Lawrence, Kansas is a unique place to live. Its local newspaper, the Lawrence Journal-World, was one of the first in America to begin an online edition in 1995. Its owner, The World Company, just so happens to also own the independent cable system serving the community, which also provides broadband and phone service to the city’s 90,000 residents. Its biggest competitor is AT&T, which has been upgrading parts of Lawrence with its U-verse system to stay competitive.

Lawrence, Kansas is a unique place to live. Its local newspaper, the Lawrence Journal-World, was one of the first in America to begin an online edition in 1995. Its owner, The World Company, just so happens to also own the independent cable system serving the community, which also provides broadband and phone service to the city’s 90,000 residents. Its biggest competitor is AT&T, which has been upgrading parts of Lawrence with its U-verse system to stay competitive.

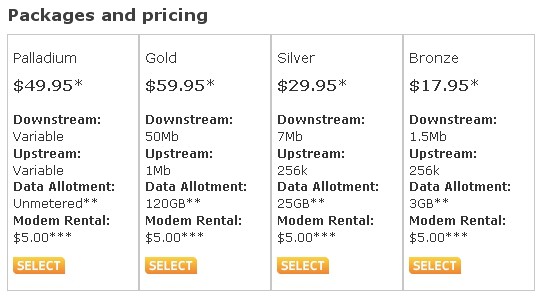

Sunflower Broadband, which provides a “triple play” package of Internet, cable TV and telephone service, has remained controversial among service providers because it instituted an Internet Overcharging scheme with usage caps and overlimit fees. The company has been used by the American Cable Association, a trade and lobbying group serving independent cable operators, as a poster child for effective rationed broadband schemes that reduce demand and increase broadband profits.

Lawrence, Kansas

Customers generally have loathed usage caps, particularly when they were stuck choosing between Sunflower’s faster, usage capped broadband service or a low speed DSL product from AT&T. Stop the Cap! receives more complaints about Sunflower Broadband than any other provider, except Time Warner Cable during its own Internet Overcharging experiment in April 2009. Lawrence residents appreciate the relatively fast speeds Sunflower can provide, but complain they can’t get much use from a service that limits customers to a set allowance and then bills them up to $2 per gigabyte in overlimit penalties when they exceed them.

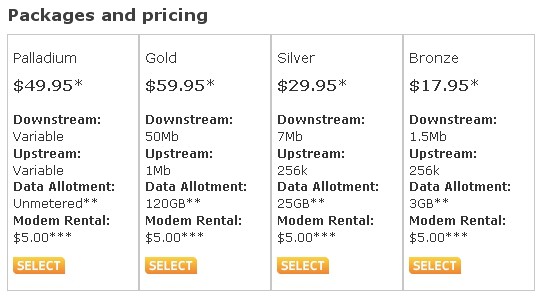

Last fall, things started to change in Lawrence as AT&T began offering it’s U-verse service in parts of the community. We began receiving e-mail from Lawrence residents pondering a new service plan Sunflower Broadband introduced — Palladium, an unmetered broadband option priced at $49.95 per month. It sounded like a good deal, perhaps introduced to protect them from U-verse customer poaching, until they noticed Sunflower was selling the plan without a fixed downstream or upstream speed. In fact, no speed was mentioned at all. Indeed, Sunflower’s Palladium is nothing new to those living abroad under various cap ‘n tier broadband regimes. It’s comparable to New Zealand Telecom’s Big Time plan, where customers need not fear overlimit fees and penalties, but have to live with a “traffic management” scheme that gives priority to customers on other plans living under a usage cap.

In other words, Palladium customers get last priority on Sunflower’s network. If the network is not congested, these customers should enjoy relatively fast connections. But during primetime, expect speeds to drop… and dramatically so according to customers writing us.

Sunflower Broadband's Internet pricing - add $10 if you want standalone service

That customers debate just how slow those speeds can get testify to the nature of cable’s “shared infrastructure.” Groups of subscribers are pooled together in geographic areas and share a set amount of bandwidth. As usage increases, so does congestion. Responsible operators measure that congestion and can split particularly busy neighborhoods into two or more distinct “pools,” each sharing their own bandwidth. Based on the variable reports we’ve read, it’s apparent Palladium works better in some parts of Lawrence, namely those with fewer broadband enthusiasts, than others.

Network management is a major concern of Net Neutrality proponents. It allows an operator to artificially impede traffic based on its type, who generates it, and potentially how much a customer has paid to prevent that throttling of their speed. In the case of Palladium, network management is used to give usage-capped customers first priority for available bandwidth, and push Palladium customers further back in line.

Judging the quality of such a service is a classic case of “your results may vary,” because it is entirely dependent on when one uses the Internet, how many others are logged in and trying to use it at the same time, how many customers are saturating their connections with high traffic downloading and uploading, and how many people are sharing your “pool” of bandwidth. Oh, and the quality of your cable line can create a major impact as well.

