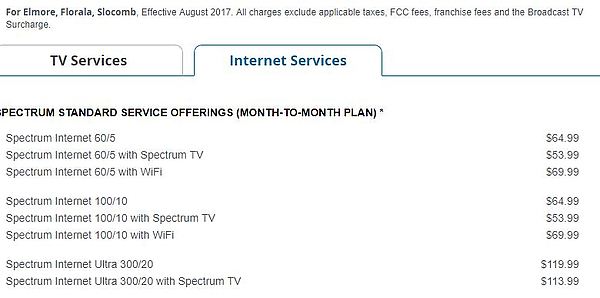

Charter Communications has a new argument for raising your cable bill: Time Warner Cable’s promotions were so low-priced, the company couldn’t afford upgrades. By ending promotional pricing and raising prices, Charter can finally afford to manage the upgrades Time Warner Cable never made.

Charter Communications has a new argument for raising your cable bill: Time Warner Cable’s promotions were so low-priced, the company couldn’t afford upgrades. By ending promotional pricing and raising prices, Charter can finally afford to manage the upgrades Time Warner Cable never made.

That novel argument comes courtesy of Charter Communications’ director of government affairs Anna Lucey, who made it in response to complaints from customers in western Massachusetts about substandard service and bill shock from Charter’s Spectrum. She was invited to answer questions and complaints raised during last week’s Board of Selectmen meeting in Adams, Mass.

Cheshire resident Peter Gentile, who was serving as cameraman to televise the public meeting with the cable company for Northern Berkshire Community Television, complained that when his Time Warner Cable promotion ended, Charter promptly raised his bill from $103 to $182 a month — nearly an $80 a month rate hike.

“It is absurd … I was told I could save some money by downgrading my internet so it would be slower and I would lose approximately 30 channels and my bill would only go down $7.75,” he said. “This is an impoverished community, this is an elderly community that is getting older and poorer and … I wish that you would go back to your team and explain.”

Lucey explained Charter is adopting one-size-fits-all nationwide pricing for its customers and is ending promotional pricing, explaining that Time Warner’s policy of “subsidizing” cable bills to give customers a lower rate did not allow Time Warner Cable to invest in its infrastructure.

“It did lend a problem to infrastructure reinvestment that Time Warner could do, which is one of the reasons why we don’t have similar promotional packages that constantly deflate the cable bills,” Lucey said. “We want to keep all of our services up to date and continue to reinvest but I understand the sticker shock isn’t pleasant.”

Unfortunately for Lucey’s creative justification for rate increases, the financial facts disprove her assertion. In fact, Time Warner Cable outperformed Charter Communications in the first quarter of 2016, just before Charter closed on its acquisition of Time Warner Cable.

In April 2016, Time Warner Cable chairman and CEO Rob Marcus reported “the best ever customer relationship net additions,” “accelerated revenue growth of 7.5%,” and “robust adjusted OIBDA growth of 8.2%.”

“Our first-quarter results are the clearest indication yet that our efforts over the last 27 months are paying off. We have made our network more reliable, our products more compelling and our customer service far better. We’ve refined our marketing, enhanced our sales channels and strengthened our retention capability. All of that has driven robust customer growth, which in Q1 translated into very strong revenue and OIBDA growth. I couldn’t be prouder of what our talented, committed, passionate team has accomplished,” Marcus said, reflecting on the history of Time Warner Cable’s Maxx upgrade project, which delivered more compelling broadband speeds at a lower cost to Time Warner Cable customers than what Charter Communications offers today.

In fact, financial results for that period showed as Time Warner methodically worked through upgrading its systems, customer and revenue growth went up. The only exception was Free Cash Flow, which the company attributed to merger-related expenses, not promotional pricing:

| SELECTED CONSOLIDATED FINANCIAL RESULTS | |||||||||||||||||

| (in millions, except per share data; unaudited) | 1st Quarter | ||||||||||||||||

| Change | |||||||||||||||||

| 2016 | 2015 | $ | % | ||||||||||||||

| Revenue | $ | 6,191 | $ | 5,777 | $ | 414 | 7.2 | % | |||||||||

| Adjusted OIBDA(a) | $ | 2,159 | $ | 1,996 | $ | 163 | 8.2 | % | |||||||||

| Operating Income(b) | $ | 1,145 | $ | 1,084 | $ | 61 | 5.6 | % | |||||||||

| Diluted EPS(c) | $ | 1.72 | $ | 1.59 | $ | 0.13 | 8.2 | % | |||||||||

| Adjusted Diluted EPS(a) | $ | 1.81 | $ | 1.65 | $ | 0.16 | 9.7 | % | |||||||||

| Cash provided by operating activities(b) | $ | 1,608 | $ | 1,508 | $ | 100 | 6.6 | % | |||||||||

| Capital expenditures | $ | 1,318 | $ | 1,134 | $ | 184 | 16.2 | % | |||||||||

| Free Cash Flow(a)(b) | $ | 346 | $ | 407 | $ | (61 | ) | (15.0 | %) | ||||||||

| (a) | Refer to Note 4 to the accompanying consolidated financial statements for definitions of Adjusted OIBDA, Adjusted Diluted EPS and Free Cash Flow and below for reconciliations. | |

| (b) | Operating Income is reduced by merger-related and restructuring costs of $40 million and $26 million for the first quarters of 2016 and 2015, respectively. Cash provided by operating activities and Free Cash Flow are reduced by merger-related and restructuring payments of $14 million and $26 million for the first quarters of 2016 and 2015, respectively. | |

| (c) | Diluted EPS represents net income per diluted common share attributable to TWC common shareholders. | |

Charter’s later announcement of upgrades for the remaining Time Warner Cable systems not upgraded to Maxx service before the merger deal was completed are occurring more slowly than Time Warner’s own original timetable. As soon as the ink was dry on the merger deal, Charter immediately canceled the Maxx upgrade program for all markets not already in progress with upgrades.

Charter’s own upgrade plan is less compelling than the Maxx menu of options, which gave customers more choices at a lower cost. Charter’s own financial reports admit the company is losing former Time Warner Cable customers as their promotions expire. Charter’s own executives attribute those losses not on deferred upgrades, but on the cost of service going forward after promotional pricing expires.

Subscribe

Subscribe