WiredWest is a public co-op seeking to deliver fiber to the home broadband across western Massachusetts.

Despite the dreary drizzle, fog, and unseasonably cold weather that has plagued the northeast since last weekend, 191 residents of New Salem, Mass. crowded into a basement for the town’s annual meeting Monday night, largely with one issue in mind: better broadband.

A reporter from The Recorder noted Moderator Calvin Layton was surprised by the overwhelming vote for fiber broadband — 189 for and only one apparently against.

The town clerk for New Salem typically counts around 60 heads at such meetings, but this night was different because the community was voting to spend $1.5 million to bring broadband to a town completely ignored by Comcast and Verizon. That fact has hurt area property values and has challenged residents and business owners alike. The town is fed up with inaction by the state’s dominant phone and cable company, which has done nothing to expand access in western Massachusetts.

“Our goal is to make this broadband available to every house, not just the places that are easy to wire,” said MaryEllen Kennedy, the chair of the town’s Broadband Committee.

New Salem isn’t alone.

Monterey passed its own bond authorization with a vote of 130 to 19, becoming the 10th consecutive town to vote in favor of bringing 21st century broadband to the region. The community of Beckett followed a day later.

Phillip “There are no broadband magic ponies” Dampier

Residents in 16 of the 17 towns asked so far to authorize the borrowing necessary to cover their community’s share of the fiber to the home project have usually done so in overwhelming majorities. But it has not been all good news. The town of Montgomery in Hampden County voted down paying its share by just two votes. Supporters claim low voter turnout may have done the project in, at least for the time being. A call for a new vote is underway.

Perhaps the most contentious debate over WiredWest continues in the small community of Hawley, where one activist has organized opposition for the project based on its cost to the community of 347. Hawley is in the difficult position of being a small community spread out across a lot of hills and hollows. The cost for Hawley to participate in the fiber to the home project would be around $1 million, a figure many residents decided was out of their price range. Participation in WiredWest was shot down in a recent vote and the repercussions continue to this day in the opinion pages of The Recorder as residents fire back and forth at each other, sometimes with strident personal comments.

While easy to vote down participation in WiredWest, finding an alternative for Hawley has proved difficult.

Kirby “Lark” Thwing, a member of both the town finance and communications committees, is trying to find the cheaper broadband solution advocated by Hussain Hamdan, who has led the charge against WiredWest’s fiber to the home service in Hawley.

Thwing has run headfirst into what Stop the Cap! feared he would find — the rosy budget-minded alternatives suggested as tantalizingly within reach simply are not and come at a higher price tag than one might think.

Installing a Wi-Fi tower to bring wireless Internet access to a resort park.

Thwing is looking at a hybrid fiber/wireless solution involving a fiber trunk line run down two well-populated roads that could support fiber service for about half the homes in Hawley and lead to at least two large wireless towers that would reach most of the rest of town. He’s also hoping Hawley would still qualify to receive its $520,000 share of broadband grant money from the Massachusetts Broadband Institute to help cover the alternative project’s costs.

If Hawley can use that money, Thwing predicts it will cover much of the construction cost of the fiber trunk line. After that, each homeowner would be expected to pay to bring fiber from the trunk line to their home, definitely not a do-it-yourself project that will cost at least several hundred dollars, not counting the cost of any inside wiring and a network interface device attached to each participating home. Residents should also expect to spend another $100 on indoor electronics including a receiver and optional router to connect broadband to their home computer and other devices.

But the expenses don’t stop there.

Thwing also has to consider the cost of the wireless towers and provisioning a wireless service to Hawley residents not immediately adjacent to the fiber trunk line. He will be asking residents if they are willing to pay an extra $25-50 a month ($300-600 a year) to pay down the debt service on the town’s two proposed wireless towers. It isn’t known if that fee would include the price of the Internet service or just the infrastructure itself.

As Thwing himself recognizes, if the total cost for the alternative approaches the $1 million the town already rejected spending on fiber to the home service for everyone, it leaves Hawley no better off.

