Time Warner Cable will not follow Comcast, Charter, Cox and Mediacom by imposing usage caps or move towards a compulsory usage-based billing scheme.

Time Warner Cable will not follow Comcast, Charter, Cox and Mediacom by imposing usage caps or move towards a compulsory usage-based billing scheme.

Yesterday, incoming CEO Robert Marcus told investors attending the Bank of America Merrill Lynch 2013 Media, Communications, and Entertainment Conference that he recognizes the majority of Time Warner Cable’s broadband customers want the company’s unlimited use offering and made it clear that option will continue to be available.

Marcus

“Most customers today — the vast, vast majority — take our unlimited offering and I think over time most customers will continue to take unlimited,” said Marcus, who currently serves as Time Warner Cable’s chief operating officer. “They value it and will be willing to pay for it. I think that is great and we have no desire to change that.”

However, Marcus also reflected on the revenue opportunities available to the company from its broadband offering, and signaled investors the company would continue to price the service commensurate with its perceived value.

“High Speed Data is a tremendous product for us,” Marcus said. “Our customers continue to use it more and more for all different sorts of applications. I think consumption growth year over year in the second quarter is somewhere north of 40 percent. It has been in that kind of range for a long time and we expect it to continue to grow at a pace like that for as long as we can see. With that increasing usage comes an increasing utility to customers and we believe an increasing willingness to pay for that incremental utility.”

Time Warner Cable increased its broadband average revenue per user (ARPU) by 9% for residential High Speed Data during the second quarter, with total broadband revenue up more than 12%, according to Marcus. Those revenue increases have been made possible by three things:

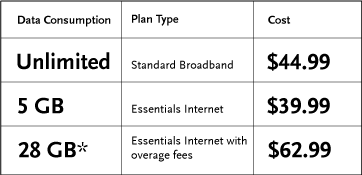

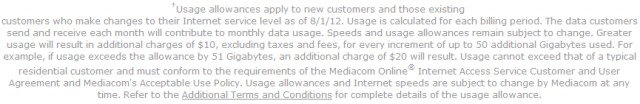

Less Costs More: *-With the FCC claiming the average Internet user consumes 28GB of broadband per month, this may explain why Time Warner Cable customers have little interest in the company’s 5GB Internet Essentials offer. (Chart: New America Foundation)

- Adding new broadband customers, mostly those abandoning telephone company DSL;

- Implementing general price increases on broadband service for existing customers and the introduction (and later increase) of modem rental fees starting last fall;

- Successfully encouraging customers to upgrade to faster speed tiers, which are sold at a higher cost.

Despite Marcus’ commitment to maintain unlimited broadband service for Time Warner Cable customers, the cable company is moving forward with several optional, usage-based tiers sold at a discount.

“There are customers who choose to consume less and we feel strongly that we need an offering for them which allows them to pay less and eliminate the structure where they have to subsidize the heavy users,” Marcus explained.

For more than a year, Time Warner has offered a little noticed, usage-limited plan for customers willing to confine their Internet browsing to a maximum of 5GB per month. The plan has not been popular with customers and very few have signed up. Time Warner announced earlier this summer they would try again.

“We’re now in the process of rolling out yet another usage-based tier of service which I think is a more meaningful one because it comports with what real-life usage is like, which allows customers to use 30GB a month of service again at a discount from the unlimited pricing,” said Marcus. “When you put 30GB in context, our average usage today is about 50GB a month, median usage is actually less than 30GB, so for some customers there is going to be an economically rational reason for them to choose that 30GB tier. I expect the take rate will be certainly higher than for the 5GB service.”

Marcus, like the current CEO Glenn Britt, admits the company is attempting to educate customers that broadband usage carries a cost.

“There is a principle at stake: that value, price and usage are related to one another and that is important over time,” Marcus said.

Subscribe

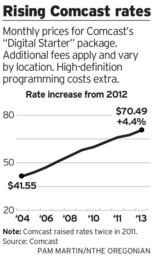

Subscribe Comcast rates are going up again this fall in the Pacific Northwest, now exceeding $70 a month.

Comcast rates are going up again this fall in the Pacific Northwest, now exceeding $70 a month.

the worst-rated cable operator in the United States, claims it needs usage caps and consumption billing to force heavy users to pay for needed upgrades. But that isn’t what Mediacom’s executives are telling investors and the Securities and Exchange Commission (SEC).

the worst-rated cable operator in the United States, claims it needs usage caps and consumption billing to force heavy users to pay for needed upgrades. But that isn’t what Mediacom’s executives are telling investors and the Securities and Exchange Commission (SEC). “

“

Other customers incensed about the new usage limits have called to cancel service only to be threatened with steep early termination fees.

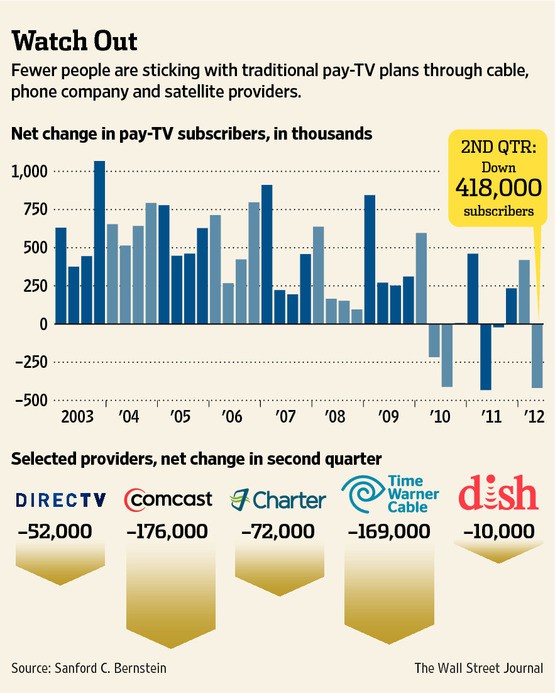

Other customers incensed about the new usage limits have called to cancel service only to be threatened with steep early termination fees. Sony’s bid to enter the “over-the-top” online video business has gotten a shot in the arm with news it has reached a preliminary agreement with Viacom, Inc., to carry its popular cable networks on the Japanese electronics giant’s planned online subscription TV service.

Sony’s bid to enter the “over-the-top” online video business has gotten a shot in the arm with news it has reached a preliminary agreement with Viacom, Inc., to carry its popular cable networks on the Japanese electronics giant’s planned online subscription TV service. The Wall Street Journal

The Wall Street Journal