TiVo Roamio DVR

The newest entry in the should-be-more-competitive world of Digital Video Recorders (DVRs) might have gotten five stars from reviewers willing to play down the device’s asking price, but the biggest hurdle of all isn’t its cost, it is the complexity of getting it to work properly with your cable provider.

TiVo’s new Roamio was designed to declutter your viewing experience. It’s a DVR that can record shows you missed, an online video device that can stream content from Netflix, Hulu Plus, Amazon Instant Video, Spotify, Pandora and YouTube right on your television, and perhaps most powerful of all — it will soon stream it all to you on any mobile device located anywhere there is an Internet connection.

That puts TiVo’s Roamio well ahead of the behind-the-times set-top boxes and DVRs rented out by the cable company. Customers have clamored for a device that can properly record scheduled programs and allow those recordings to be viewed anywhere the customer wants to watch. Comcast’s box doesn’t work that way. Neither do boxes from Time Warner Cable, Cox, Bright House, and the rest.

Cue the lawyers.

Cue the lawyers.

The reason these common sense portability features are not available on the box you rent in perpetuity from the cable company is that programmers won’t allow it and many pay television providers don’t consider it a priority. Time Warner Cable only recently filed a patent to deliver customer-recorded content to portable devices. The patent application is an exercise to placate litigious programmers that cannot sleep nights knowing someone is offering a service they failed to monetize for themselves through licensing agreements. Feel the legal fees piling up:

“Because of the increasing popularity of home networking, there is a growing need for a strategy that enables a user to perform authorized transfer of protected content, e.g., transferring content from an STT [set-top terminal] to a second device in a home network, and at the same time prevents unauthorized distribution of the protected content,” Time Warner writes in its patent application.

While TiVo is selling a device that allows consumers to record programming for private viewing purposes, a cable operator with deep pockets that only rents DVRs cannot do likewise.

The Roamio comes in three versions, none of which are compatible with satellite television services:

- Roamio Pro ($600): Six tuners allow customers to record up to six shows at one time and has storage capacity for 450 hours of HD programming. Includes built-in Wi-Fi. Stream TV to mobile iOS devices coming soon (as is Android support);

- Roamio Plus ($400): Same as above except storage capacity is 150 hours of HD programming;

Roamio ($200): Four tuner basic version omits built-in streaming to mobile devices but can record four shows at once and store 75 hours of HD programming. A good choice for cord-cutters as it includes an over-the-air broadcast television antenna input.

- All Roamio devices require TiVo service, which costs $15 a month or $500 for a lifetime subscription. All boxes support external hard drives with an eSATA interface to backup or store more recordings. All Roamio devices support 1080p and Dolby Digital 5.1 sound.

This Comcast DVR is only available for rent.

In contrast, cable operator-provided DVR service can often add $20 a month to your cable bill… forever. But is there real value for money paying TiVo $15 a month (or a $500 payment for the life of the device) for “service” on top of hardware that can cost up to $600?

TiVo thinks so: “Once you bring together all your favorite shows, movies and music into one place, you’ll wonder how you ever lived without it.”

Unfortunately, getting there is one heck of a battle according to Bloomberg’s Rich Jaroslovsky, who got his hands on a test unit that simply refused to get along well with Comcast.

“The cable industry is standing in the way,” Jaroslovsky writes.

That may not be surprising, considering the lucrative business of renting DVR equipment to customers eager for time-shifting and commercial-skipping. The cable company’s concept of DVR service includes a set-top box, decoder, and recording unit into one, relatively simple integrated device.

TiVo’s persistent monthly “service fee” as well as a steep purchase price made marketing the cable company’s “no-purchase-required” DVR easy, and the cable industry quickly won the lion’s share of the DVR business. Another strong argument in favor of the cable company’s DVR is the lack of a complicated set up procedure to get competing devices to reliably work with the cable company’s set-top box.

Motorola’s M CableCARD

Thanks to Comcast and other cable companies, setting up Roamio managed to confound even a tech reporter like Jaroslovsky, and Comcast was not much help.

The Roamio requires a CableCARD, a plug-in card-sized version of the cable company’s set-top box, to unlock digital cable channels.

