It’s time to take a look inside Time Warner Cable’s latest quarterly financial report and pick out some interesting developments that will impact customers during the first quarter of 2013.

It’s time to take a look inside Time Warner Cable’s latest quarterly financial report and pick out some interesting developments that will impact customers during the first quarter of 2013.

Time Warner Cable managed 9 percent revenue growth in 2012, primarily from its broadband service, its strongest product. The company added another 500,000 broadband customers over the last year, primarily poached from telephone company DSL service. This growth in subscribers continues despite rate increases and the introduction of a $3.95 monthly modem rental fee introduced last fall.

CEO Glenn Britt noted that Time Warner Cable customers use and love their broadband service.

“The average customer used roughly 40% more capacity last year,” Britt noted.

But Time Warner Cable has plenty of capacity to handle that traffic growth.

Britt plans to leave as CEO of Time Warner Cable by the end of this year.

Irene Esteves, Time Warner’s chief financial officer noted Time Warner Cable continues to decrease its capital spending. Overall, Time Warner spent $3.1 billion on capital expenditures in 2012, or just 14.5% of its revenue. That represents a 40-basis point decrease from 2011. The bulk of that spending was on business services, primarily from the costs of wiring business office parks and buildings for cable. Less than 12% of Time Warner Cable’s spending targeted residential services.

“Overall, we expect capital intensity will continue to decline modestly, with full year capital spending around $3.2 billion in 2013,” Esteves told investors.

Time Warner’s new modem fee is earning the company a major boost in Average Revenue Per User (ARPU). The average Time Warner customer now spends $103.79 a month for service, an increase of 6.3%. Three-quarters of that increase is attributable to the modem fee alone.

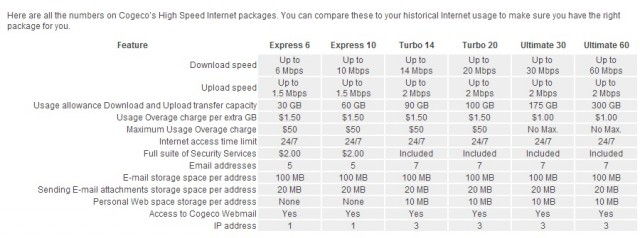

Customers are clamoring for higher broadband speeds. At the end of 2012, Turbo, Extreme and Ultimate subscribers comprised over 23% of the company’s residential broadband customer base, up from 19% a year ago and 11% three years ago.

Britt, expected to retire by the end of this year, noted the company’s biggest challenge during his tenure continues to be programming costs. But the company is contributing to that problem itself, spending $110 million in 2012 on its new regional sports networks in southern California, which feature the Los Angeles Lakers and the Los Angeles Dodgers.

“Our programming costs per subscriber has grown 32% in the last four years,” Britt complained. “Over that same period, the Consumer Price Index has risen by 9%. So the math is pretty simple, programming costs have been rising at more than three times the rate of inflation. Our residential video ARPU increased 16% over that same period, so we’ve effectively raised pricing a little faster than inflation but only half as fast as programming costs have risen.”

The rising price of cable service has caused Time Warner to lose a larger number of customers, particularly when promotional pricing deals expire. The company has retrained its retention agents to avoid losing customers to the competition as new customer promotions expire. Time Warner noted some of its strongest competition is coming from AT&T U-verse promotional pricing for double-play offers in Texas and the midwest. In Kansas City, Time Warner continues to dismiss competition from Google Fiber as largely irrelevant, although the company has boosted its maximum broadband speeds to 100Mbps in that city.

Time Warner’s TV Everywhere app.

Other highlights:

♦ TWC completed its DOCSIS 3.0 broadband enhancement rollout in 2012 and began a process of reclaiming bandwidth previously dedicated to the delivery of analog video. These steps will allow the company to continue to devote more network resources to enhancing broadband service, including handling more traffic and selling faster service.

♦ Optional usage-based tiers are available from most Time Warner Cable regions. The offer of a $5 monthly discount for customers keeping their usage under 5GB each month has received almost no interest from subscribers. Sources inside Time Warner tell Stop the Cap! the company never expected much customer interest, but the offer allowed Time Warner to introduce the concept of usage-based pricing without alienating current customers.

♦ Time Warner Cable’s “TV Everywhere” platform continues to expand. Various TWC TV apps now offer as many as 300 streamed video channels on both smartphones and streaming set-top boxes. In December the company expanded its offering to include video on demand, and last week those on-demand programs became available on the desktop. Time Warner expects to grow its on-demand library and introduce local television channels to its streaming apps in 2013.

♦ Time Warner is trying to improve the standing of its residential telephone service with the introduction of a Global Penny plan, which offers international calling to over 40 countries for one cent per minute. This helps the company market its phone service to subscribers choosing its various ethnic and foreign language television packages.

♦ One-hour service windows are now available in most Time Warner Cable areas. In New York City, a 30-minute window is available for the first appointment of the day. The company is also expanding its self-install packages, letting customers do simple equipment installations themselves. The equipment is delivered free of charge by package delivery services and can be returned by mail as well.

♦ Although Time Warner is earning more from its broadband customers, the introduction of a modem rental fee did cause a significant number of customers to disconnect service, presumably in favor of a competitor. But the extra money in the cable company’s pockets more than makes up for the loss.

♦ Time Warner Cable’s forthcoming “hosted navigation product” represents a major change for the company’s set-top boxes. The “gateway” device will include 1TB of storage, can record up to six shows at once, and will automatically transcode video for an IP platform, letting customers view recorded and live programming on set-top boxes or wireless devices like smartphones and tablets inside the home. Expect to see the new device arrive in the second half of this year in many Time Warner cities.

Subscribe

Subscribe

Most existing clients have already had the benefit of a promotion on sign-up. As with all promotions, including the current new client promotions, they run for a limited time and the discounts they offer expire. We do have loyalty programs in place for existing loyal clients and we do offer existing clients the new promotions in cases where they may not have received anything when they signed up.

Most existing clients have already had the benefit of a promotion on sign-up. As with all promotions, including the current new client promotions, they run for a limited time and the discounts they offer expire. We do have loyalty programs in place for existing loyal clients and we do offer existing clients the new promotions in cases where they may not have received anything when they signed up.