Xfinity Flex

Comcast today announced the launch of Xfinity Flex, a $5/month service targeting Comcast’s internet-only customers with a streaming set-top box capable of accessing Comcast-approved apps including Netflix, Amazon Prime Video, HBO, and other services.

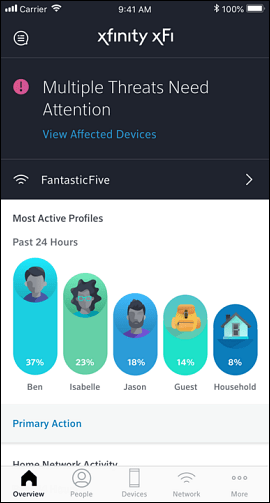

Subscribers must have a Comcast-supplied internet connection, no video package, and an xFi Gateway (a cable modem/router combination that costs between $10-13 a month to lease). After the new service becomes available nationwide next week, those enrolling will receive a small set-top box comparable to a Roku capable of streaming 4K HDR video. Comcast also supplies its own voice remote, and bundles access to Comcast’s apps that manage in-home Wi-Fi, mobile, security, and automation services for easy access.

“Xfinity Flex will deepen our relationship with a certain segment of our Internet customers and provide them with real value,” said Matt Strauss, executive vice president of Xfinity Services for Comcast Cable. “For just five dollars a month, we can offer these customers an affordable, flexible, and differentiated platform that includes thousands of free movies and shows for online streaming, an integrated guide for accessing their favorite apps and connected home devices, and the ease of navigating and managing all of it with our voice remote.”

A closer look at the device and the fine print suggests customers may want to carefully evaluate whether Flex offers good value for money. Instead of buying a traditional streaming set-top box like Roku, customers can only lease the Flex box for $5 a month… indefinitely. Comcast is not including any programming with the box, just hardware to access streaming content already available, often for free, on other streaming or desktop platforms. Flex’s search function is supposed to make it easier to find programming across a wide number of services, but you will have to subscribe to each service independently.

Comcast also warns that using Flex will count against your monthly data cap.

The 4K capable Roku 3920R can be purchased from Best Buy for $39.99.

Comcast has also carefully designed the box to protect the cable company from any competitive threats. Competing streaming services like DirecTV Now, Sling TV, YouTube TV, Hulu Live, and other services are intentionally blocked, another example of life without net neutrality. The only available path to cable TV programming using Flex is to visit the ‘easy upgrade’ app that will sign you up for Comcast’s X1 cable TV service, presumably the one you cord-cut before you signed up for Flex.

The service is also designed to protect other cable companies from competition from Comcast. Only Comcast internet customers can purchase Flex service, so it is not available to customers of Charter Spectrum, Cox, Altice, or other cable operators.

The $5 subscription fee is also misleading, because you will also have to rent Comcast’s own xFi Gateway, which costs between $10-13 a month, instead of using your own cable modem. That suddenly makes Flex a $15 a month service that essentially just gives you access to a walled garden of the services Comcast approves of for around $180 a year (including the Gateway).

Comcast probably won’t attract a big audience for Flex because of all the restrictions it comes with.

Consider buying a streaming set-top box outright instead of living with Comcast’s restrictions and mandatory gateway fees. Shoppers can find basic Roku devices for purchase under $30, with more capable 4K-compatible devices starting at around $40.

Subscribe

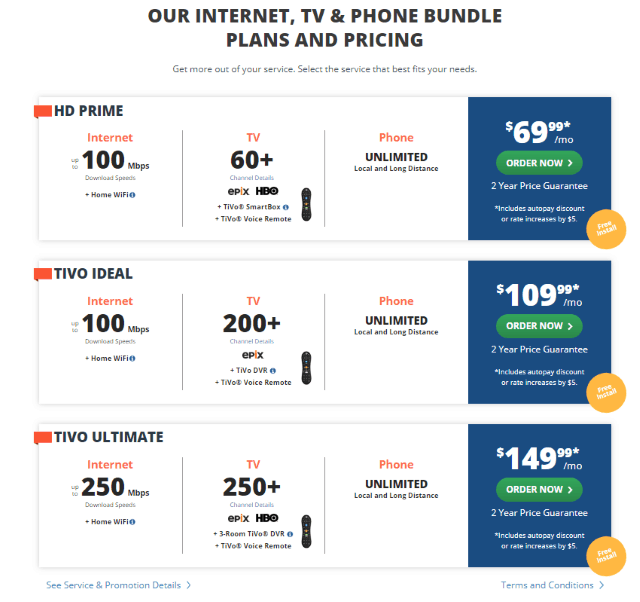

Subscribe Comcast and Charter Communications have no real interest in competing head-to-head in wireless with AT&T, Verizon, T-Mobile, or Sprint. Instead, the two cable companies hope to trap you in a bundled package of services too inconvenient to cancel.

Comcast and Charter Communications have no real interest in competing head-to-head in wireless with AT&T, Verizon, T-Mobile, or Sprint. Instead, the two cable companies hope to trap you in a bundled package of services too inconvenient to cancel.

Despite the growing impact of cord-cutting, Comcast is following companies like Charter Spectrum by cutting back customer retention discounts that savvy subscribers negotiate to keep their cable bill reasonable. Despite losing more than 344,000 cable television customers in 2018, almost twice as many as it lost in 2017, Comcast has lost interest in cutting prices to keep customers.

Despite the growing impact of cord-cutting, Comcast is following companies like Charter Spectrum by cutting back customer retention discounts that savvy subscribers negotiate to keep their cable bill reasonable. Despite losing more than 344,000 cable television customers in 2018, almost twice as many as it lost in 2017, Comcast has lost interest in cutting prices to keep customers. “Time Warner wanted to make a video number, and there were data packages that cost less if you took video than if you didn’t,” Rutledge said. “And a lot of those were churning out. And a lot of them were basic-only. So on the margin, at the end – in the last year, I think they were selling 40% of their connects as basic-only. [TWC had] 90,000 different promotional offers, many of them deeply discounted and piled on top of each other.”

“Time Warner wanted to make a video number, and there were data packages that cost less if you took video than if you didn’t,” Rutledge said. “And a lot of those were churning out. And a lot of them were basic-only. So on the margin, at the end – in the last year, I think they were selling 40% of their connects as basic-only. [TWC had] 90,000 different promotional offers, many of them deeply discounted and piled on top of each other.”

Comcast internet customers have a new add-on option –

Comcast internet customers have a new add-on option –

“After years of MetroCast’s dark ages of bad service, Atlantic Broadband bought them up, raised some internet speeds, and raised our bill even more,” said Charlie Saunders. “It is real easy to pay a $200 cable bill around here, so I am glad Comcast is giving us a choice.”

“After years of MetroCast’s dark ages of bad service, Atlantic Broadband bought them up, raised some internet speeds, and raised our bill even more,” said Charlie Saunders. “It is real easy to pay a $200 cable bill around here, so I am glad Comcast is giving us a choice.”