Wheeler

Note to Readers: Tom Wheeler’s blog (mobilemusings.net) was taken offline in late November, 2014. You might still find it archived at archive.org. Because the blog has been taken down, we have removed all of the original links that were originally contained in this piece.

Tom Wheeler has had a blog.

The presumptive leading candidate for America’s next chairman of the Federal Communications Commission also has a major conflict of interest problem, with at least 30 years of working directly for the business interests of the cable and telephone companies he may soon be asked to oversee in the public interest. Wheeler is the former president of the National Cable & Telecommunications Association (NCTA) — the nation’s largest cable industry lobbying group and past CEO of the Cellular Telecommunications & Internet Association (CTIA) — the AT&T and Verizon-dominated wireless trade association. Today Wheeler serves as a managing director at Core Capital Partners, a Washington, D.C.-based venture capital firm that invests in these and other industries.

In more than 60 articles in the last six years, Wheeler has written of his trials and tribulations with federal regulators who simply refuse to see telecom industry wisdom on spectrum management, the legacy telephone network, obstinate broadcasters, outdated regulations, mergers and acquisitions, and the amazing story of private Wall Street investment and its wisdom to naturally shape America’s telecommunications landscape by “letting the marketplace work” unfettered by oversight and consumer protection laws.

Almost entirely absent in Wheeler’s writings is any interest in the plight of ordinary consumers that do business, often unhappily, with the companies Wheeler used to represent. America’s love of many-things Apple and Google, two runaway success stories heavily invested in the digital economy and well-regarded by more than a few consumers, are scorned by Wheeler as part of the “Silicon Valley mafia.”

Wheeler is the consummate Washington beltway insider, a lifelong lobbyist well-positioned to walk through the perpetually revolving door between the public and private sector. Even worse, he has maintained warm regards for not one, but two telecom industry lobbying giants — the cable and wireless industry trade associations that have daily business before the FCC. Whether Wheeler can stand up to his former best friends is open for debate. Wheeler wrote in one blog entry he remains in awe of AT&T’s chief lobbyist, Jim Ciccioni, who he called “one of the smartest and shrewdest policy mavens in the capital.”

Wheeler’s blog makes it clear he would have supported the 2011 attempted merger between AT&T and T-Mobile, with a few temporary token pre-conditions. He heaped scorn on antitrust regulators for missing an opportunity the merger approval could have had on reshaping the American wireless marketplace. Less is more in Wheeler World.

D.C.’s perpetually revolving door keeps on spinning.

Like outgoing FCC chairman Julius Genachowski, Wheeler is a longtime Obama loyalist and was involved in Obama’s 2008 election campaign.

Wheeler relays to C-SPAN’s Brian Lamb in a 2009 interview that who you know in Washington can mean a lot. After Obama entered the 2008 race, Wheeler connected to Obama through a friend — Peter Rouse, who had recently accepted the position of Obama’s chief of staff.

“I picked up the phone one day and there was a message from Barack Obama that he wanted to talk about some issues related to technology,” Wheeler described. “Things began to develop. We got really interested in the potential of this person and the opportunity that he represented for a transformational moment in American history, and we decided that Iowa was the place.”

Wheeler and his wife Carol (employed by the National Association of Broadcasters, itself a lobbying group) had the financial resources in place to put their D.C. jobs on hold and spend six weeks in the Region 2 Obama election office in Ames, Iowa.

After Obama won the election, Lamb predicted Wheeler might find himself at the FCC. Instead, Obama’s college friend and money-bundler Julius Genachowski won the position.

Wheeler’s chances of succeeding Genachowski improved dramatically in mid-April after receiving the written support of several public policy advocates. One of them was Susan Crawford, whose recent book, Captive Audience: The Telecom Industry and Monopoly in the New Guilded Age, railed against many of the policies supported by the largest telecommunications companies Wheeler professionally represented in his roles at the NCTA and CTIA. Some consumer groups wrote President Obama directly, strongly recommended a change from the ‘business as usual’ revolving door:

During his election campaign, President Obama pledged “to tell the corporate lobbyists that their days of setting the agenda in Washington are over.” Yet the president is reportedly considering a candidate for the next FCC chair who was the head of not one but two major industry lobbying groups. After decades of industry-backed chairmen, we need a strong consumer advocate and public interest representative at the helm. It’s time to end regulatory capture at the FCC and restore balance to government oversight.