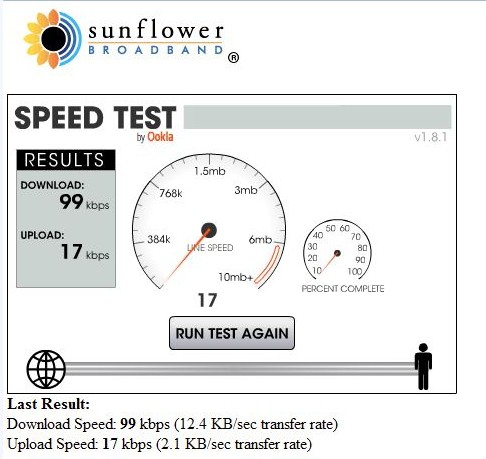

Sunflower Broadband representatives claim Palladium is “optimized for video” and should provide at least 2Mbps service during peak usage and up to 21Mbps service at non-peak times. That’s a tremendous gap, and we wanted to find out whether most customers were getting closer to the low end or the high end of that range.

Back in October, we wrote a request in the comments section of the Journal-World asking customers to e-mail us with answers to several questions about their experiences with Sunflower Broadband:

- 1) whether you ever exceed the cap.

- 2) do you think there should be one.

- 3) would you prefer faster speed with a cap or slightly slower speed with no cap.

- 4) your experience with the new unlimited option.

- 5) whether you would contemplate switching to AT&T U-verse if it meant escaping a usage cap, even if it had slower speeds.

- 6) Would you pay more for faster speed and no cap?

- 7) your overall feelings about Sunflower Broadband.

We heard from just over two dozen readers sharing their thoughts about the company and its service. The response was mixed.

Generally speaking, customers hate the usage caps Sunflower Broadband maintains on most of their broadband tiers. All thought it was unfair and unreasonable to limit broadband service under Sunflower’s Bronze tier to just 2GB per month and their Silver tier to just 25GB per month. Most customers who wrote subscribed to the Silver tier of service with 7Mbps/256kbps speeds at $29.95 per month. They also paid a $5 monthly modem rental charge. Those who wrote who fit the “broadband enthusiast” category were internally debating whether the Gold plan, with its assured 50Mbps/1Mbps speeds for $59.95 per month was a better option, even with a 120GB allowance, or whether they should opt for Palladium’s $49.95 option to escape the usage cap.

Among enthusiasts, some felt Sunflower responded to customer demands by offering an unlimited plan in the first place, and thought it was an acceptable trade-off to obtain lower speeds at peak usage times for a correspondingly lower price, and no cap, as long as speeds were reasonable at all times. Others were offended they had to make the choice in the first place.

“If I lived anywhere else, I wouldn’t have to choose between a throttled service or one that asks for $60 a month for 120GB of service,” writes Steve from Lawrence. “AT&T DSL for me is 1.5Mbps service because I live close to the edge of the distance limit from AT&T’s exchange.”

But Justin, also from Lawrence, has a more favorable view. “I hate their usage cap with a passion, but when you look at what small cable companies usually offer their customers, it’s slow speed service at terribly high prices,” he writes. “At least Sunflower did DOCSIS 3 upgrades and can offer big city speeds here. How long will that take other small independent providers?”

Troy adds, “at least they gave us one choice for unlimited service. Time Warner Cable and Comcast sure didn’t.”

About half of those who wrote did exceed their usage cap by underestimating the amount of usage in their respective households. Most of those who did were on the Silver plan.

Dave writes, “I knew right off the bat the Bronze tier was ridiculous for anyone to choose, and our family has three teenagers so we knew that was not an option. We tried the Silver plan when we switched from AT&T DSL service and blew the lid off that 25GB cap probably within two weeks and got a crazy bill. At least Sunflower forgave the overlimit fees for the first month, but they could afford to because we upgraded to Palladium, paying them $20 more per month.”

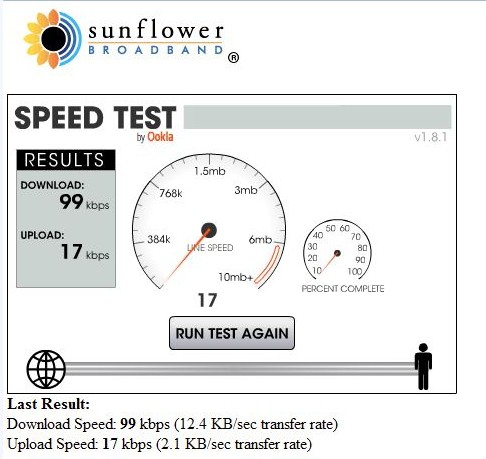

One customer's dismal Palladium speed test result from last October, likely the result of a signal problem

Angela, who shares an apartment with two other roommates had their share of fights over who used up all the broadband allowance.

