Wireless Internet Service Providers (WISPs) are incensed about efforts by CenturyLink to win waivers from the Federal Communications Commission’s Connect America rural broadband funding program that could leave WISPs facing new competition from CenturyLink made possible by surcharges paid by phone customers nationwide.

Wireless Internet Service Providers (WISPs) are incensed about efforts by CenturyLink to win waivers from the Federal Communications Commission’s Connect America rural broadband funding program that could leave WISPs facing new competition from CenturyLink made possible by surcharges paid by phone customers nationwide.

At issue is a filing from CenturyLink before the FCC that would allow the phone company to “change the rules,” according to critics. One of CenturyLink’s most prominent arguments is that WISPs have data caps that inconvenience customers. But CenturyLink buries the fact it has usage caps of its own in a footnote.

“The waiver application we filed … would allow CenturyLink to spend tens of millions of dollars to bring more broadband services to more rural and high-cost customers who do not have reasonable access to broadband service today,” CenturyLink said in a media release. “These funds would be provided by the FCC’s Connect America Fund, as well as additional investment dollars would be provided by CenturyLink. If the waiver application is approved, CenturyLink will build needed broadband services to thousands of homes in Arizona, Colorado, Washington, Oregon and several other states.”

CenturyLink claims WISPs charge considerably more for service, suffer from line-of-sight restrictions which could leave many rural customers without service, have limited spectrum which keeps broadband speeds to a bare minimum and often forces customers to endure stringent data usage caps.

The waiver request would allow CenturyLink to receive and use federal Connect America funds to deploy its DSL service to rural customers already served by WISPs if two conditions are met:

- The state where CenturyLink would spend the money has not independently verified the coverage area of the wireless ISP and objective data opens the door to an argument that a WISP cannot adequately service areas where they claim coverage;

- The WISP imposes unusually high prices ($720/yr or more) or severe usage caps (25GB per month or less).

Chuck Siefert, CEO of the Montana Internet Corporation (MIC), a WISP, argues CenturyLink has no case, and is attempting to modify the rules to accomplish its own objectives rather than adhering to the original goals of the program — to deliver broadband to the rural unserved:

CenturyLink is simply raising an old protest in a new venue. Having been designated as eligible for almost ninety million dollars of the Connect America Program (CAP), it wishes to have the opportunity to use more than a third of that as it chooses, rather than as the Commission designated after input and analysis from all parties. The Rubicon has been crossed with respect to this issue: unserved areas are those that are not served by fixed wireless providers. Regardless of CenturyLink’s opinion of the quality of service provided, these areas have been deemed served by the Commission and CAP incremental support may not be used to build out broadband in these areas. CenturyLink is certainly capable of using other funding to build out in these areas; the Commission has not precluded that.

CenturyLink’s complaints that WISPs often come with data usage caps is ironic because CenturyLink is now imposing usage caps on its own broadband service. CenturyLink argues data caps expose the limitations inherent in wireless broadband in their filing with the FCC:

Satellite broadband also often comes encumbered with restrictive data caps. The same is true of many of the WISPs subject to this waiver request. They impose on their users highly restrictive data caps of less than 25 GB per month. Indeed, two of the WISPs impose a cap of just 5 GB per month.

It is no surprise that these WISPs would impose such unusually low caps; like satellite providers, they must ration out their highly constrained capacity among the various end users who compete for it. WISP broadband capacity—unlike the customer-specific links in DSL-based broadband—is shared by all customers within a given wireless cell or sector.

This means that the more customers a WISP persuades to sign up, the worse the average service quality gets for all customers unless the WISP sharply limits how much customers may consume.

That imperative may be an unavoidable consequence of the WISPs’ technology, but it further underscores the need to give the affected consumers a robust broadband alternative.

Siefert claims CenturyLink’s assertions about the quality of its DSL service, pricing, and performance simply fall short of the truth, and MIC does better by its customers.

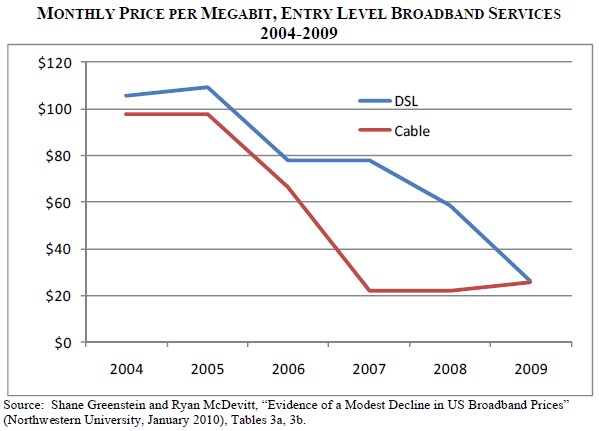

Pricing

CenturyLink charges a $134.89 non-recurring charge plus $29.99/mo for “up to 1.5Mbps” DSL service, plus “up to” $99.95 for professional installation. CenturyLink’s DSL modem costs $99 and has a one-year warranty.

