The new CEO of Frontier Communications is promising more fiber to the home service and advanced ADSL2+ and VDSL2 service to dramatically boost Internet speeds… if you happen to live in a Verizon territory Frontier is planning to acquire in Texas, California, or Florida. For Connecticut customers that used to belong to AT&T, Frontier also plans to spend money to further build out AT&T’s U-verse platform to reach more suburban customers not deemed profitable enough to service by AT&T.

The new CEO of Frontier Communications is promising more fiber to the home service and advanced ADSL2+ and VDSL2 service to dramatically boost Internet speeds… if you happen to live in a Verizon territory Frontier is planning to acquire in Texas, California, or Florida. For Connecticut customers that used to belong to AT&T, Frontier also plans to spend money to further build out AT&T’s U-verse platform to reach more suburban customers not deemed profitable enough to service by AT&T.

For legacy Frontier customers in other states? Frontier plans nothing beyond what it already provides — usually dismally slow DSL.

Speaking to investors during the JP Morgan Global Technology, Media and Telecom Conference, Frontier CEO Daniel McCarthy said upgrades offer the company new earnings opportunities, but a closer analysis reveals those benefits will only reach customers in areas where Verizon and AT&T already did most of the work and spent the money required to build advanced network infrastructure.

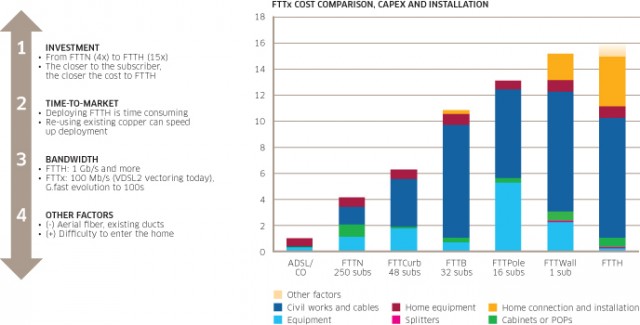

Verizon has spent millions upgrading customers in Texas to its FiOS service and has a significant fiber to the home presence in California and Florida. Because fiber infrastructure is already largely in place, Frontier will not have to spend huge sums to build a new network. Instead, it will spend incrementally to expand service to nearby service areas.

Mediocre broadband in upstate New York.

“The FiOS penetration is much higher, specifically in Texas, but we think there’s a lot of opportunity to drive FiOS penetration in Florida and California,” McCarthy said. “We see that as a big opportunity.”

Fierce Telecom notes Frontier won’t have to make a large investment outside of installing new DSLAMs in remote terminals or local Central Offices to deliver higher speeds over copper. Frontier will likely depend on VDSL2 technology on short copper line lengths in suburban areas and ADSL2+ in rural locations.

“I think in this case it might be replacing some electronics, but it’s not a heavy lift from a construction perspective,” McCarthy said. “By putting in a shelf and next-generation capabilities, whether it’s VDSL, ADSL2+, or all the different flavors you can use to serve the different loop lengths in a market you achieve the ability to bring a fresh product set into an area at a fairly low cost.”

While Frontier is willing to invest money in areas that are easy to upgrade, it has proven itself reluctant to consider major upgrades in its legacy service areas where it acquired traditional copper-based landline networks.

“The new states will clearly have new growth opportunities,” McCarthy said. “In Florida there has been a revival of housing in certain areas and subdivision growth in Texas and California.”

In Connecticut, Frontier will build on the acquired AT&T fiber/copper network with a modest expansion of U-verse.

“We actually see growth opportunity in Connecticut,” McCarthy said. “As we go through and look at the Connecticut property, one of the things that have been a recent development from a technology perspective allows us to serve lower density parts of the state of Connecticut with U-verse product that was limited by densities and loop lengths in the past.”

“We actually see growth opportunity in Connecticut,” McCarthy said. “As we go through and look at the Connecticut property, one of the things that have been a recent development from a technology perspective allows us to serve lower density parts of the state of Connecticut with U-verse product that was limited by densities and loop lengths in the past.”

