Greater Austin, a city served by up to four different broadband providers — three either offering or promising fiber to the home service — is getting a speed upgrade from the one company that is sticking with its fiber-coax network — Time Warner Cable.

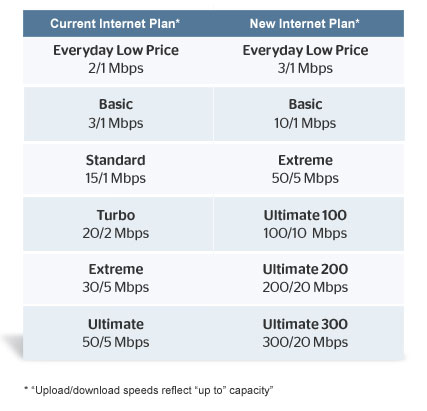

Starting June 3, Time Warner Cable customers who receive letters regarding the upgrade will see major broadband speed boosts at no additional charge:

Austin: Keeping the good broadband all to themselves. (Image courtesy: Kong)

The upgraded speeds will be offered to approximately 40 percent of customers in Austin and surrounding communities in June, with the remaining customers in the area getting upgraded through early fall. Here is the upgrade schedule:

June Speed Upgrade: Downtown Austin, West Campus, Hyde Park, Clarksville, Old Enfield, North Loop, Terrytown, Highland Park West, Central East Austin, Windsor Hills, Copperfield, Springdale Heights, Harris Branch, Edinburgh Gardens, Rollingwood, West Lake Hills, Lost Creek, Barton Creek, Jollyville, Anderson Mill, Brushy Creek, Bull Creek Park, Steiner Ranch, River Place, Canyon Creek, and the Reserve at Twin Peaks, as well as these communities: Manor, Cedar Park, Jonestown, Bee Cave, Kyle, Mountain City, and Uhland.

Fall Speed Upgrade: Round Rock, Leander, San Marcos, Elgin, Marble Falls, Lockhart, Bastrop, Fredericksburg, Taylor, Smithville, Wimberley, Liberty Hill, Lago Vista, Buda, Kyle, Elroy, and Lakeway.

“These significant speed increases will allow all our Internet customers in the greater Austin area to enjoy TWC Internet better,” said Kathy Brabson, area vice president of operations for Time Warner Cable in Central Texas.

Time Warner says it is spending about $60 million to upgrade its Austin-area network. That investment may help the cable company withstand competition from providers like Grande Communications, AT&T, and Google. For most in Austin, Time Warner Cable will be the first provider to dramatically boost Internet speeds. Google Fiber has postponed its launch until this fall, AT&T’s U-verse fiber to the home service is more press release than reality, and Grande Communications, although offering 1,000Mbps service for $65, only has that service available in parts of the greater Austin area.

Some customers will need to upgrade and/or exchange their current cable modem to receive the full speed upgrade. Customers leasing a modem can get information about whether an upgrade is needed from Time Warner’s Speed Increase website. We still strongly recommend customers consider purchasing their own modem — it will pay for itself in no time. Communication to the first group of customers about the new speeds and details about equipment is being delivered to homes this week.

Separately, Time Warner also announced it is expanding its local Wi-Fi hotspot network, but did not share any specific details.

Stop the Cap! will not be surprised to see Kansas City the next upgrade choice for Time Warner Cable — Google Fiber is up, running, and competing there. The rest of us will have to wait up to two years for faster speeds to arrive.

Subscribe

Subscribe

Lobbyists like Gray used astroturf tactics to mobilize various unaffiliated non-profit groups to write glowing letters in support of consolidating Sirius and XM Radio, usually in return for generous contributions. It is likely to be more of the same with this merger.

Lobbyists like Gray used astroturf tactics to mobilize various unaffiliated non-profit groups to write glowing letters in support of consolidating Sirius and XM Radio, usually in return for generous contributions. It is likely to be more of the same with this merger.

One way to prove the merged company would not offer better service is to alert the Commission Comcast plans to reimpose usage caps on its customers while Time Warner Cable does not have any compulsory usage limits or usage billing.

One way to prove the merged company would not offer better service is to alert the Commission Comcast plans to reimpose usage caps on its customers while Time Warner Cable does not have any compulsory usage limits or usage billing. The announced merger of Comcast and Time Warner Cable is expected to have far-reaching implications for other companies in the video and broadband business, with expectations 2014 could be one of the busiest years in a decade for telecom industry mergers and buyouts.

The announced merger of Comcast and Time Warner Cable is expected to have far-reaching implications for other companies in the video and broadband business, with expectations 2014 could be one of the busiest years in a decade for telecom industry mergers and buyouts. In a less likely deal Sprint is still trying to pursue T-Mobile USA for a potential merger and if regulators reject that idea, Charles Ergen’s Dish Network is said to be interested.

In a less likely deal Sprint is still trying to pursue T-Mobile USA for a potential merger and if regulators reject that idea, Charles Ergen’s Dish Network is said to be interested.