“We have a wireless network and everyone splits the bill, but when we ran up almost 200GB of usage, we freaked. Nobody would admit to using that much Internet. Thanks to my boyfriend, we discovered our wireless router was wide open and one of our lovely neighbors probably hopped on to enjoy,” Angela writes.

Sunflower also forgave their overlimit bill for the first month, but they decided to take advantage of an introductory offer from AT&T and switched to U-verse and are much happier.

“At least with AT&T, we know what our broadband bill is going to be and we don’t have fights or worries about getting a huge bill from Sunflower,” she adds.

Among those answering our question about reduced speed in return for no cap, the consensus view was “we would need to know what speed they are providing.” Broadband speed was important to most who wrote. While many may not be able to discern a difference between 10 and 20Mbps service for most online activities, obtaining 2Mbps service when expecting closer to 20Mbps is readily apparent, and that was the biggest problem with Palladium users unimpressed with its performance.

“Palladium is god awful, and close to unusable on the weekends and during the early evening when everyone is online,” writes Kelly, also in Lawrence. “We have college students all over the neighborhood and these people can’t be unconnected for a minute, so I’m not surprised Palladium crawls when everyone is online.”

Kyle, a regular Stop the Cap! reader writes the whole concept of Palladium leaves a bad taste in his mouth.

“Palladium is the equivalent of going into a restaurant and eating leftovers — whatever speed is leftover, it’s yours. Sometimes it might be a whole meal, other times scraps! It’s an example of crappy customer service coming from a provider which doesn’t have much competition (although maybe that will change with U-verse),” he says.

Kyle is on the Gold plan, but remains unimpressed with Sunflower:

“Is there another DOCSIS 3 system in the country that limits upload speed to 1Mbps or has a bandwidth cap this low (120 GB) with DOCSIS 3?”

Stop the Cap! also obtained access to the company’s subscriber-only forums and discovered considerable discontent with Sunflower’s broadband service.

“I recently switched over to Palladium to avoid the new Gold price gouging. I bought the new modem set it up and much to my surprise my speeds were HORRIFIC! Consistently 4.5Mbps service over the course of a week at various times. Upload speeds were so terrible it took 15 minutes to send emails with one minute movies,” writes one user. “So, for $20 more a month Palladium offers much slower speeds BUT unlimited bandwidth (which according to Sunflower’s own statistics almost no one exceeds their limits anyway.) What a rip-off. All I want is my old Gold back, same speed and price. I am absolutely disgusted with Sunflower. Calling Palladium “variable speed” is a lie. You are throttling customers – period.”

“So I have Palladium and the speeds are decent, usually around 10Mbps down (we won’t talk about up speeds.) But every time I run a torrent my speeds go down to about 500kbps. The second I turn off my torrent client and run a speed test again its right back up to 10. Has anyone else been having similar issues? It seems like Sunflower throttles my entire connection when they detect a torrent,” writes another.

One Lawrence resident claims he was blacklisted by Sunflower Broadband after criticizing them.

“Their blacklisting of me served as a warning to others after I spoke out nationally. They are quite pissed and I’m not allowed to go to any event sponsored by them. I even got removed from the local Twitter festival,” a person who I have chosen to keep anonymous writes. “The nutshell is that the bandwidth from DOCSIS 3.0 is extremely throttled for Palladium users. If they have done heavy downloading the throttle drops speed to about 2Mbps.”

For Lawrence residents who have decided they don’t like the choices Sunflower provides for broadband service, the good news is that AT&T is upgrading their network in the city to provide U-verse service, and many who wrote us have switched just because AT&T does not engage in Internet Overcharging caps and limits in Lawrence.

There is even a blog devoted to comparing Sunflower Broadband service with AT&T U-verse. The Lawrence Broadband Observer has been reporting on the dueling providers since August. His verdict: AT&T U-verse wins for broadband for its more stable speeds, and no Internet Overcharging schemes, even if it costs more:

We decided to go with U-verse for our Internet service, canceling our Sunflower Broadband Internet, which we had used for over 13 years. U-verse’ top line internet costs $15 more per month then Sunflower’s; we decided that the advantages of U-Verse for Internet were enough to make this extra $15 per month a reasonable value.

Furthermore, the speed of U-verse has been remarkably consistent, always ranging between 16 and 17Mbps down and about 1.4Mbps up, no matter the time of day.

While Sunflower’s service is very fast at certain times of day, it frequently slows down during evenings or other times of heavy network use, sometimes to less then half of the speed we were paying for.

The other primary reason we went with U-verse was because U-verse does not have bandwidth overage fees or any kind of bandwidth limits. Although we have been careful with Sunflower and managed to avoid any bandwidth overage charges, having “the meter running” all the time was annoying, and we worried that we could always be surprised with an unexpected charge. With U-verse we do not have this worry. One could almost think of the $15 extra for U-verse as an insurance policy…it buys peace of mind not having to worry about bandwidth overages.

Subscribe

Subscribe