Those consumer groups have plenty to worry about if Tom Wheeler becomes the next head of the FCC. Stop the Cap! has found several quotes from his blog which paint a picture of a potential FCC chairman devoted to industry interests:

Close Wireless Retail Stores to Save Money and Kill Jobs: “Sprint announced plans to close eight percent of its over 1,500 company-owned retail outlets. Why stop there? Why does it make sense for wireless carriers to operate more stores than Sears and Macy’s combined?”

Wireless network redundancy is a waste of money — an interesting sentiment in light of major wireless network failures during Hurricane Sandy and insufficient capacity during the terrorist attack on the Boston Marathon last week: “The history of the U.S. wireless industry is a network-centric history that wasted untold billions of dollars building duplicative networks and advertising ‘mine is better than yours.’”

The failed merger of AT&T and T-Mobile represented a missed opportunity in Wheeler’s view.

WiMAX is King of the World?: “Back in the mid-1990s new digital technology called Personal Communications Service (PCS) was forecast to be the death knell of the cellular industry. It seemed all anyone could talk about was the “smaller, cheaper, lighter” handsets that would perform feats beyond the capabilities of analog cellular. Now in the mid-2000s the differentiator is speed and throughput and WiMAX is the new hot technology.”

Who needs free over the air television when only 10-15 percent of the country watches?: “What is the purpose of continuing the local TV broadcasting model when between 85 and 90 percent of American homes are connected to cable or satellite services?”

AT&T and Verizon will save us from the Great Recession, except for the fact they laid off “redundant” workers: “In the midst of the first shrinking of global economic growth in almost 70 years, the wireless industry represents what must be the largest non-governmental stimulus program in the world. Wireless is an economic recovery triple play.”

Those mooching broadcasters got their spectrum for free when Verizon and AT&T had to pay real money: “The setting for these theatrics is the digital conversion for which broadcasters lobbied so hard for. Yes, they won new spectrum – which they got for free while all other were paying billions – but getting what they asked for also brought something no one ever imagined. Broadcasting ceased to be broadcasting. Going digital meant that what used to be about moving atoms is now about moving bits.”

We need to verify broadcasters use their spectrum the way we define it or we might take it away: “But threatening a shootout at the OK Corral in order to ‘hang on to every last hertz of spectrum’ is an invitation to irrelevance and proof that the spectrum needs to be assigned to parties that think digitally and see themselves as a part of the solution to the spectrum crisis. Opportunity is knocking for the broadcasters; we’ll see if anyone is at home.”

Cicconi

Reduced quality of service is worth it, even if it means shutting down wired telephone service or increasing interference for wireless users: “It is time to abandon the concept of perfection in spectrum allocation. The rules for 21st century spectrum allocation need to evolve from the avoidance of interference to interference tolerance. We’ve seen this evolution in the wired network; it’s now time to bring the chaotic efficiency of Internet Protocol to wireless spectrum policy. What the FCC’s TAC is proposing is that we officially wean ourselves from the old wireline switched circuit world to embrace the reality of IP and its benefits. It’s time to start down the same road with spectrum allocation.”

Did you know your mobile bill is lower than ever and sending data wirelessly costs next to nothing? How much is your limited data plan costing you again?: “As wireless rates have plunged for both voice and data such regulation has less impact than it did in the wireline era anyway. When each connection required an analog circuit, the cost of such a connection, and the return on that investment was a more logical nexus than today’s digital networks where the incremental cost of a packet of information approaches zero.”

AT&T’s propaganda supporting its attempted merger with T-Mobile was brilliant. Those pesky consumer groups and their meddling, truth-telling agenda ruined everything. When Americans think of rural wireless broadband, the first company that comes to mind is T-Mobile, right?: “The most important times in any merger approval process are the first two weeks when the acquiring company gets to define the discussion and the last four weeks when the concerns raised by others and the analysis by the government congeals to define the issues to be negotiated in the final outcome. AT&T shot out of the blocks brilliantly, framing their action in terms of the spectrum shortage and President Obama’s desire to provide wireless broadband to rural areas. Over the coming months those who were caught by surprise, as well as those who would use the review process to gain their own advantages, will have organized to present their messages.”

