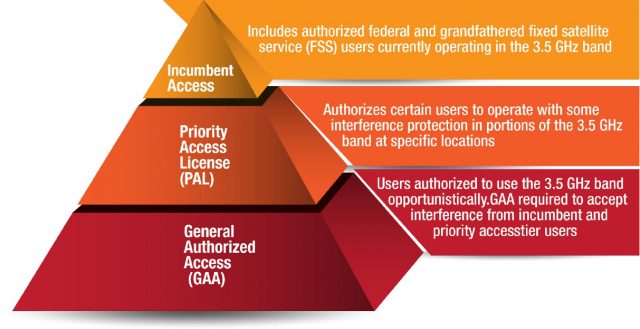

There are three tiers of Citizens Broadband Radio Service users – incumbent users (usually military) that get top priority access and protection from interference, a mid-class Priority Access License group of users that win limits on potential interference from other users, and unlicensed users that have to share the spectrum, and interference, if any.

Charter Communications wants to license a portion of the 3.5 GHz Citizens Broadband Radio Service (CBRS) band to launch a new wireless broadband service for its future mobile customers and potentially also offer its own rural broadband solution.

The CBRS band has sat largely unused except by the U.S. military since it was created, but now the Federal Communications Commission is exploring opening up the very high frequencies to attract wireless broadband services with Priority Access Licenses that will assure minimal interference.

One of the most enthusiastic supporters of CBRS is Charter/Spectrum, which has been testing a 3.5 GHz wireless broadband service using CBRS spectrum in Centennial and Englewood, Col., Bakersfield, Calif., Coldwater, Mich., and Charlotte, N.C. Those tests, according to Charter, reveal the cable company “can provide speeds of at least 25/3 Mbps at significant distances,” which it believes could become a rural broadband solution for customers outside of the reach of its wired cable network.

But Charter’s interest in CBRS extends well beyond its potential use to reach rural areas. Charter’s primary goal is to offer wireless connectivity in neighborhoods for its forthcoming mobile phone service. Charter plans to enter the wireless business this year, selling smartphones and other wireless devices that will depend on in-home Wi-Fi, CBRS, and a contract with Verizon Wireless to provide coverage everywhere else.

Charter wants to keep as much data usage on its own networks as possible to reduce costs. It has no interest in building a costly, competing LTE 4G or 5G wireless network to compete with AT&T, Verizon, Sprint, and T-Mobile. But it is interested in the prospect of using LTE technology on CBRS frequencies, which are likely to be licensed at much lower costs than traditional mobile spectrum.

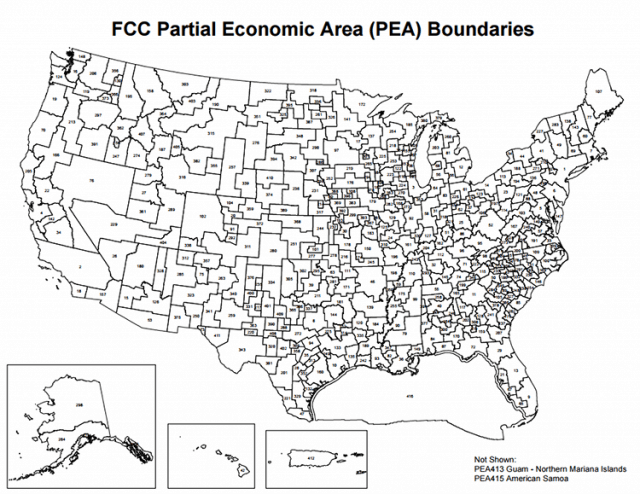

Primary Economic Areas

There are several proposals on the table on how to license this spectrum. Large wireless companies want Priority Access Licenses (PALs) based on Partial Economic Areas (PEAs) — 416 wireless service areas the FCC established as part of its spectrum auctions. PEAs are roughly equivalent to metropolitan areas and typically cover multiple counties surrounding a major city. Major wireless carriers are already familiar with PEAs and their networks cover large portions of them.

Charter is proposing to license PALs based on county lines, not PEAs, which will likely reduce the costs of licensing and, in Charter’s view, will “attract interest and investment from new entrants to small and large providers.” If Charter’s proposal is adopted, its costs deploying small cell technology used with CBRS will be much lower, because it will not have to serve larger geographic areas.

Charter is proposing to license PALs based on county lines, not PEAs, which will likely reduce the costs of licensing and, in Charter’s view, will “attract interest and investment from new entrants to small and large providers.” If Charter’s proposal is adopted, its costs deploying small cell technology used with CBRS will be much lower, because it will not have to serve larger geographic areas.

The FCC envisioned licensing PALs based on census tract boundaries, which would result in licenses for areas as small as portions of neighborhoods. That proposal has not won favor with like wireless companies or cable operators. The wireless giants would prefer licenses based on PEAs, but companies like AT&T seem also amenable to the cable industry proposal.

Charter’s proposed CBRS network would likely allow the cable company to offload a lot of its mobile data traffic away from Verizon Wireless, reducing the company’s data costs. Charter’s deployment costs are relatively low as well, because the backhaul fiber network used to power small cells is already present throughout Charter’s service areas.

Just how far into rural unserved areas Charter’s CBRS network can reach isn’t publicly known, but it would likely not extend into the most difficult-to-serve areas far away from Charter’s current infrastructure. But if the FCC establishes county boundaries and a requirement that those companies obtaining priority licenses actually serve those areas, it could help resolve some rural broadband problems.

Subscribe

Subscribe Verizon will spend most of the benefits gained from the Trump Administration’s tax cuts on writing off investments that will reduce the company’s tax exposure and boosting its dividend to shareholders.

Verizon will spend most of the benefits gained from the Trump Administration’s tax cuts on writing off investments that will reduce the company’s tax exposure and boosting its dividend to shareholders. Because the technology isn’t revolutionary, Starry can utilize equipment already for sale in the marketplace. Some commercial fixed-wireless services already exist using a similar approach, and Google itself is developing

Because the technology isn’t revolutionary, Starry can utilize equipment already for sale in the marketplace. Some commercial fixed-wireless services already exist using a similar approach, and Google itself is developing

But Moffett is thinking even further ahead, by suggesting wireless carriers might be able to stop spending billions on building and expanding their competing 4G LTE networks when they could all share a single provider’s network in each city. That idea could work if providers agreed to creating local monopolies.

But Moffett is thinking even further ahead, by suggesting wireless carriers might be able to stop spending billions on building and expanding their competing 4G LTE networks when they could all share a single provider’s network in each city. That idea could work if providers agreed to creating local monopolies.