Cable companies, including Time Warner Cable, are offering a mix of threats and financial incentives to keep popular cable programming away from online video competitors.

Cable companies, including Time Warner Cable, are offering a mix of threats and financial incentives to keep popular cable programming away from online video competitors.

Bloomberg News today reported the private discussions primarily target upstart streaming video services from companies like Intel, Apple, and Google, which are all proposing multichannel streaming video services that could one day replace the local cable company.

All three would-be competitors have been stymied, some for years, from signing contracts with popular cable networks like HBO, USA, ESPN and Comedy Central. If a viewer wants to watch those networks, they usually have to authenticate themselves as existing cable, satellite, or telco-TV customers to get access to live and recorded programming. The cable industry prefers it that way as a customer retention tool.

Time Warner Cable CEO Glenn Britt admitted to Wall Street analysts attending this week’s Cable Show his company probably insists on contract language that bars programmers from providing content to online video services.

“We may well have ones that have that prohibition,” Britt said at the conference in Washington. “This is not a cookie-cutter kind of business.”

Some cable company contracts are more benign, only requiring programmers to license content on the same terms offered to their online competitors. Britt said some of Time Warner Cable’s contracts fall into this category.

Britt

Britt has repeatedly emphasized Time Warner wants to license content more broadly to allow the company to include it in its TV Everywhere platform, which streams video content to wireless devices. The cable operator adopted a policy in 2009 that sought to deliver content to customers on any device they wish. Restrictive contracts have kept that policy from being fully implemented.

AT&T U-verse says it won’t pay full price for cable programming sold to its online competitors.

“If they’re going to go over-the-top, then that’s a very different conversation and a very different value for our customers,” Jeff Weber, president of content, said last month at an investor conference. “Exclusive versus non-exclusive has materially different value for our customers. And I think we would want that reflected.”

Restrictive contracts are all about protecting the existing pay television ecosystem, according to Charter’s chief financial officer, Chris Winfrey.

“It’s in everybody’s mutual interest that we are protecting the ecosystem in a way that continues to keep the value of that programming that we have and the way it’s delivered to our subscribers today,” Winfrey said added.

Consumer groups say restrictive contracts are the epitome of anticompetitive industry behavior that should be examined by the Justice Department.

“Is it anticompetitive generally? Of course it is, they are keeping programming from their competitors,” said Gigi Sohn from Public Knowledge.

Satellite companies were originally in this same position, unable to carry popular cable networks on reasonable terms at fair prices until the 1992 Cable Act mandated reforms that required non-discriminatory access to cable programming. Online video providers have not yet been able to demand the same terms for their competing services.

Subscribe

Subscribe One of America’s lowest-rated cable companies and an industry legend labeled by consumer advocates as the “Darth Vader of cable” may be joining forces to buy Time Warner Cable, according to Bloomberg News.

One of America’s lowest-rated cable companies and an industry legend labeled by consumer advocates as the “Darth Vader of cable” may be joining forces to buy Time Warner Cable, according to Bloomberg News.

But the most obvious foreshadowing of a big deal with Time Warner would most likely come if Charter first successfully acquires always-rumored-for-sale Cablevision, where the controlling Dolan family is rumored to be holding out for an exceptionally attractive buyout package other cable companies aren’t willing to offer. Time Warner itself has been rumored as a buyer, but current management has repeatedly stressed it will not pay a premium price for acquisition targets.

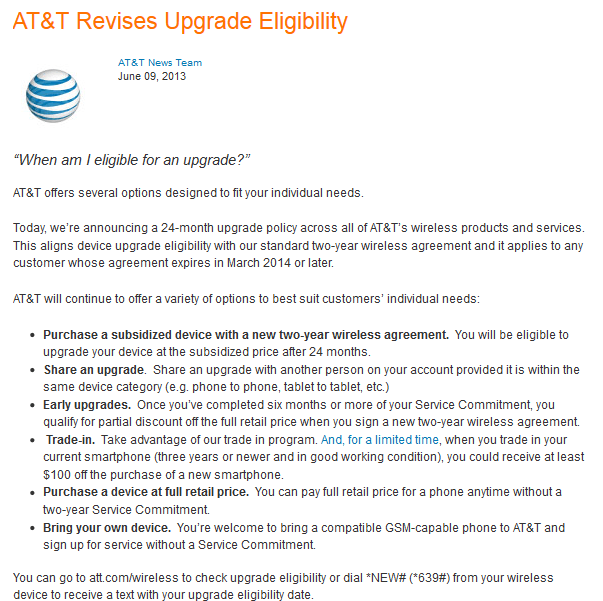

But the most obvious foreshadowing of a big deal with Time Warner would most likely come if Charter first successfully acquires always-rumored-for-sale Cablevision, where the controlling Dolan family is rumored to be holding out for an exceptionally attractive buyout package other cable companies aren’t willing to offer. Time Warner itself has been rumored as a buyer, but current management has repeatedly stressed it will not pay a premium price for acquisition targets. AT&T has once again followed Verizon Wireless’ lead by ending early upgrades for contract customers, making it impossible to upgrade a handset with a full device subsidy until 24 months have passed.

AT&T has once again followed Verizon Wireless’ lead by ending early upgrades for contract customers, making it impossible to upgrade a handset with a full device subsidy until 24 months have passed.