Wheeler sends a Hallmark card to AT&T’s most powerful lobbyist: “AT&T’s recent negotiations with the FCC on the Net Neutrality/Open Internet issue provide an insight into how the company deals with such a complex issue. Jim Cicconi, AT&T’s Senior Executive Vice President, is one of the smartest and shrewdest policy mavens in the capital.”

What do they know about it?

AT&T’s Jim Cicconi is the go-to-guy for determining future wireless policy, not the FCC: “Randall Stephenson may be channeling Theodore Vail, but Jim Cicconi sits astride a process that could determine the future of wireless policy, first for AT&T and then by extension for everyone else. Quite possibly the result of this merger decision will be far wider than the merger itself. At the end of the day we may be talking about a new era of wireless policy based on the Cicconi Commitment.”

The Justice Department just proved it does not understand regulatory concepts governing relentless corporate telecom mergers because it decided Americans should have at least four wireless companies to choose from, not three: “Thus, the long-term impact of the Justice Department’s decision would appear to be the growing irrelevance of traditional telecommunications regulatory concepts on mobile broadband providers.”

Wheeler lacks the realization wireless providers are moving to usage pricing for fun and profit, not because of spectrum shortages: “Having walked away from taking the easy money, will the Congress remain as committed as they were to selling spectrum? What will be the light at the end of the tunnel for wireless carriers who see their spectrum capacity being consumed by huge increases in demand? Will the resulting shortage mean that usage based mobile pricing becomes a demand dampening and profit increasing tool?”

We don’t need free over the air television. Just tell free viewers to subscribe to cable like everyone else: “I’ve been mystified why broadcasters have declared jihad against the voluntary spectrum auction. Getting big dollars for an asset for which you paid nothing while still being able to run your traditional business over cable (the vast majority of its reach anyway) and maintain a broadcast signal at another point on the dial seems a pretty good business proposition – unless you really are serious about providing new and innovative services and need all that spectrum.”

You don’t deserve free Internet access either, because it hurts the corporate business plans of other providers: “Competition among networks for customers has put the consumer in the enviable position of being told they won’t have to pay for access to Internet services. “Free It,” the advertisements of British network operator “3” proclaim to promote their unlimited data plan, for instance. The policies that created wireless network competition have trapped operators between holding market share and giving away capacity for ever-increasing data demands. So long as there is one carrier willing to offer its capacity at a low price (or for free), the other carriers must play along thus bringing those who run networks to loggerheads with those who use the networks.”

(Image courtesy: FCC.com)

Google and Apple are privacy invaders that collect your personal data as part of a great Silicon Valley mafia: “If wireless carriers are truly going to become “operators” participating in the broader ecosystem their focus needs to shift from running networks to managing the information created by the 21st Century’s digital networks. The Silicon Valley mafia hijacked that information, but they could quite possibly be in the process of blowing their escape with the goods by exposing what they were really up to.”

We need a “voluntary” auction of the public airwaves with a subjective standard for what represents their “best use” (ie. the way the wireless industry defines it): “For almost four decades I have listened to businesspeople tell government policy makers to “let the marketplace work.” There is no more effective marketplace than a voluntary auction where everyone is free to decide whether to sell, how much to sell, and at what price to sell. The marketplace for wireless spectrum has spoken through its explosion; now it’s time for the marketplace to be able to decide the best use of spectrum. There is no doubt that some broadcasters will opt to use their spectrum in innovative ways [my firm, Core Capital Partners, has invested in such a belief]. Bully for the broadcast entrepreneurs! The FCC should be encouraging and rewarding of entrepreneurial initiative. Just as clearly, however, some broadcasters will choose other options. It is essential that we get on with offering that option quickly so we can nip the spectrum crunch in the bud, spur innovation, stimulate investment, create jobs, and continue American leadership in wireless services.”

Coming Clean: Wheeler ran astroturf operations that pretended to represent the interests of consumers but actually were little more than corporate sock-puppetry: “In the early days of cable television a cabal of Hollywood and broadcast interests combined to convince the Federal government to deny cable its competitive advantage of more channel choices for consumers. Corporate lobbyists told Congressmen and Senators how cable would mean the end of “free TV” unless it was stopped or controlled. Then these same groups recruited real people – the so-called “grassroots” – to back up their claims. Such lobbyist-organized grassroots efforts were the Standard Operating Procedure (SOP) of political organizing – I know because I used to do it.”

