Barr

WASHINGTON (Reuters) – U.S. President Donald Trump met with nine Republican attorneys general on Wednesday to discuss the fate of a legal immunity for internet companies after the Justice Department unveiled a legislative proposal aimed at reforming the same law.

Trump met with state attorneys general from Texas, Arizona, Utah, Louisiana, Arkansas, Mississippi, South Carolina, Missouri and West Virginia.

The White House said they discussed how the attorneys general can utilize existing legal recourses at the state level – in an effort to weaken the law known as Section 230 of the Communications Decency Act, which protects internet companies from liability over content posted by users.

After the meeting, Trump told reporters he expects to come to a conclusion on the issue of technology platforms within a short period. It was not immediately clear what conclusion he was referring to.

He also said his administration is watching the performance of tech platforms in the run-up to the Nov. 3 presidential election.

“In recent years, a small group of powerful technology platforms have tightened their grip over commerce and communications in America,” Trump said. “Every year countless Americans are banned, blacklisted and silenced through arbitrary or malicious enforcement of ever-shifting rules,” he added.

Earlier on Wednesday, the Justice Department unveiled a legislative proposal that seeks to reform Section 230. It followed through on Trump’s bid earlier this year to crack down on tech giants after Twitter Inc placed warning labels on Trump tweets, saying they have included potentially misleading information about mail-in voting.

The Justice Department’s bill would need congressional approval and is not likely to see action until next year at the earliest. There are several pieces of legislation doing the rounds in Congress that seek to curb the same immunity. It was not immediately clear whether the Justice Department will support any single piece of legislation that has already been proposed.

Any such bill would have to win the support of the Republicans who control the Senate and the Democrats who control the House of Representatives in order to become law. Such legislation’s future would be further complicated if the Democrats regain control of the Senate or win the White House.

The Justice Department proposal primarily states that when internet companies “willfully distribute illegal material or moderate content in bad faith, Section 230 should not shield them from the consequences of their actions.”

The Justice Department proposal primarily states that when internet companies “willfully distribute illegal material or moderate content in bad faith, Section 230 should not shield them from the consequences of their actions.”

It proposes a series of reforms to ensure internet companies are transparent about their decisions when removing content and when they should be held responsible for speech they modify. It also revises existing definitions of Section 230 with more concrete language that offers more guidance to users and courts.

It also incentivizes online platforms to address illicit content and pushes for more clarity on federal civil enforcement actions.

Attorney General William Barr said in a statement the administration was urging “Congress to make these necessary reforms to Section 230 and begin to hold online platforms accountable both when they unlawfully censor speech and when they knowingly facilitate egregious criminal activity online.”

In June, the Justice Department proposed that Congress take up legislation to curb this immunity. This was after Trump in May signed an executive order that seeks new regulatory oversight of tech firms’ content moderation decisions and backed legislation to scrap or weaken Section 230.

In June, the Justice Department proposed that Congress take up legislation to curb this immunity. This was after Trump in May signed an executive order that seeks new regulatory oversight of tech firms’ content moderation decisions and backed legislation to scrap or weaken Section 230.

Trump in May also directed the Commerce Department to file a petition asking the Federal Communications Commission to limit protections under Section 230. The petition is still pending.

The Internet Association – a group representing major internet companies including Facebook, Amazon.com, and Google, said the Justice Department’s proposal would severely limit people’s ability to express themselves and have a safe experience online.

The group’s deputy general counsel, Elizabeth Banker, said moderation efforts that remove misinformation, platform manipulation and cyberbullying would all result in lawsuits under this proposal.

Reporting by David Shepardson and Nandita Bose in Washington; Additional reporting by Jeff Mason, Diane Bartz and Eric Beech in Washington and Ayanti Bera in Bengaluru; editing by Patrick Graham, Chizu Nomiyama and Jonathan Oatis

Subscribe

Subscribe Comcast has

Comcast has  Cable ONE today announced it has acquired family owned cable operator Fidelity Communications, in a $525.9 million cash deal.

Cable ONE today announced it has acquired family owned cable operator Fidelity Communications, in a $525.9 million cash deal. Louisiana

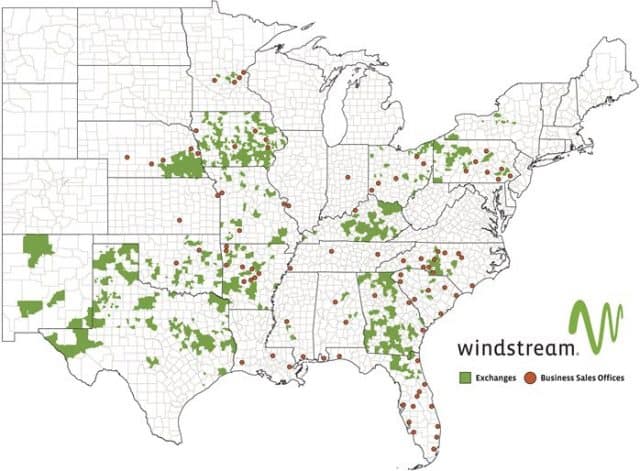

Louisiana Windstream Holdings, Inc.

Windstream Holdings, Inc.

YouTube TV, which offers cable-free live television, today announced it now offers local network affiliates covering over 98% of the U.S., allowing consumers in smaller cities to cut the cord and still keep good reception from most local, over-the-air stations.

YouTube TV, which offers cable-free live television, today announced it now offers local network affiliates covering over 98% of the U.S., allowing consumers in smaller cities to cut the cord and still keep good reception from most local, over-the-air stations.