As Stop the Cap! reported last month, we believe Hawley will soon discover the costs of the alternatives Mr. Hamdan has suggested are greater than he suspects and do not include the cost of service, billing and support. Fiber to the home remains the best solution for Hawley and the rest of a region broadband forgot. Other towns that want to believe a cheaper alternative is out there waiting to be discovered should realize if such a solution did exist, private companies would have already jumped in to offer the service. They haven’t.

At the same time, we cannot ignore there are small communities in western Massachusetts that will find it a real burden to pay the infrastructure costs of a fiber network when there are fewer residents across wide distances to share the costs.

That is why it is critical for the Federal Communications Commission to expand rural broadband funding opportunities to subsidize the cost of constructing rural broadband services in communities like Hawley.

At the very least, state officials should consider creative solutions that either spread the cost of network construction out over a longer term or further subsidizing difficult to reach areas.

There is strong evidence voters across western Massachusetts are not looking for a government handout and have more than stepped up to pay their fair share to guarantee their digital future, but some challenges can be insurmountable without the kind of help the FCC already gives to private phone companies that spend the money on delivering dismally slow DSL service. Western Massachusetts has demonstrated it can get a bigger bang for the buck with fiber to the home service — a far better use of Connect America Funds than spending millions to bring 3Mbps DSL to the rural masses.

Subscribe

Subscribe Today’s offer by Altice SA to spent $11 billion to acquire France’s Bouygues Telecom and combine it with Altice-owned Numericable-SFR to create France’s largest wireless operator

Today’s offer by Altice SA to spent $11 billion to acquire France’s Bouygues Telecom and combine it with Altice-owned Numericable-SFR to create France’s largest wireless operator

French lawmakers, particularly those aligned with France’s labor unions, accuse Drahi of acting like a bulimic debtor and feared his splurge would eventually lead to a banker-forced purge and government bailout if he cannot meet his debt obligations in the future.

French lawmakers, particularly those aligned with France’s labor unions, accuse Drahi of acting like a bulimic debtor and feared his splurge would eventually lead to a banker-forced purge and government bailout if he cannot meet his debt obligations in the future.

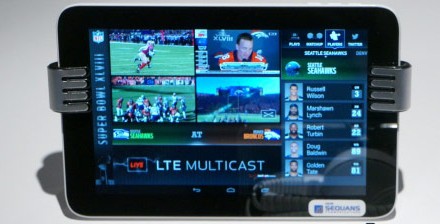

Verizon Communications this morning announced it will

Verizon Communications this morning announced it will  All signs point to the AOL acquisition as more evidence Verizon management is shifting priorities to its mobile business, Verizon Wireless. In 2014, Verizon acquired the assets of Intel Media, which was planning an Internet TV service called OnCue. Verizon’s acquisition will help it develop an alternative television platform and many analysts expect it will primarily reach Verizon Wireless customers.

All signs point to the AOL acquisition as more evidence Verizon management is shifting priorities to its mobile business, Verizon Wireless. In 2014, Verizon acquired the assets of Intel Media, which was planning an Internet TV service called OnCue. Verizon’s acquisition will help it develop an alternative television platform and many analysts expect it will primarily reach Verizon Wireless customers.

A Florida utility company has told federal regulators it is certain Verizon has a plan to exit its landline and wired broadband businesses within the next ten years to become an all-wireless service provider.

A Florida utility company has told federal regulators it is certain Verizon has a plan to exit its landline and wired broadband businesses within the next ten years to become an all-wireless service provider. “Verizon has not increased its efforts to deploy wireline broadband in the last three years; and there is no evidence that Verizon has used the capital saved on joint use rates for the expansion of wireline broadband,” FP&L officials write. “Indeed, all of the evidence shows that Verizon is abandoning its efforts to build out wireline broadband.”

“Verizon has not increased its efforts to deploy wireline broadband in the last three years; and there is no evidence that Verizon has used the capital saved on joint use rates for the expansion of wireline broadband,” FP&L officials write. “Indeed, all of the evidence shows that Verizon is abandoning its efforts to build out wireline broadband.”