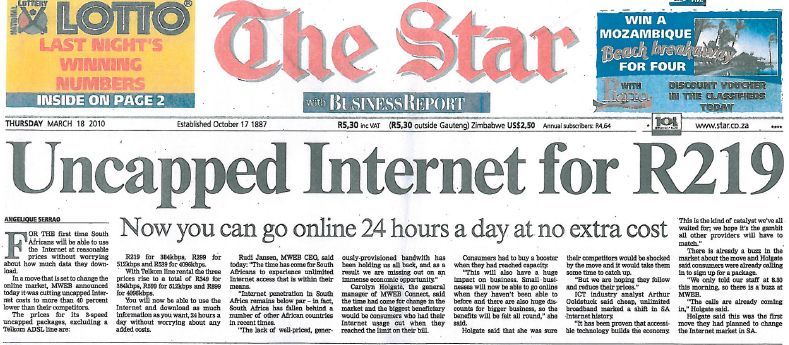

South Africans won uncapped broadband service one year ago tomorrow when an upstart provider — MWeb — unveiled its “Free the Web” campaign, delivering usage-limit free Internet access to customers across South Africa.

South Africans won uncapped broadband service one year ago tomorrow when an upstart provider — MWeb — unveiled its “Free the Web” campaign, delivering usage-limit free Internet access to customers across South Africa.

The company’s move to unlimited, flat rate service was heavily criticized by competing providers, who enforce draconian usage limits and have tried to convince customers the global trend was moving towards metered broadband. But MWeb president Rudi Jansen dismisses the notion limiting broadband is the way to go, suggesting usage caps and meters are more about profits than serving customers.

Today, MWeb’s uncapped broadband is a runaway success, with more than 50 percent of its customers switching to the meter-free service. It has been profitable, too.

“We are running ahead of our business plan and all our products are profitable,” Jansen tells TechCentral.

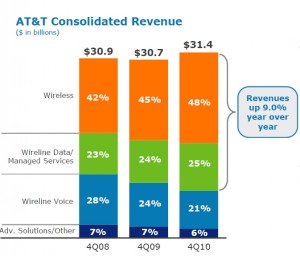

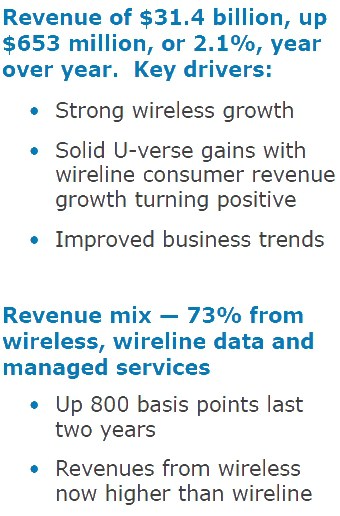

Now the nation’s semi-privatized, 39% state-owned phone company Telkom is widely expected to stop the erosion of its own broadband customers by adopting flat rate broadband service itself.

For Jansen, that would represent a welcome move. The Internet visionary wants to transform South African broadband away from its current expensive pricing model and throw the Internet wide open.

“I’m looking forward to it,” Jansen says. “The sooner they launch it the better.”

South African broadband has coped with challenges few other countries endure. International connectivity has always been one of the biggest — sustaining traffic on satellite backbone links or underpowered undersea cables first forced providers to limit Internet use because of capacity concerns. But new fiber-based underseas cables from Seacom and Wacs, including the forthcoming 5.1Tbps West African Cable System project will dramatically increase capacity and slash costs.

Yet several of his competitors want to keep the caps on and prices high, earning lucrative profits on a service Jansen says is becoming less costly to deliver every day.

Jansen admits MWeb is currently forced to traffic shape certain activities on his network, particularly bandwidth-intensive peer to peer traffic, because other providers in the country don’t agree with his wide-open view of the Internet.

He wants every provider in South Africa to agree to “open peering,” a practice that allows providers to exchange traffic with each other without charging transit fees. He also wants to see wholesale mobile wireless pricing come down. In Africa, mobile broadband has a strong place in a market where cable infrastructure (and broadband speed) is often lacking.

Telkom, South Africa’s equivalent to AT&T or Bell, is cited by Jansen as the biggest impediment to his plan to deliver truly unfettered, unlimited access.

In South Africa, broadband customers pay two providers — Telkom for the monthly rental of the telephone line and an ISP for the DSL service that connects through it. Jansen says Telkom’s broadband line rental prices are too high. But more importantly, the interconnection fee Telkom charges providers to access its network is “absolutely ludicrous.”

“Those prices are far more than the price of international connectivity,” Jansen says. “Telkom charges us to get access to their last mile and then charges end users to get access to the same last mile, so they make double money on it. And it’s completely mispriced.”

Despite the challenges from other providers, MWeb will celebrate the first anniversary of uncapped broadband tomorrow with a surprise announcement, probably targeting small business clients.

Subscribe

Subscribe