Haven't we been here before?

History is best ignored when a Wall Street Journal columnist frames an argument in favor of strengthening the hegemony of Ma Bell, and darn ‘ole past precedent gets in the way of the writer’s “facts.”

Gordon Crovitz is a media and information industry adviser and executive, including former publisher of The Wall Street Journal, executive vice president of Dow Jones and president of its Consumer Media Group. But today he’s unofficially, unabashedly AT&T.

In a column published this week, Crovitz hosts a whine and cheese festival on behalf of poor and abused AT&T, whose multi-billion dollar takeover of T-Mobile is in tatters. Crovitz places the blame squarely on the government for ruining everything:

How soon we forget the risks of overregulation: Last week, the Federal Communications Commission flexed the same muscle it once used to quash market forces in the phone industry to quash market forces in the wireless industry.

Today’s AT&T, a spinoff from the original, needs more spectrum to catch up with market leader Verizon, also a Ma Bell descendant, to support iPhones, Androids and other devices that feature video and sophisticated apps. It wants to buy T-Mobile, a division of a German company, which doesn’t have the resources to compete in the United States on its own. But the FCC decided to apply antitrust theory from the industrial era and claims to know better than wireless companies how they should operate their businesses.

AT&T’s proposed acquisition is best understood as a private-sector solution to a government-created problem. The FCC has not been able to get Congress to approve auctions to reallocate spectrum to wireless from less valuable uses. AT&T wants T-Mobile’s bandwidth so it can extend the latest fourth-generation network to 97% of the country from 80% and improve its spotty service in congested areas.

Under laws dating to the 1920s, the FCC gets to decide if a merger is in the “public interest,” a vague standard for top-down decision making. Government is the last institution in this era of fast technological innovation to act as if it has the information and power to dictate how change happens.

Crovitz apparently prefers AT&T and its phone pal Verizon Wireless dictate how “change happens,” because the two companies control the vast majority of wireless telecommunications in the United States. Both also charge near-identical prices for near-identical levels of service. AT&T & VZW are completely comfortable with that status quo, especially if disruptive competitor T-Mobile is dealt with in the usual industry manner (merger/buyout).

Crovitz apparently prefers AT&T and its phone pal Verizon Wireless dictate how “change happens,” because the two companies control the vast majority of wireless telecommunications in the United States. Both also charge near-identical prices for near-identical levels of service. AT&T & VZW are completely comfortable with that status quo, especially if disruptive competitor T-Mobile is dealt with in the usual industry manner (merger/buyout).

There is nothing vague about the FCC report that condemns the merger of AT&T and T-Mobile for the anti-competitive monstrosity it represents. In hundreds of pages Crovitz evidently never read, a careful and credible argument against the deal was laid out for all to examine. That evidence is far more persuasive than AT&T’s heavily-redacted filings the public was not authorized to see (for ‘competitive reasons’), and a multi-million-dollar-a-holler public relations distortion strategy based on hollow promises.

Playing Catch-Up With Verizon Wireless? Hardly.

