The FCC has circulated a draft rulemaking that proposes to make it easier for phone companies to end landline and DSL service in areas they are no longer interested in maintaining existing infrastructure.

The FCC has circulated a draft rulemaking that proposes to make it easier for phone companies to end landline and DSL service in areas they are no longer interested in maintaining existing infrastructure.

“We propose eliminating some or all of the changes to the copper retirement process adopted by the Commission in the 2015 Technology Transitions Order,” according to the draft, which would allow phone companies to end service “where alternative voice services are available to consumers in the affected service area.”

The proposed new policy would depart significantly from the one put in place during the Obama Administration because it would end assurances that competing providers would have reasonable and affordable access to wholesale broadband and voice services after phone companies mothball their copper wire networks in favor of wireless or fiber alternatives. If the FCC proposal passes, incumbent phone companies like Verizon and AT&T could end rural landline and DSL service and not make provisions for competitors to have access to the technology alternatives the phone companies would offer affected customers.

Verizon immediately praised the FCC proposal, saying it was “encouraged the FCC has set as a priority creating a regulatory environment that encourages investment in next-generation networks and clears away outdated and unnecessary regulations,” wrote Will Johnson, senior vice-president of federal regulatory and legal affairs at Verizon. “This action is forward-looking, productive and will lead to tangible consumer benefits.”

Verizon immediately praised the FCC proposal, saying it was “encouraged the FCC has set as a priority creating a regulatory environment that encourages investment in next-generation networks and clears away outdated and unnecessary regulations,” wrote Will Johnson, senior vice-president of federal regulatory and legal affairs at Verizon. “This action is forward-looking, productive and will lead to tangible consumer benefits.”

Previous attempts by Verizon to discontinue landline and DSL service did not lead to “tangible consumer benefits” as Verizon might have hoped. Instead, it led to a consumer backlash, particularly in areas affected by Superstorm Sandy in 2012. Verizon elected not to rebuild its copper wire infrastructure in affected coastal communities in New York and New Jersey. Instead, it introduced a wireless landline replacement called Voice Link that proved unpopular and caused a revolt among residents on Fire Island. The wireless replacement did not support data, health monitoring, credit card transaction processing, faxing, and was criticized for being unreliable. Verizon eventually relented and opted to expand its FiOS fiber to the home network on the island instead.

Verizon also attempted to market Voice Link to New York residents in certain urban and rural service areas affected by extended service outages in lieu of repairing its existing infrastructure. Under the proposed changes, the FCC would ease the rules governing the transition away from copper-based services, which include traditional landline service and DSL, in favor of wireless technology replacements and fiber optics.

Because telephone companies like AT&T and Verizon have made mothballing rural wireline infrastructure a priority, the FCC strengthened its rules in 2015 by doubling the notification window from 90 to 180 days, giving more time for affected customers to make other service arrangements or complain to regulators that there were no suitable alternatives. The FCC wants to roll back that provision to its earlier 90-day notification window in response to telephone company complaints that maintaining copper wire infrastructure is expensive and diverted investment away from next-generation networks.

Because telephone companies like AT&T and Verizon have made mothballing rural wireline infrastructure a priority, the FCC strengthened its rules in 2015 by doubling the notification window from 90 to 180 days, giving more time for affected customers to make other service arrangements or complain to regulators that there were no suitable alternatives. The FCC wants to roll back that provision to its earlier 90-day notification window in response to telephone company complaints that maintaining copper wire infrastructure is expensive and diverted investment away from next-generation networks.

AT&T has been lobbying for several years to win permission from state legislatures to abandon copper wireline infrastructure, mostly in rural areas, where the company has chosen not to upgrade to fiber optic networks. AT&T claims only about 10% of their original landline customer base still have that service.

Both Verizon and AT&T have shown an interest in moving rural consumers to more proprietary wireless networks, preferably their own, where consumers would get voice and data services. But consumer advocates complain customers could lose access to competitive alternatives, may not have a guarantee of reliable service because of variable wireless coverage, could pay substantially more for wireless alternatives, and may be forced to use technology that either does not support or works less reliably with home security systems, medical monitoring, faxing, and data-related transactions like credit card processing.

