Brindisi, as he appeared in an ad slamming Charter Spectrum in the summer of 2018.

Rep. Anthony Brindisi (D-N.Y.) today introduced a bill in Congress to force cable operators fined by a state telecommunications regulator to publicly reveal the actual performance of their internet services, subscriber counts, and a complete price listing including all fees and surcharges.

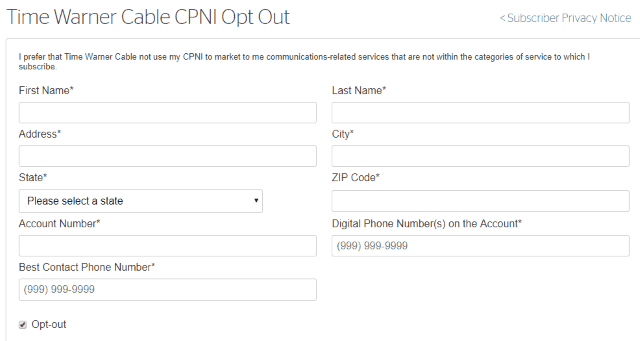

The Transparency for Cable Consumers Act comes in response to New York’s experiences with Charter Communications, which was fined for failing to meet its commitments under a 2016 merger agreement allowing Charter to acquire Time Warner Cable. Brindisi made the cable company’s performance a core issue in his 2018 campaign, brazenly buying commercial time on Spectrum cable systems for 30-second ads slamming the cable company.

“I’ve heard from thousands of Upstate New Yorkers who are sick and tired of dealing with frequent rate hikes, poor customer service, and failed promises,” said Brindisi. “This is more than just an inconvenience. For families on fixed incomes, an unexpected rate hike could wreck their budget. And for people in rural communities, crawling internet speeds can take away their connection to jobs, health care, information, and important online services. When a company enters into an agreement, it should be required to hold up its part of the bargain. We can’t keep giving these companies a free pass. If we don’t hold them accountable, nothing will change.”

Brindisi has bristled over the New York State Public Service Commission’s decision to repeatedly extend the deadline given to Charter to file an orderly exit plan winding down its cable operations in the state. The most recent extension was approved on Wednesday, now giving Charter Communications until April 5, 2019 to appeal the Commission’s decision and until May 9, 2019 to file its six-month exit plan.

Brindisi has bristled over the New York State Public Service Commission’s decision to repeatedly extend the deadline given to Charter to file an orderly exit plan winding down its cable operations in the state. The most recent extension was approved on Wednesday, now giving Charter Communications until April 5, 2019 to appeal the Commission’s decision and until May 9, 2019 to file its six-month exit plan.

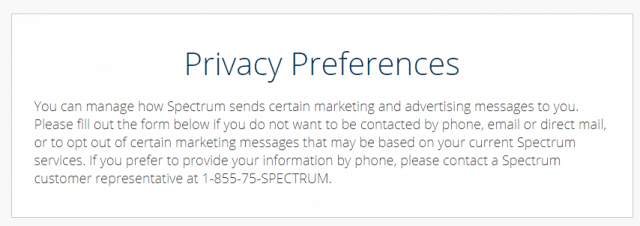

Brindisi complains Spectrum is being allowed to linger even as consumers continue to contact his office with complaints about frequent rate hikes, slow internet speeds, and poor customer service. His December 2018 letter to the PSC asking the Commission to stop giving Charter additional time extensions has gone unanswered, according to Brindisi.

Brindisi’s bill attempts to walk a fine line around the federal government’s wholesale deregulation of the cable industry. Various deregulation measures stripped federal, state, and local officials of most of their powers to oversee the internet and Voice over IP telephone service. Cable television remains subject to some local oversight and regulation, but not in all areas. Many states also have so-called “state franchise” laws in place, which gives blanket authority for cable operators to offer cable television in the state without seeking a separate agreement with each community.

The Transparency for Cable Consumers Act, would require a cable or internet company to disclose information about its operations if it is fined by a state regulator:

- The number of cable and broadband internet customers in each county;

- The average cable bill and broadband internet bill amounts in each county;

- A full accounting of all fees charged customers in each county; and

- The average broadband internet speeds delivered in each county.

Rep. Anthony Brindisi (D-N.Y.) appeared on the House floor this afternoon to introduce the Transparency for Cable Consumers Act. (1:18)

Subscribe

Subscribe

“After years of MetroCast’s dark ages of bad service, Atlantic Broadband bought them up, raised some internet speeds, and raised our bill even more,” said Charlie Saunders. “It is real easy to pay a $200 cable bill around here, so I am glad Comcast is giving us a choice.”

“After years of MetroCast’s dark ages of bad service, Atlantic Broadband bought them up, raised some internet speeds, and raised our bill even more,” said Charlie Saunders. “It is real easy to pay a $200 cable bill around here, so I am glad Comcast is giving us a choice.”

Rutledge told investors he does not see much threat from Verizon FiOS or its newly launched 5G offerings, and has no immediate plans to upgrade service in Verizon service areas because neither offering seems that compelling.

Rutledge told investors he does not see much threat from Verizon FiOS or its newly launched 5G offerings, and has no immediate plans to upgrade service in Verizon service areas because neither offering seems that compelling. Cable companies continue to dominate the U.S. broadband marketplace, and the gap between cable broadband and telephone company DSL continues to widen.

Cable companies continue to dominate the U.S. broadband marketplace, and the gap between cable broadband and telephone company DSL continues to widen.