The CableCARD was Congress’ attempt in the 1996 Telecom Act to give consumers an option to avoid costly and unsightly set-top boxes. Originally envisioned as a plug-in device that would offer “cable-ready” service without a set-top box in future generations of televisions, the CableCARD never really took off. The cable industry opposed the devices and dragged its feet, preferring to support its own set-top boxes. The CableCARD that eventually did emerge was initially often difficult to obtain and had huge limitations, such as one-way-only access which meant no electronic program guide, no video-on-demand, and no access to anything that required two-way communications between the card and the cable company. Newer CableCARDs do offer two-way communications and support today’s advanced cable services.

The only place most cable operators mention the availability of the CableCARD in detail is in a federally mandated disclosure of pricing, services, and a consumer’s rights and responsibilities — usually provided in a rice-paper-thin, tiny-print leaflet included with your bill once a year, if you still get one in the mail.

Roamio is likely to frighten technophobes right from the start with this important notification:

CableCARDs are made by one of four manufacturers: Motorola, Scientific Atlanta/Cisco, NDS, or Conax. You need one multi-stream CableCARD (M-card). Single-stream CableCARDs (S-cards) are not compatible.

“That costs an extra $1.50 a month from Comcast, and in my case, required three trips to its nearest office because the first card didn’t work,” Jaroslovsky writes.

On the second trip, Comcast handed him two cards in the hope at least one would work, requiring one last trip to return the card that didn’t.

Time Warner Cable and certain other cable operators use Switched Digital Video, incompatible with the Roamio without a Digital Tuning Adapter, available from the cable company.

The second hurdle was to get Comcast to recognize and authorize that CableCARD. Comcast’s technical customer support staff was lacking. Jaroslovsky found his call bounced from department to department attempting to authorize the card and diagnose why it simply refused to work at first.

After finally overcoming those problems, Jaroslovsky discovered he was out of luck getting Roamio to stream premium movie channels like HBO and Cinemax. The encryption system Comcast supports prohibits streaming the movie networks outside of the home. The Slingbox works around the issue by bypassing the encryption system’s permission settings with extra cables between it and your cable box.

Time Warner Cable subscribers will need still another piece of equipment — a Tuning Adapter compatible with Switched Digital Video (SDV). To conserve bandwidth, cable companies like Time Warner limit certain digital channels being sent to each neighborhood unless someone is actively watching.

Before you can view or record a program on an SDV channel, your box must be able to send channel requests back to the cable headend. Roamio is a one-way device and cannot send the required channel requests. Cable providers who have deployed SDV technology will provide a Tuning Adapter to customers who have HD TiVo boxes. A Tuning Adapter is a set top box that provides two-way capabilities, so your box can request SDV channels. There are two Tuning Adapter brands: Motorola and Cisco. Motorola CableCARDs work with Motorola Tuning Adapters. Scientific Atlanta and NDS CableCARD work with Cisco Tuning Adapters. Without the Tuning Adapter, a Roamio user will find error messages on several digital channels indicating they are “temporarily unavailable.”

Other cable operators offer varying support for Roamio. Cablevision has been learning how to support the device along with customers. Prior customer experiences make it clear front-line service representatives are not going to be very helpful managing the technical process to properly configure, update, and authorize CableCARD technology for the new TiVo device, so prepare to have your call transferred to one or more representatives.

After all this, Jaroslovsky was finally watching his Comcast cable channels, able to access on-demand services, and found TiVo’s interface and program guide more satisfying than the one offered on Comcast’s DVR.

Roamio Plus and Pro have built-in support for video streaming away from home that will be fully enabled this fall.

Jaroslovsky found in-home streaming smooth and satisfying. Programs launched quickly and looked terrific on an iPad with Apple’s high-resolution Retina display, with none of the blockiness or stuttering sometimes associated with streaming video.

