019. The rates for Marine packages will change on November 13, 2019.

If I subscribe to one of the packages impacted by the rate adjustment, will you notify me before my subscription rate changes?

Yes, if we have valid contact information on your account, we sent or will send a notification to you by mail or email, before your plan bills or renews. This might be a good time to visit the Online Account Center to make sure your contact information is correct. If you have never before visited your online account, you will need to go through a short registration process before you can access your account.

When will the subscription rates for Marine weather change?

The new subscription rates will be effective November 13, 2019 for packages impacted by the rate adjustment. The new rates will apply to subscription purchases made on and after that date, or renewals of existing subscriptions that are processed on and after that date.

Which Marine weather packages will be impacted by the rate change on November 13, 2019?

The standard monthly subscription rates for all SiriusXM (Inland, Coastal, and Offshore), XM (Skywatch, Fisherman, Sailor, Master Mariner) and Sirius (Inland, Mariner, Charter) will increase.

How much will the rates change?

Effective November 13, 2019:

- The standard rate for SiriusXM Marine Inland and Sirius Inland subscription packages will increase by $2 per month.

- The standard rate for SiriusXM Marine Coastal and Offshore, XM Skywatch, Fisherman, and Sailor, and Sirius Marine and Charter subscription packages will increase by $5 per month.

- The standard rate for XM Marine Master Mariner subscription packages will increase by $10 per month.

- The standard rate for Sirius Marine Voyager subscription with Select, All Access, and Premier packages will increase by $1 per month.

My current Marine weather subscription plan does not renew until November 13, 2019 or later. When will I be billed at the new rates?

You will be billed the new rate the next time your plan renews on and after November 13, 2019.

Subscribe

Subscribe

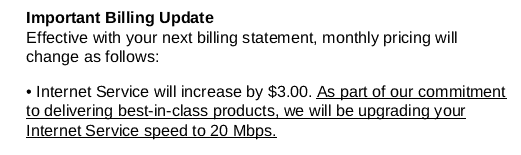

A modem rental fee may also apply in most states, unless you use your own cable modem. Outside of New York and New Jersey, most legacy ELP customers have already experienced several

A modem rental fee may also apply in most states, unless you use your own cable modem. Outside of New York and New Jersey, most legacy ELP customers have already experienced several  Charter Spectrum TV customers will pay at least $94 a month for cable television starting this October, thanks to a sweeping rate increase that will hike the cost of TV packages, internet service, equipment, and fees. Internet customers will soon face a base price for internet service of just under $70 a month.

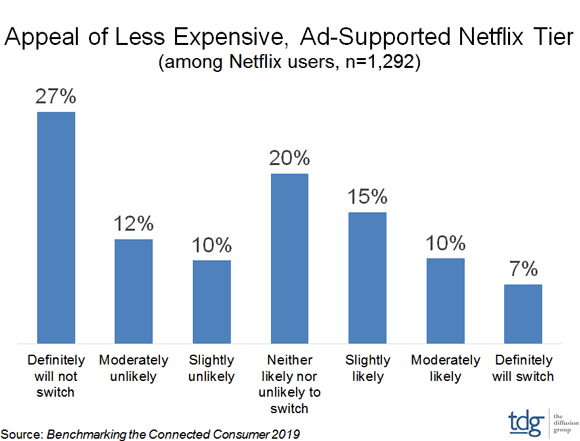

Charter Spectrum TV customers will pay at least $94 a month for cable television starting this October, thanks to a sweeping rate increase that will hike the cost of TV packages, internet service, equipment, and fees. Internet customers will soon face a base price for internet service of just under $70 a month. Netflix stock lost over 11% of its value late today after the company

Netflix stock lost over 11% of its value late today after the company