Maryland-based Antietam Broadband has permanently shelved internet usage data caps, retroactive to mid-March, for all of its customers.

Maryland-based Antietam Broadband has permanently shelved internet usage data caps, retroactive to mid-March, for all of its customers.

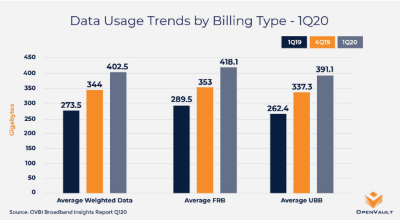

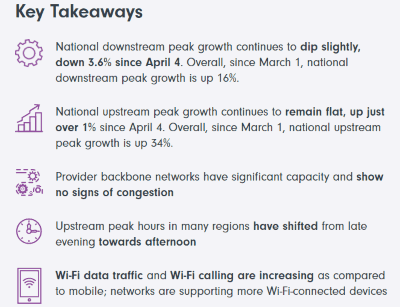

An ongoing study of customer usage patterns during the early days of the COVID-19 pandemic by Antietam engineers showed data caps were no longer technically necessary. Antietam is one of dozens of telecom providers that temporarily shelved data caps under the FCC’s Keep Americans Connected Pledge, a voluntary effort to suspend data caps, late fees, and service disconnections. After three months of collecting data about customer usage patterns and upgrade activity, Antietam Broadband president Brian Lynch said there was no legitimate need to return to usage caps.

Antietam may be the first U.S. provider to drop usage based billing after the FCC’s pledge expires at the end of June.

Lynch said customers appropriately self-managed their accounts, with heavier users (such as those now working from home) moving towards more profitable, higher-speed internet packages on their own. Antietam has traditionally offered seven different speed tiers, each including its own (now defunct) usage allowance:

- Internet Starter: 5 Mbps down / 1 Mbps up, 500GB per month.

- Go Fast: 10 Mbps down / 1 Mbps up, 500GB per month.

- Ultra Fast 30: 30 Mbps down / 5 Mbps up, 600GB per month.

- Ultra Fast 50: 50 Mbps down / 5 Mbps up, 750GB per month.

- Ultra Fast 100:100 Mbps down / 5 Mbps up, 1,250GB per month.

- Ultra Fast 200: 200 Mbps down/ 10 Mbps up, 1,500GB per month.

- Flight Gigabit Fiber: 1,000 Mbps down/ 1,000 Mbps up, no usage limit.

“These are uncertain times,” said Lynch. “We felt a need to give customers as much certainty over their bill as possible. Eliminating data usage caps means that customers will know the exact amount of their broadband bill every month.”

It also reduces customer confusion by eliminating the need to factor in data usage when selecting the right broadband package. Now, Antietam customers buy based exclusively on speed needs.

The pandemic caused a significant increase in data usage, but Antietam’s network was capable of handling usage demands, Lynch added.

“Since the pandemic began, we have seen as much increase in broadband usage as we generally would see over the course of a year,” said Lynch.

Subscribe

Subscribe

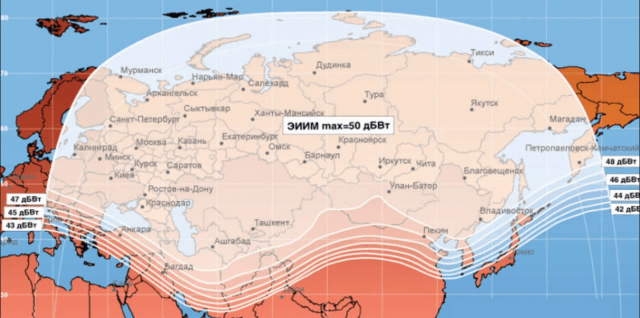

Russian satellite television provider Tricolor, in collaboration with Eutelsat Networks, has launched

Russian satellite television provider Tricolor, in collaboration with Eutelsat Networks, has launched

Charter Communications has set the stage for a Wall Street-pleasing boost in average revenue per user (ARPU) with a major broadband rate hike planned for this fall.

Charter Communications has set the stage for a Wall Street-pleasing boost in average revenue per user (ARPU) with a major broadband rate hike planned for this fall. While net neutrality in the United States has been neutered by the Republican-controlled FCC, the concept of an online level playing field is alive and well in Germany, and T-Mobile’s parent company Deutsche Telekom (DT) just got called out for a foul ball.

While net neutrality in the United States has been neutered by the Republican-controlled FCC, the concept of an online level playing field is alive and well in Germany, and T-Mobile’s parent company Deutsche Telekom (DT) just got called out for a foul ball.