Other consumer groups like AARP and Public Knowledge have complained that shortening the window for a transition away from basic landline and DSL service to alternative technology could disproportionately affect the customers most likely to still depend on traditional wireline service — the elderly, poor, and those in rural areas.

Subscribe

Subscribe

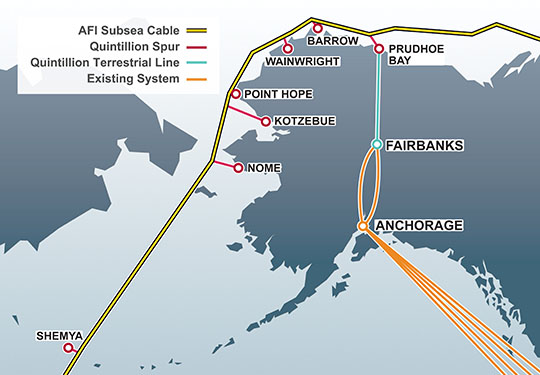

The biggest weakness of the plan, according to its critics, is its lack of support for middle-mile networks — wired infrastructure that connects providers to a statewide broadband backbone that can manage traffic needs without having to turn to slow-speed satellite connectivity. One of Alaska’s biggest challenges is finding low-cost connectivity with Canada and the lower-48 states. Much of the state relies heavily on GCI’s still-expanding TERRA network, which provides fiber as well as microwave connectivity to 72 towns and villages in rural Alaska. Quintillion, a new player, is working on stretching fiber connectivity through the Northwest Passage. Its forthcoming 30 terabit capacity fiber network offers the possibility of dramatically lower broadband rates and no more data caps, assuming providers have the network capacity to connect their service areas and the nearest fiber access point.

The biggest weakness of the plan, according to its critics, is its lack of support for middle-mile networks — wired infrastructure that connects providers to a statewide broadband backbone that can manage traffic needs without having to turn to slow-speed satellite connectivity. One of Alaska’s biggest challenges is finding low-cost connectivity with Canada and the lower-48 states. Much of the state relies heavily on GCI’s still-expanding TERRA network, which provides fiber as well as microwave connectivity to 72 towns and villages in rural Alaska. Quintillion, a new player, is working on stretching fiber connectivity through the Northwest Passage. Its forthcoming 30 terabit capacity fiber network offers the possibility of dramatically lower broadband rates and no more data caps, assuming providers have the network capacity to connect their service areas and the nearest fiber access point. Instead, the ATA managed to convince regulators that 10/1Mbps service was good enough — speed that can be achieved by the DSL service phone companies favor. This is well below Alaska’s Broadband Task Force goal of 100Mbps for every state resident by 2020. Another free pass built into the plan is allowing providers to collect subsidies even when they do not offer 10Mbps because of network limitations, including lack of suitable middle mile networks. In those cases, the only speed requirement is 1Mbps download speeds and 256kbps uploads, the same as satellite broadband providers.

Instead, the ATA managed to convince regulators that 10/1Mbps service was good enough — speed that can be achieved by the DSL service phone companies favor. This is well below Alaska’s Broadband Task Force goal of 100Mbps for every state resident by 2020. Another free pass built into the plan is allowing providers to collect subsidies even when they do not offer 10Mbps because of network limitations, including lack of suitable middle mile networks. In those cases, the only speed requirement is 1Mbps download speeds and 256kbps uploads, the same as satellite broadband providers.

At least 54,000 Time Warner Cable customers downgraded or canceled their cable TV service in the last three months as Charter Communications continues to take a harder line on offering or renewing customer retention discounts for customers unhappy with their bill.

At least 54,000 Time Warner Cable customers downgraded or canceled their cable TV service in the last three months as Charter Communications continues to take a harder line on offering or renewing customer retention discounts for customers unhappy with their bill.

Rutledge made clear that despite any product changes or rebranding, the long term goal of Charter Communications is to see revenue grow. Whether that will come from gradual repricing of cable products and services to a higher rate or from improved products and services that attract new upgrade business is not yet certain. But Rutledge outlined key areas Charter expects to focus on in the next few years:

Rutledge made clear that despite any product changes or rebranding, the long term goal of Charter Communications is to see revenue grow. Whether that will come from gradual repricing of cable products and services to a higher rate or from improved products and services that attract new upgrade business is not yet certain. But Rutledge outlined key areas Charter expects to focus on in the next few years: