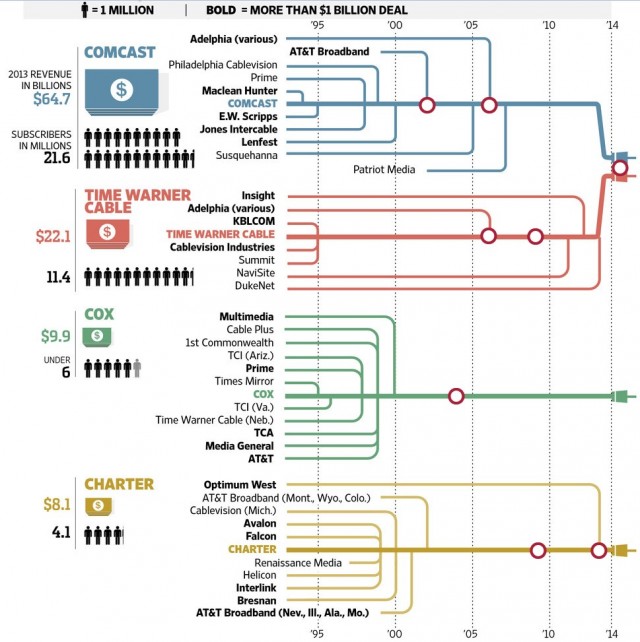

The announced merger of Comcast and Time Warner Cable is expected to have far-reaching implications for other companies in the video and broadband business, with expectations 2014 could be one of the busiest years in a decade for telecom industry mergers and buyouts.

The announced merger of Comcast and Time Warner Cable is expected to have far-reaching implications for other companies in the video and broadband business, with expectations 2014 could be one of the busiest years in a decade for telecom industry mergers and buyouts.

AT&T + DirecTV = Less Video Competition

Bloomberg News reports an announcement from AT&T that it intends to acquire DirecTV for as much as $50 billion could be forthcoming before Memorial Day. Such a merger would drop one satellite television competitor in AT&T landline service areas and promote nationwide bundling of AT&T wireless service with satellite television.

Historically low-interest rates would help AT&T finance such a deal and would turn DirecTV into a division of AT&T, easing concerns the satellite company has been at a disadvantage because it lacks a broadband and phone package.

“While the Comcast/TWC deal was the trigger, the backdrop of a slow macro economy, new competitors, shifts in technology and consumer habits all come together and force the need for more scale,” Todd Lowenstein, a fund manager at Highmark Capital Management Inc. in Los Angeles told Bloomberg.

Satellite television companies remain technologically disadvantaged to withstand the growing influence of online video and their subscriber numbers have peaked.

If AT&T buys DirecTV, the wireless giant could theoretically bundle its service with DirecTV’s video product, and in some areas of the country its U-verse high-speed broadband to the home, to compete with cable, said Amy Yong, an analyst at Macquarie Group in New York, in a note to clients.

Sprint + T-Mobile = Less Wireless Competition

Dish + T-Mobile = A Draw

In a less likely deal Sprint is still trying to pursue T-Mobile USA for a potential merger and if regulators reject that idea, Charles Ergen’s Dish Network is said to be interested.

In a less likely deal Sprint is still trying to pursue T-Mobile USA for a potential merger and if regulators reject that idea, Charles Ergen’s Dish Network is said to be interested.

To prepare Washington for another telecommunications deal, SoftBank founder Masayoshi Son’s lobbying firm, Carmen Group, has again been meeting with elected officials and regulators to argue the merits of a merger with T-Mobile, according to a person familiar with the matter.

Dish, which failed to buy Sprint last year, would be interested in acquiring T-Mobile if regulators block Sprint’s efforts, Ergen said. That hinges on whether SoftBank Corp. fails to win regulatory approval for its plan to buy T-Mobile, which is controlled by Deutsche Telekom AG, Ergen said last week. The Japanese wireless company owns 80 percent of Sprint.

All three deals carry a combined value of $170 billion in equity and debt and would impact 80 million Americans.

Suitors hope regulators will be in the mood to approve merger deals as they contemplate enlarging Comcast through its purchase of Time Warner Cable.

Even if all the deals don’t pass muster, Wall Street banks will still rake in millions in fees advising players on how to structure the deals. Goldman Sachs and J.P. Morgan would join executives winning considerable sums for reducing the number of competitors providing telecommunications services in the U.S.

Whether customers would benefit is a question open to much debate.

Subscribe

Subscribe

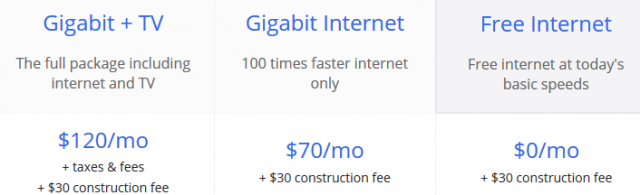

Despite years of arguments from telecom companies that residential customers don’t need or want super-fast broadband speeds, the people of Kansas City think otherwise.

Despite years of arguments from telecom companies that residential customers don’t need or want super-fast broadband speeds, the people of Kansas City think otherwise.

If Bernstein’s research holds true in other markets, Google Fiber could eventually become a serious competitive threat to both cable and telephone companies, depending on how quickly they expand. Google Fiber is also likely to become a profitable service for the search engine giant, despite the high initial expense of wiring communities for fiber optics.

If Bernstein’s research holds true in other markets, Google Fiber could eventually become a serious competitive threat to both cable and telephone companies, depending on how quickly they expand. Google Fiber is also likely to become a profitable service for the search engine giant, despite the high initial expense of wiring communities for fiber optics. AT&T has approached DirecTV about a possible acquisition of the satellite provider in a deal expected to fetch at least $40 billion, spare change for AT&T’s $185 billion operation.

AT&T has approached DirecTV about a possible acquisition of the satellite provider in a deal expected to fetch at least $40 billion, spare change for AT&T’s $185 billion operation. DirecTV’s growth has fallen every year since 2010 and starting in 2013, the company began losing more subscribers than it signed up.

DirecTV’s growth has fallen every year since 2010 and starting in 2013, the company began losing more subscribers than it signed up.