Although the company often touts millions in upgrade investments, most legacy service areas see only modest service improvements, while the company continues to score very poor in customer satisfaction, especially in states like West Virginia, Ohio, Pennsylvania and New York. With Frontier’s ongoing focus on newly acquired service areas, long-standing customers in other states are feeling neglected.

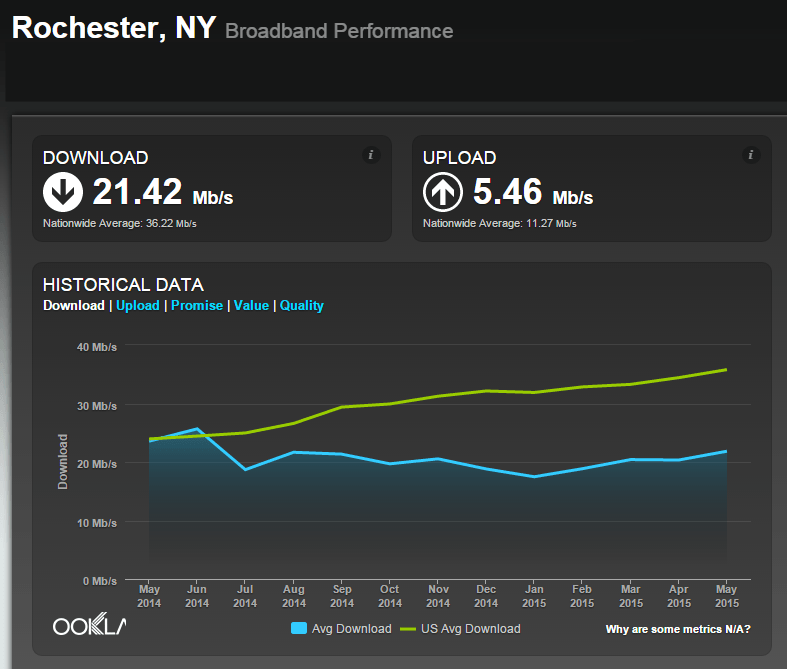

In upstate New York, the prevalence of Frontier Communications’ low speed DSL on the company’s legacy copper network has dragged down overall broadband speed ratings to some of the lowest in the country. Frontier territory Rochester, N.Y., in particular, is now among the worst cities in the northeast for overall broadband speed performance, now rated at just 21.42Mbps. The national average is 36.22Mbps. In comparison, Buffalo scores 24.31Mbps, Cleveland: 22.57Mbps, and NYC 55.56Mbps.

Subscribe

Subscribe A Wall Street research firm is asking questions about the “mixed messages” AT&T is sending consumers over its broadband offerings.

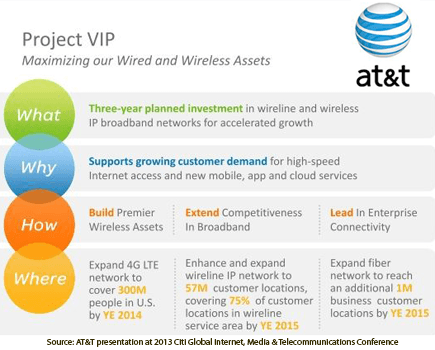

A Wall Street research firm is asking questions about the “mixed messages” AT&T is sending consumers over its broadband offerings. AT&T says it intends to boost part of its Project VIP footprint to 75Mbps or 100Mbps with VDSL2 vectoring, but the extent of this is unknown. It has also deployed a small amount of GPON FTTH in greenfield markets, typically designed to support 80–100Mbps to each household. Also as part of Project VIP, it plans to reach 1 million businesses with symmetric 1Gbps FTTH.

AT&T says it intends to boost part of its Project VIP footprint to 75Mbps or 100Mbps with VDSL2 vectoring, but the extent of this is unknown. It has also deployed a small amount of GPON FTTH in greenfield markets, typically designed to support 80–100Mbps to each household. Also as part of Project VIP, it plans to reach 1 million businesses with symmetric 1Gbps FTTH.

AT&T U-verse customers hoping for speeds faster than 24Mbps may have significant hurdles to overcome to qualify for a speed boost up to 45Mbps.

AT&T U-verse customers hoping for speeds faster than 24Mbps may have significant hurdles to overcome to qualify for a speed boost up to 45Mbps.