“We did try, but it’s over now.” — Barry Diller, a major investor in Aereo

The multibillion dollar broadcasting conglomerates that control over-the-air television and most cable networks got everything they wanted today from a 6-3 decision in the U.S. Supreme Court that declared Aereo, an independent provider of online over-the-air television streams, illegal.

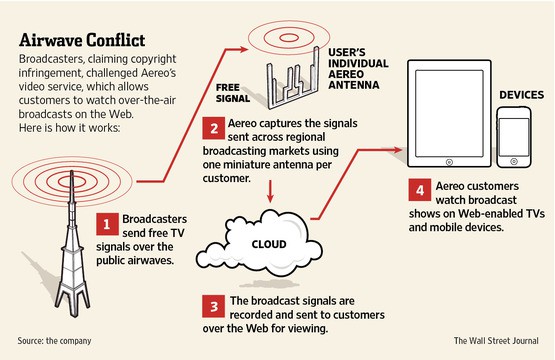

The court’s liberal justices joined Chief Justice John Roberts and moderate Anthony Kennedy in a complete repudiation of the legality of Aereo’s business model — selling over the air television signals received by individual tiny antennas and streamed over the Internet — without seeking permission from the stations involved. In a sweeping ruling, the court found that no matter the technology involved, any effort to resell access or copies of television programs without the permission of the copyright holders is illegal. “We conclude that Aereo is not just an equipment supplier,” Justice Breyer wrote in the opinion. “We do not see how the fact that Aereo transmits via personal copies of programs could make a difference.”

Aereo CEO and founder Chet Kanojia quickly released a statement declaring the decision “a massive setback for the American consumer.”

“We’ve said all along that we worked diligently to create a technology that complies with the law, but today’s decision clearly states that how the technology works does not matter. This sends a chilling message to the technology industry,” Kanojia said. “We are disappointed in the outcome, but our work is not done. We will continue to fight for our consumers and fight to create innovative technologies that have a meaningful and positive impact on our world.”

That is news to Barry Diller, perhaps Aereo’s biggest investor. He has said for months if Aereo loses in the Supreme Court, the service will be shut down. He repeated that today on CNBC.

“We did try, but it’s over now.” Diller said.

Image: Wall Street Journal

Reed Hundt, former FCC chairman under the Clinton Administration, said despite the fact the ruling may inconvenience Aereo subscribers, the court wasn’t wrong in its decision.

“Aereo has very little chance surviving in the business and Barry Diller got his hands caught in the regulatory cookie jar,” Hundt said. “You can’t use technological tricks to bypass [cable network] rules and regulations. I think that’s a very reasonable decision.”

Observers worried about the impact the Aereo case might have on ancillary services unintentionally caught up in any broad legal language, but the court appeared to carefully avoid those complications.

The ruling leaves antenna manufacturers unaffected because antenna users simply capture over-the-air signals for reception in the home without paying the kind of ongoing subscription fees Aereo charged its customers.

The decision also protects the legality of cloud computing, DVR recordings, and other new technologies not directly related to the lawsuit. “We agree with the Solicitor General that “[q]uestions involving cloud computing, [remote storage] DVRs, and other novel issues not before the Court, as to which ‘Congress has not plainly marked [the] course,’ should await a case in which they are squarely presented,” Breyer wrote.

The court’s liberal wing shared Breyer’s opinion. Ruth Bader Ginsburg, Sonia Sotomayor and Elena Kagan all voted in favor of broadcasters including Walt Disney (ABC), Comcast (NBC), CBS Corp., and FOX.

Conservatives slammed the majority ruling against Aereo, claiming the court was bending over backwards for Hollywood and giant broadcasting conglomerates. Justice Antonin Scalia’s dissent ripped the majority’s ruling, claiming it would “sow confusion for years to come.” Scalia predicts there will be plenty of new litigation before the courts on issues related to online transmission of copyright works as a result of today’s decision.

Although Aereo was still pre-registering customers as of this afternoon, that isn’t likely to stay true for much longer. Aereo’s only bid to stay alive is to seek licensing agreements with the stations it distributes over its service. With broadcasters’ strengthened hand, it is unlikely they will be receptive to pricing agreements that would allow Aereo to continue providing service for $8 a month. Major cable and satellite operators are signing retransmission consent agreements with volume discounts that run above $1 a month per subscriber for each television station in a local area. In most cities, that would amount to at least $5 a month, but Aereo will likely face even higher costs because it lacks access to discounts.

