A Wall Street analyst has urged Time Warner Cable’s competitors to deny promotional pricing to new customers switching providers because of the CBS blackout.

A Wall Street analyst has urged Time Warner Cable’s competitors to deny promotional pricing to new customers switching providers because of the CBS blackout.

“While Time Warner Cable’s competitors appear to be resisting predatory marketing campaigns to take advantage of the CBS blackout, at least so far, we believe they need to go even further to cause real industry change,” wrote BTIG Research’s Richard Greenfield. “While TWC’s competitors cannot stop consumers from switching their video service provider due to the loss of CBS, they could make it less appealing to switch due to a programming dispute blackout.”

Greenfield wants providers to support solidarity against programmers like CBS by not taking advantage of the situation to poach subscribers away from Time Warner with attractive promotional packages and pricing. He believes it will ultimately lead to lower prices for consumers.

“The only way to begin to shift leverage in these content negotiations is for [providers] to start supporting each other in programming disputes, rather than try to steal each others’ subscribers,” said Greenfield. “We believe it would make strategic sense for all major [providers] to add a script to their website and call-center new customer acquisition process that asks whether a customer is switching due to the Time Warner CBS dispute (or whatever disputes are currently on-going in the country). If the answer is ‘Yes’ we believe that consumer should not be offered promotional pricing and should be informed that these types of disputes are becoming a problem for all video providers — essentially teaching consumers that ‘switching won’t help’ during these short-term programming battles.”

DirecTV is among the first to express solidarity with its cable competitor, issuing a statement last weekend:

DirecTV is among the first to express solidarity with its cable competitor, issuing a statement last weekend:

DirecTV has certainly had its share of these battles, so we applaud Time Warner Cable for fighting back against exorbitant programming cost increases. We are also appalled to learn that CBS is now punishing DirecTV customers, who may happen to have Time Warner as their Internet provider, by denying them access to CBS content online.

Greenfield’s suggestion essentially asks that cable operators and telephone companies agree not to compete. His idea also penalizes consumers caught in the middle of programming disputes that customers ultimately pay for in the form of higher bills. We think it comes dangerously close to illegal, anti-competitive behavior. Even Greenfield seems to understand his suggestion comes close to the line.

“It is obviously illegal for MVPD’s to collude,” Greenfield concludes. “However, it is not illegal for each to do what is right for the future of their business, even if it means passing on short term opportunity. Tacit cooperation is the best strategy we see available, barring government intervention.”

What is right for business is not right for consumers. Stop the Cap! strongly recommends those signing up with a competitor over programming blackouts avoid explaining their reasons for switching. As well as being none of their business, being candid could cost consumers valuable money-saving discounts and promotions that other new customers receive.

We believe the most effective “game-changer” in the fight between providers and broadcasters demanding 600% rate increases for programming available for free on any television is technology like Aereo, which picks up over-the-air stations with dime-sized antennas and provides customers with online streams of those channels. This technology, if found legal, could eventually be adopted by cable operators to avoid retransmission consent payments altogether or use as effective leverage in negotiations. Aereo is a win-win for providers and consumers. Telling providers to deny consumers new customer pricing just because someone wants to get missing programming back is not.

We’d remind Greenfield of this universal truth: cable bills never go down unless a customers downgrades or threatens to leave.

Subscribe

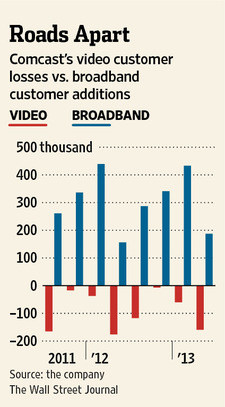

Subscribe Time Warner Cable admitted this morning extracting more revenue from existing customers was more important than attracting new ones, and long time subscribers responded by canceling service in above average numbers.

Time Warner Cable admitted this morning extracting more revenue from existing customers was more important than attracting new ones, and long time subscribers responded by canceling service in above average numbers.

Although cable and phone companies love to declare themselves part of a fiercely competitive telecommunications marketplace, it is increasingly clear that is more fairy tale than reality, with each staking out their respective market niches to live financially comfortable ever-after.

Although cable and phone companies love to declare themselves part of a fiercely competitive telecommunications marketplace, it is increasingly clear that is more fairy tale than reality, with each staking out their respective market niches to live financially comfortable ever-after. That means Time Warner Cable has an 80 percent market share. Actually, it is probably higher because that total number of households includes those who either don’t want, need, or can’t afford broadband service. Some may also rely on limited wireless broadband services from Clearwire or one of the large cell phone companies.

That means Time Warner Cable has an 80 percent market share. Actually, it is probably higher because that total number of households includes those who either don’t want, need, or can’t afford broadband service. Some may also rely on limited wireless broadband services from Clearwire or one of the large cell phone companies. Rochester remains a happy hunting ground for Internet Overcharging schemes because the only practical, alternative broadband supplier is Frontier Communications, which Time Warner Cable these days dismisses as an afterthought (remember that 80 percent market share). Without a strong competitor, Time Warner has no problem experimenting with new “usage”-priced tiers.

Rochester remains a happy hunting ground for Internet Overcharging schemes because the only practical, alternative broadband supplier is Frontier Communications, which Time Warner Cable these days dismisses as an afterthought (remember that 80 percent market share). Without a strong competitor, Time Warner has no problem experimenting with new “usage”-priced tiers. In nearby Ohio, the average broadband user already exceeds Time Warner’s 30GB pittance allowance, using 52GB a month. Under both plans, customers who exceed their allowance are charged $1 per GB, with overlimit fees currently not to exceed $25 per month. That 30GB plan would end up costing customers an extra $22 a month above the regular, unlimited plan. So much for the $5 savings.

In nearby Ohio, the average broadband user already exceeds Time Warner’s 30GB pittance allowance, using 52GB a month. Under both plans, customers who exceed their allowance are charged $1 per GB, with overlimit fees currently not to exceed $25 per month. That 30GB plan would end up costing customers an extra $22 a month above the regular, unlimited plan. So much for the $5 savings.