The alliance between Verizon and a cabal of cable companies selling each others’ products is pro-competition: “A TV subscription service like the one Apple is proposing is the heart of what cable is all about. And whatever Google is doing, they aren’t in every TV just for the heck of it. The Mongols of Silicon Valley have been behaving just like their 13th and 14th century predecessors. Using new technology to their advantage, the Mongols of the Middle Ages sent invasions in every direction. Soon they had the largest contiguous empire the world has ever seen. Sound familiar? It may be a case of “my enemy’s enemy is my friend,” but a cable-wireless alliance is an exceedingly logical response to the impending attack. Cable operators have program distribution rights (or leveraged access to them) and Verizon has the high-speed wireless network to deliver to the growing number of mobile devices. Both these players can help each other confront the coming onslaught.”

Subscribe

Subscribe

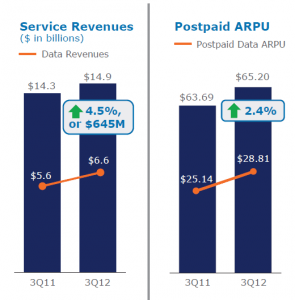

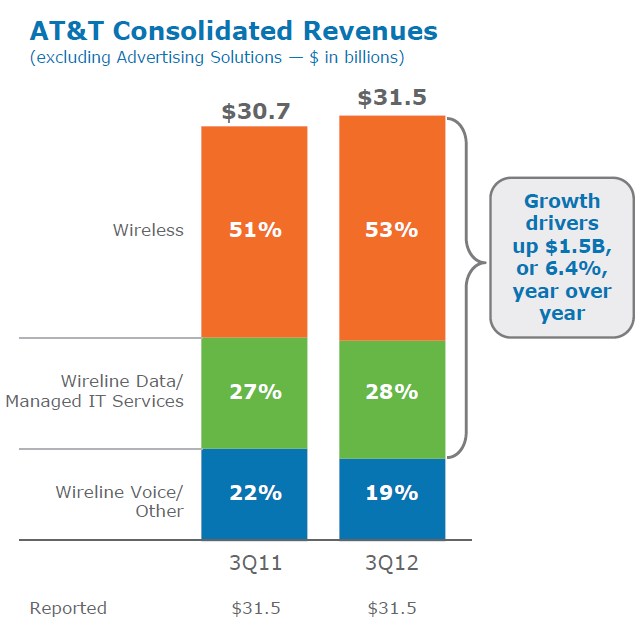

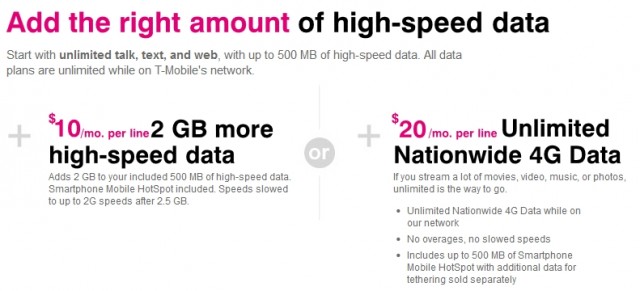

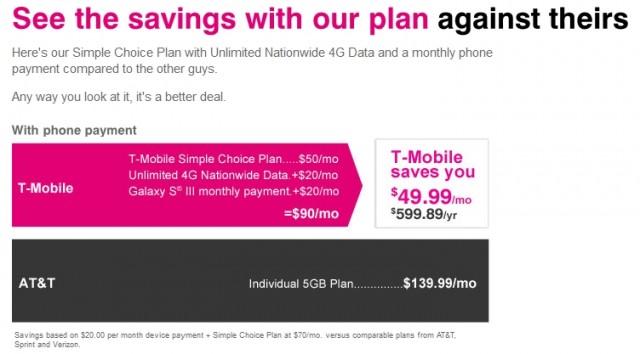

AT&T has new wireless data plans you can’t afford.

AT&T has new wireless data plans you can’t afford.