[flv]http://www.phillipdampier.com/video/CNN Supreme Court rules against Aereo 6-25-14.mp4[/flv]

CNN attempts to explain the meaning of the Aereo case to its less-informed viewers with mixed success. But the story explains why this is relevant to cord cutters. (4:41)

[flv]http://www.phillipdampier.com/video/Bloomberg Supreme Court Rules Against Aereo in Landmark Case 6-25-14.flv[/flv]

Bloomberg News reports the Aereo case was a decisive victory for programmers who now have a strengthened hand asking for more compensation during retransmission consent negotiations with cable and satellite providers. (1:55)

[flv]http://www.phillipdampier.com/video/Bloomberg Aereo Ruling Gets Positive Response from Broadcasters 6-25-14.flv[/flv]

Broadcasters called today’s victory “pro-consumer” but that is open to debate. Bloomberg News digs deeper into what this case means for DVR and cloud storage services as well. (5:26)

[flv]http://www.phillipdampier.com/video/Bloomberg Aereo Violating Broadcaster Copyrights Stocks Up 6-25-14.flv[/flv]

Wall Street is rewarding big television networks and station owner groups with higher stock prices after winning a decisive victory against Aereo, Bloomberg reports. (2:35)

Subscribe

Subscribe

AT&T’s claim it wants to expand gigabit fiber to the home service to as many as 100 cities nationwide requires closer inspection on news this week it has slashed spending on its wireline business.

AT&T’s claim it wants to expand gigabit fiber to the home service to as many as 100 cities nationwide requires closer inspection on news this week it has slashed spending on its wireline business.

“Comcast Corp.’s bid to buy Time Warner Cable Inc. may be the opening act for a yearlong festival of telecommunications deals that would alter Internet, phone and TV service for tens of millions of Americans.” — Bloomberg News, May 14, 2014

“Comcast Corp.’s bid to buy Time Warner Cable Inc. may be the opening act for a yearlong festival of telecommunications deals that would alter Internet, phone and TV service for tens of millions of Americans.” — Bloomberg News, May 14, 2014

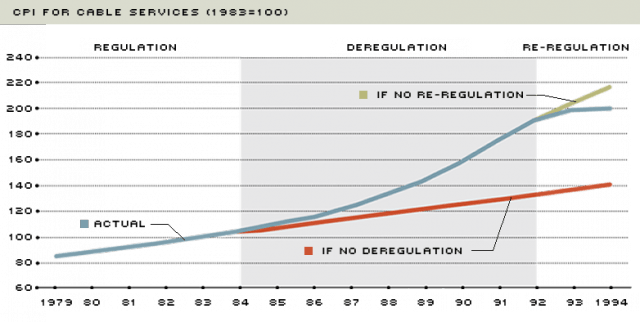

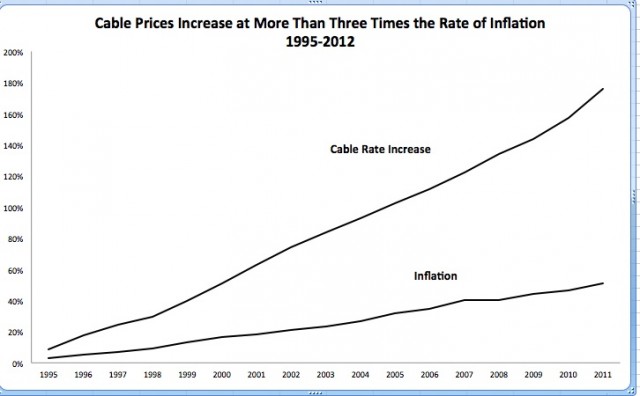

Economists reviewing data found in publicly available corporate balance sheets soon found evidence that the “increased programming costs”-excuse for rate increases did not hold water. The less competition or number of choices available to consumers in the market unambiguously lead to higher prices. It has remained true since Consumers’ Union

Economists reviewing data found in publicly available corporate balance sheets soon found evidence that the “increased programming costs”-excuse for rate increases did not hold water. The less competition or number of choices available to consumers in the market unambiguously lead to higher prices. It has remained true since Consumers’ Union  When a cable operator pays such an outrageous price, the previous owner is reaping the financial rewards of his monopoly power. The acquiring company can only pay such a high price by assuming that his monopoly power will allow him to continue to increase prices. Monopoly power is being bought and sold and borrowed against. The new cable operator, who has paid for market power, may insist that the debt he has incurred to obtain it is a real cost on his books. That may be correct in the literal sense (he owes someone that money) but that does not make it right, or the abuse of market power legal.

When a cable operator pays such an outrageous price, the previous owner is reaping the financial rewards of his monopoly power. The acquiring company can only pay such a high price by assuming that his monopoly power will allow him to continue to increase prices. Monopoly power is being bought and sold and borrowed against. The new cable operator, who has paid for market power, may insist that the debt he has incurred to obtain it is a real cost on his books. That may be correct in the literal sense (he owes someone that money) but that does not make it right, or the abuse of market power legal.