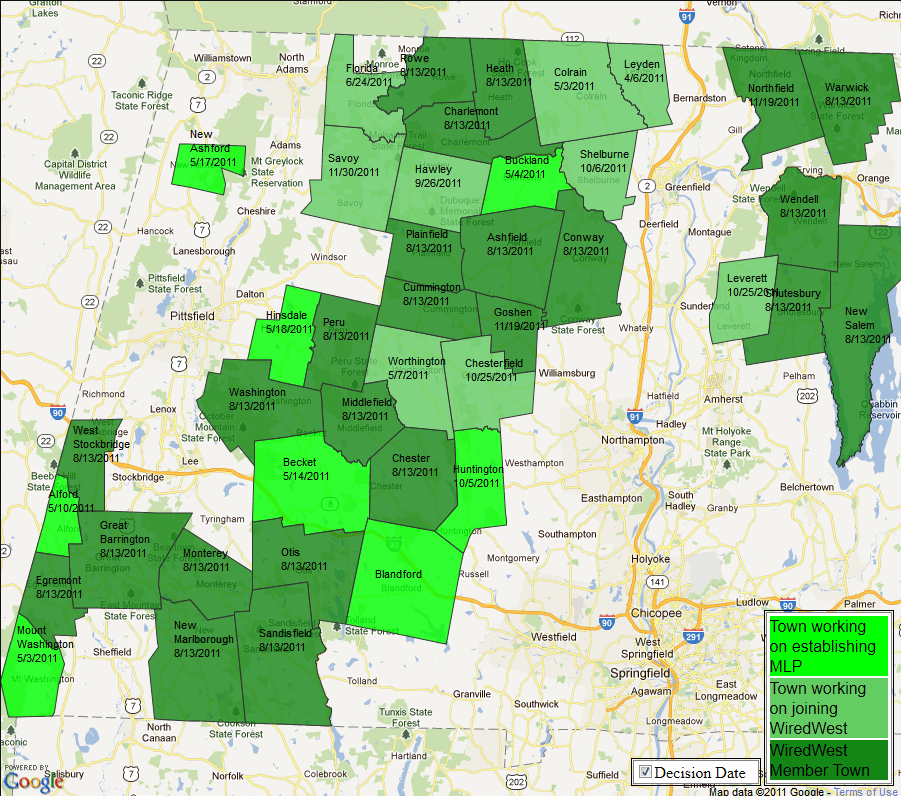

AT&T hardly needs to “catch up” with Verizon Wireless. Both companies own wireless spectrum they have warehoused for “future use.” As a backdrop to the merger, FCC Chairman Julius Genachowski has already indicated the agency is hard at work carefully re-allocating spectrum to make more room for wireless services. The “bandwidth crisis” AT&T talks about is a convenient argument for a merger, until you realize T-Mobile’s mostly-urban wireless network won’t help AT&T achieve its goal of rural wireless expansion. T-Mobile has never provided service in rural America and never will.

Crovitz attempts to leverage Verizon Wireless’ recent deal with America’s largest cable companies as an argument for the AT&T and T-Mobile merger, suggesting that deal was a game changer. What goes unsaid is the fact AT&T could have pursued that deal for themselves. Did they? No. Despite AT&T’s public relations spin, the proposed merger with T-Mobile is much more than a spectrum acquisition. As the FCC and the Justice Department have argued, this merger is about ridding AT&T of a competitor willing to offer more services at lower prices. That forces AT&T to respond in kind to compete, and consumers have benefited greatly from that competition. Verizon Wireless is hardly competition at all considering both companies price services nearly identically. Beyond that is Sprint, already saddled with the financial albatross Clearwire and questions about its long term viability in a duopolistic wireless market.

Crovitz is wrong on his other “facts” as well:

Deutsche Telekom is hardly short on cash. The company has plenty of resources and could bolster T-Mobile USA to compete if it saw fit. It doesn’t, preferring to focus on its more lucrative European markets. Instead of selling the operation on the open market to other players, which could include foreign providers interested in competing in the high-priced American market, it elected to be courted by AT&T.

Overconfident AT&T

Henry De Lamar Clayton, Jr.: Author of the Clayton Act

The merger illustrates AT&T’s unparalleled level of overconfidence it could deal with regulators and consumer groups who would certainly object to the deal. The company has since spent millions it could have used to improve its network on campaign-contribution-fueled support building on Capitol Hill, a shameless dollar-a-holler astroturf campaign that pays off non-profit groups to sing the deal’s praises, and an expensive ad campaign to sucker Americans into thinking reduced competition will somehow deliver lower prices and better service.

Even former Republican FCC Chairman Kevin Martin would have likely paused over such an obvious monopoly-building operation. The Obama Administration’s FCC chairman — Julius Genachowski — while often too timid for our tastes, at least knows when it is time to join the chorus of opposition.