CenturyLink charges a $134.89 non-recurring charge plus $29.99/mo for “up to 1.5Mbps” DSL service, plus “up to” $99.95 for professional installation. CenturyLink’s DSL modem costs $99 and has a one-year warranty.

Siefert claims MIC charges $30/mo for “bursting speeds up to 10Mbps” and $250 for technician installation, but the company offers regular installation promotions that cost $99. MIC warrants its equipment for the life of the service and charges no fee for service calls as long as the customer is current on their bill.

But Stop the Cap! found speeds and pricing less advantageous than Siefert might have the FCC believe. For instance, MIC’s $30 tier only guarantees 384kbps with speed “bursts” up to 10Mbps. Getting committed 2Mbps service runs $55 a month with the same “bursting” speed of 10Mbps. We also found CenturyLink willing to negotiate installation charges, and the company frequently discounts or even waives them if a customer signs up for a multi-service package.

Data Caps

CenturyLink now imposes a 150GB usage cap on customers with 1.5Mbps service or slower, 250GB for customers at higher speeds.

MIC claims it does not even monitor individual customer usage. Siefert says data use limitations are found in the terms and conditions of its service and are imposed only when a customer creates a problem for other users on the network.

“Rather than strictly applying data caps, MIC’s policy is to contact its customers and explain the impact their usage has on other customers,” Siefert explains. “As a small provider in a local community, MIC is able to do this in a way that a carrier like CenturyLink cannot. CenturyLink’s representations regarding transfer caps imply that WISPs arbitrarily and automatically shut a customer down once the cap is reached. This assertion is not based on evidence and is not an accurate statement of MIC’s approach to the caps. CenturyLink’s argument that WISPs operate like satellite and therefore WISPs service areas should be categorized as unserved areas based on how transfer caps are used fails.”

Stop the Cap! found different information on MIC’s website, however, including a 20GB monthly data cap and a $15/GB overage charge. Siefert’s submission to the FCC may suggest the published cap is a guideline more than a rule.

Performance

CenturyLink still uses T1-level circuits (1.5Mbps) to connect at least some of their remote D-SLAMs, according to Siefert, which helps the phone company extend DSL service to homes and businesses far away from the company’s central office. The net result is that customers fight for the bandwidth on an insufficient backhaul, which dramatically reduces speeds during peak usage times. In Helena, Montana CenturyLink “daisy-chains” D-SLAMs to support customers over a single T3 line, creating latency problems, packet loss, and further reductions in speed and performance.

CenturyLink still uses T1-level circuits (1.5Mbps) to connect at least some of their remote D-SLAMs, according to Siefert, which helps the phone company extend DSL service to homes and businesses far away from the company’s central office. The net result is that customers fight for the bandwidth on an insufficient backhaul, which dramatically reduces speeds during peak usage times. In Helena, Montana CenturyLink “daisy-chains” D-SLAMs to support customers over a single T3 line, creating latency problems, packet loss, and further reductions in speed and performance.

MIC is capable of providing a total of 252Mbps per distribution site. The incoming next generation of wireless technology will increase that to 1.4Gbps. Additional distribution sites can divide the traffic load similar to how new cell towers can reduce demand on other nearby towers.

Speeds

CenturyLink sells speeds “up to” a certain level without guaranteeing customers will actually get the speed they are paying to receive. Siefert says CenturyLink customers in Montana currently can manage up to 7Mbps in some areas.

MIC says it can commit to its customers they can receive 10-40Mbps (and 80Mbps by the end of 2012) over its wireless network.

Independent Netindex.com suggests MIC does offers faster service on average than CenturyLink provides in Montana:

- Montana (statewide average): MIC 5.04Mbps vs. CenturyLink 3.8Mbps

- Helena: MIC 5.08Mbps vs. CenturyLink 2.73Mbps

The Wireless Internet Service Provider Association says their members are not eligible for federal Connect America subsidies, and most wireless providers are privately financed operations built with the support of their rural customers.

Said Richard Harnish, WISPA’s executive director, “We find it hard to believe that a company like CenturyLink that gets millions of dollars in federal support now wants more free money to overbuild unsubsidized rural broadband networks that WISPs already successfully operate. To do this, CenturyLink has attempted to discredit the taxpayer-funded National Broadband Map and invent its own standards in an effort to show that they should receive more than $30 million in additional subsidies. Our strong opposition reflects WISPA’s view that CenturyLink’s arguments are factually and technically flawed. We thank the other associations, state agencies and WISPs that support our views.”

AT&T has new wireless data plans you can’t afford.

AT&T has new wireless data plans you can’t afford.

Subscribe

Subscribe