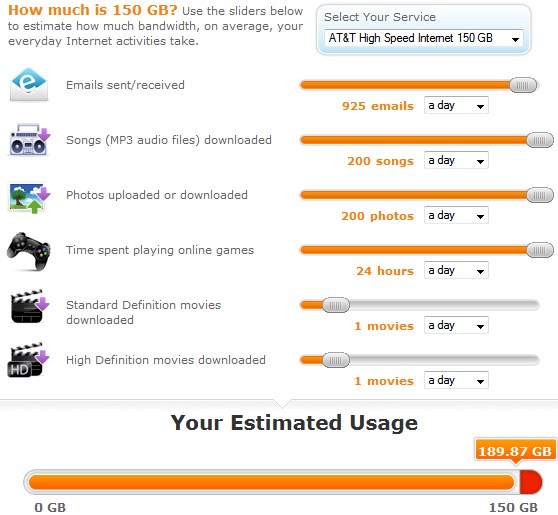

His review unit allowed him to test streamed programming outside of the home and video quality on the go was much more variable. The current software prohibits video streaming on AT&T’s 4G LTE network, a problem with a resolution now in the works. Public Wi-Fi hotspots often delivered poor performance, even when they could supply up to 2Mbps. Blurred pictures and pixel blocks often broke up the video on slow Internet connections. A faster connection supporting more than 10Mbps is capable of delivering a better viewing experience, especially if that connection comes without usage caps.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/TiVo Roamio DVR Demo Video 8-19-13.flv[/flv]

An introduction and demo of the TiVo Roamio DVR, produced by TiVo. (3 minutes)

This article was updated with a clarification about Tuning Adapters, required by some cable operators using Switched Digital Video. Thanks to reader Dave Hancock for helping clear things up.

Gizmodo just did the math for those intending to spend a weekend watching the entire second season of the made-for-Netflix series in high-definition:

Gizmodo just did the math for those intending to spend a weekend watching the entire second season of the made-for-Netflix series in high-definition:

Subscribe

Subscribe

$6.99 a month for one stream (SD only);

$6.99 a month for one stream (SD only); For Netflix, the increased revenue that can be earned by charging different rates for concurrent streams might prove a win-win proposition because many lurkers may be unwilling to buy their own account.

For Netflix, the increased revenue that can be earned by charging different rates for concurrent streams might prove a win-win proposition because many lurkers may be unwilling to buy their own account.

Cue the lawyers.

Cue the lawyers.

Pay television providers forced Al Jazeera to remove or block its online video content from American viewers in return for launching its new news channel on cable systems this week.

Pay television providers forced Al Jazeera to remove or block its online video content from American viewers in return for launching its new news channel on cable systems this week.

Time Warner Cable won’t engage in an expensive bidding war for ownership of Hulu so it is trying to convince the online video venture’s current owners not to sell.

Time Warner Cable won’t engage in an expensive bidding war for ownership of Hulu so it is trying to convince the online video venture’s current owners not to sell. Hulu’s new owners could continue to offer the service much the same way it is provided today, with a free and pay version. But most expect the new owners will throw up a programming “pay wall,” requiring users to authenticate themselves as a pay television customer before they can watch Hulu programming. If Time Warner Cable acquired a minority interest and the current owners stayed in place, Time Warner Cable TV customers could benefit from free access to certain premium Hulu content, now sold to others for $8 a month. That premium content would presumably be available to U-verse customers if AT&T emerges the top bidder, or DirecTV could offer Hulu to satellite subscribers to better compete with cable companies’ on-demand offerings.

Hulu’s new owners could continue to offer the service much the same way it is provided today, with a free and pay version. But most expect the new owners will throw up a programming “pay wall,” requiring users to authenticate themselves as a pay television customer before they can watch Hulu programming. If Time Warner Cable acquired a minority interest and the current owners stayed in place, Time Warner Cable TV customers could benefit from free access to certain premium Hulu content, now sold to others for $8 a month. That premium content would presumably be available to U-verse customers if AT&T emerges the top bidder, or DirecTV could offer Hulu to satellite subscribers to better compete with cable companies’ on-demand offerings. The Los Angeles Times reports that pay TV distributors are in a rush to make deals, not only to offer more viewing options for customers, but to potentially get rid of expensive and cumbersome set-top boxes.

The Los Angeles Times reports that pay TV distributors are in a rush to make deals, not only to offer more viewing options for customers, but to potentially get rid of expensive and cumbersome set-top boxes.