The FCC doesn’t pretend to tell AT&T how to run its business. It does, however, serve the public interest by providing checks and balances to unfettered corporate power. While the Wall Street Journal‘s world view of capitalism would have been favored by the most egregious robber barons, history has taught us that when big corporations get a stranglehold on vital industries, the entire economy can suffer.

Crovitz would have us ignore the massive corporate abuses of 100 years ago that eventually provoked Congress into trust-busting legislative reform, breaking up the monopolies and oligopolies that presided over the railways, early telecommunications networks, and industrial raw materials like oil and steel. Restrained competition brought monopoly prices and blockades against would-be competitors. What was true then is still true now, only the technology has changed.

In 1911, the economy was powered in part by railroads, which transported goods and raw materials. Telecommunications networks like the telegraph and early telephone helped conduct business and coordinated the movement of goods. In 2011’s growing digital economy, telecommunications increasingly represents the railroads, telegraph, and telephone all combined-into-one. Some of America’s richest tech companies depend on broadband and communications to fuel demand for their products. Allowing AT&T to control the largest part of that pipeline could be disastrous to everyone but that company and their shareholders.

History Repeats Itself

In 1914, the Clayton Act was passed to put a stop to increasing anti-competitive activity and abusive market tactics. Amazingly, the problems being solved a century ago are back with a vengeance today, all thanks to the endless drumbeat for deregulation, which has fueled mergers, acquisitions, and increased concentration of market power. That Act cracked down on:

- Price discrimination: selling products and services at different prices to similarly situated buyers;

- Tying and exclusive-dealing contracts: sales on condition that the buyer sign exclusive contracts that force an end to dealing with the seller’s competitors;

- Corporate mergers: acquisitions of competing companies to reduce competition; and

- Interlocking directorates: Boards of directors of competing companies, packed with common members.

Today’s laissez-faire attitude towards government checks and balances helped provoke the Great Recession, corporate scandals of epic proportions, and a revolving door in Washington where regulators end up working for the companies they used to regulate. Just ask former FCC chairman Michael Powell. Three years ago he worked for us. Today he works for Big Cable’s largest lobbying group — the National Cable & Telecommunications Association. FCC Commissioner Meredith Attwell Baker went to work for Comcast shortly after green-lighting their super-merger with NBC-Universal.

Today’s laissez-faire attitude towards government checks and balances helped provoke the Great Recession, corporate scandals of epic proportions, and a revolving door in Washington where regulators end up working for the companies they used to regulate. Just ask former FCC chairman Michael Powell. Three years ago he worked for us. Today he works for Big Cable’s largest lobbying group — the National Cable & Telecommunications Association. FCC Commissioner Meredith Attwell Baker went to work for Comcast shortly after green-lighting their super-merger with NBC-Universal.

It’s All About the Money. Always.

The only thing stopping AT&T from providing wireless nirvana to rural America is its own unwillingness to spend money on behalf of customers to upgrade its network. The company claims it didn’t see the value of spending nearly $4 billion needed to deliver expansive 4G service, but suddenly had no trouble at all finding nearly ten times that amount to purchase T-Mobile USA.

Did AT&T suddenly win PowerBall?

AT&T saw crushing a competitor Job #1. Central Idaho’s 4G service could wait.

Crovitz later notes AT&T “was unusually blunt” criticizing the FCC report, a classic case of protesting too much. The company got caught with its rhetorical pants down, with a series of evolving arguments for a deal that never made the first bit of sense once you began to dig deeper into their case.

In the end, Mr. Crovitz wants you to blame Big Government for AT&T’s pervasive dropped-call problem that its competitors don’t seem to have.

It’s not the company that owns and runs the network, it is that Obama and his nasty henchmen at the FCC who are responsible! Who knew?

[flv width=”360″ height=”290″]http://www.phillipdampier.com/video/Bloomberg FCC Says ATT Failed to Show Public Benefit of Merger 11-30-11.mp4[/flv]

Bloomberg News reports the FCC found AT&T failed to demonstrate any real public benefit of its merger with T-Mobile USA. (2 minutes)

Subscribe

Subscribe