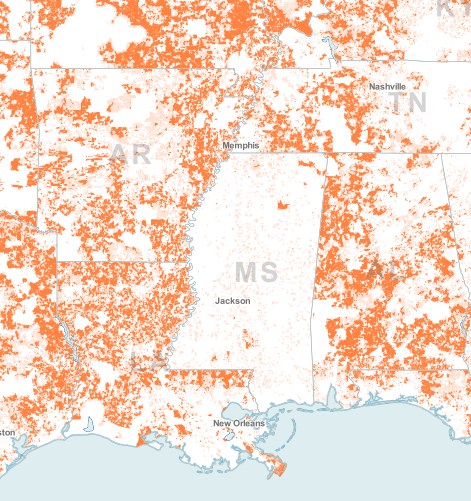

According to broadband coverage maps drawn from data provided by telecommunications companies across Mississippi, high speed Internet service is available just about everywhere in the state.

Only it isn’t.

Now one Public Service Commissioner is going public warning broadband expansion funding is in jeopardy because the Federal Communications Commission is relying on faulty map data.

Northern District Commissioner Brandon Presley told the DeSoto Times-Tribune things are not nearly as rosy as some providers would have you believe.

“The maps the FCC have are just plain wrong,” Presley said. “Their maps show that Mississippi is almost completely covered and that is certainly not the case. Getting this corrected is a top priority so that Mississippi can get its fair share of funding to cover these areas for residents and businesses.”

The implications for DeSoto County, Mississippi’s fastest growing county, are profound.

Thanks to map data volunteered by service providers that suggest virtually the entire state already has access to broadband, federal assistance funding for expanding Internet access may be off-limits. Most assistance programs require that areas be unserved to avoid duplicating existing service.

“Currently, the map vastly overstates the broadband coverage in the state,” Presley said. “While the map shows neighboring states with extensive underserved areas, Mississippi appears with nearly universal coverage.”

The FCC’s map of unserved areas depicts Mississippi as a broadband outlier in the southern United States, with far more service options than other nearby southern states. Digging deeper reveals major problems with the FCC’s data.

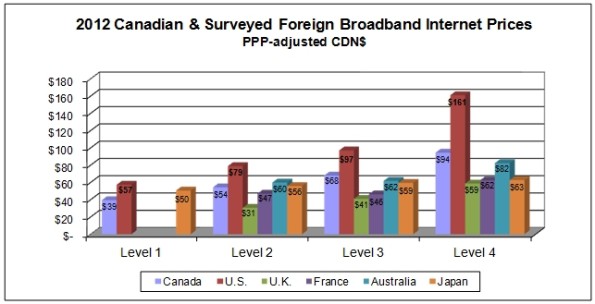

For instance, the state’s map reveals much of Mississippi is covered by wireless providers like AT&T, C-Spire, and Verizon. But those companies offer only limited data plans at high prices that are not equivalent to traditional wired broadband from a cable or phone company. A company called Callis Communications is depicted as providing a large part of the state with DOCSIS 3 cable modem service, when in fact Callis markets cloud-services to business customers and does not operate a cable company.

Most of Mississippi’s broadband connections from cable companies and AT&T are in larger communities including Tupelo, Jackson, Meridian, Gulfport, Hattiesburg and Biloxi. That leaves large sections of central and western Mississippi with significant service gaps.

Presley said his office is working to correct the FCC’s National Broadband Map, but with federal spending cutbacks looming, it may already be too late.

“Without this assistance, rural communities will continue to be left behind as small businesses, health care and emergency services will be left without necessary access to the Internet,” Presley told the newspaper.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/WLOX Biloxi Broadband map could cost the state millions 12-21-12.mp4[/flv]

WLOX in Biloxi reports Mississippi officials are scrambling to correct faulty broadband map data with the FCC so the state can qualify for broadband expansion funding. (2 minutes)

Subscribe

Subscribe