The Chair of the New York State Public Service Commission announced today that the Commission is seeking a possible revocation of Charter Communication’s franchise to serve New York City and a $1 million fine payable to New York State for failing to meet its network buildout obligations agreed to as part of its 2016 merger with Time Warner Cable.

The Chair of the New York State Public Service Commission announced today that the Commission is seeking a possible revocation of Charter Communication’s franchise to serve New York City and a $1 million fine payable to New York State for failing to meet its network buildout obligations agreed to as part of its 2016 merger with Time Warner Cable.

“It is critically important that regulated companies strictly adhere to the state’s rules and regulations,” said Commission chair John B. Rhodes. “If a regulated entity like Charter’s cable business decides to violate or ignore the rules, we will take swift action and hold them accountable to the full extent of the law.”

The most serious potential consequence is the revocation of Charter’s franchise agreement with New York City, which would force the cable operator out of the most important media market in the country. The Commission has opened an official proceeding to investigate whether Charter has tried to achieve its network expansion targets by using addresses in New York City where the company was allegedly already offering service or should have been.

Is Charter Meeting its Buildout Obligations in New York?

One of the key requirements Charter had to meet in New York in return for approval of its buyout of Time Warner Cable was an expansion of its cable footprint to at least 145,000 additional New York homes or businesses over a four-year buildout period. These “passings” — where service would be available for the first time, had to be in areas where the company was not already compelled to offer service through its existing franchise agreements. This requirement was designed to overcome the cable company’s traditional objections to servicing a location because of inadequate Return On Investment. A detailed audit performed by the Commission discovered more than 14,000 ineligible passings included by Charter in its December milestone report. Once these addresses were disqualified, Charter fall short of its obligation by more than 8,000 passings. As a result, this triggers an automatic $1 million fine, payable each time Charter fails to meet its agreed-upon buildout milestones.

New York City officials were concerned that Charter’s most recent milestone report asserted the cable company expanded service to 12,467 addresses in New York City, despite an existing franchise agreement with the city that included requirements that would guarantee those addresses either already had or should have had cable service available. If those allegations are proven true, Charter attempted to meet its buildout obligations by fudging the numbers.

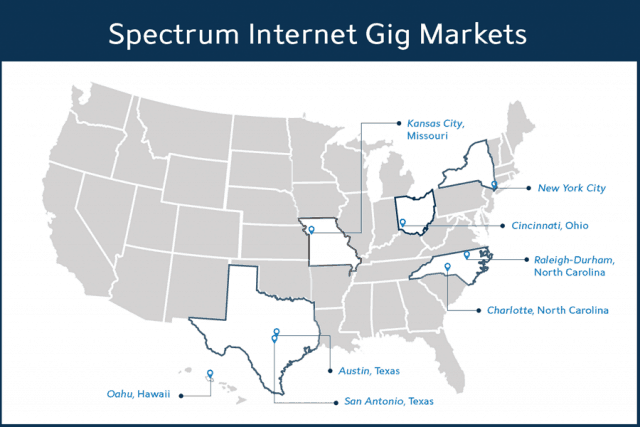

“Metropolitan NYC is one of the most-wired cities in America and the world, and essentially, 100% of the NYC areas are served by one or more 100 Megabits per second (Mbps) wireline providers

such as Verizon FiOS, Cablevision, RCN, and Charter itself,” the Commission wrote.

The PSC’s staff conducted detailed reviews of 490 of those addresses claimed by Charter as having cable service available for the first time. None of them were found to be valid for inclusion in Charter’s service expansion reports, either because they were already serviced by Charter’s network or received service from a competing provider offering at least 100 Mbps service, or both.

In two instances, the staff found Charter was claiming new service expansion in buildings clearly already covered by the city’s existing franchise agreement.

In two instances, the staff found Charter was claiming new service expansion in buildings clearly already covered by the city’s existing franchise agreement.

“In a more egregious example, Charter also listed the Reuters Building as countable toward the December 2017 target in Charter’s January 2018 filing, which has a listed address of 3 Times Square,” the PSC wrote. “Staff could not find any photos of the building prior to 2014 beside aerial views, but construction was completed in 2001, well before the effective date of the current franchise agreements.”

In either case, Charter may be stuck between a rock and a hard place. If the company argues it did, in fact, provision cable service only recently, Charter probably materially breached its franchise agreement with the city, providing immediate grounds to begin franchise revocation proceedings under PSL §227.11. If Charter argues instead it was in compliance with its franchise agreement and did in fact already offer cable service to those addresses, Charter would be subject to an investigation about why it misled the regulator by claiming those locations as “new passings” when they were not.

Franchise Fee Dispute

A second controversy involves the amounts of franchise fee payments payable to New York City. City officials claim those payments have declined year-over-year since Charter completed its merger with Time Warner Cable.

Rhodes

A decline in franchise fee payments could be the result of cord-cutting, which has taken its toll on cable TV subscriptions at almost every cable company in the country. The fewer cable TV subscribers, the more likely revenue declines are going to occur, which in turn cuts franchise fee payments.

Charter Communications’ business model is also a departure from its predecessor, Time Warner Cable. In addition to ending many pricing promotions, Charter also stopped marketing stripped down, budget-conscious television packages. Many customers also faced dramatic rate increases as a result of Charter’s new bundled TV packages, which in some cases required customers to pay substantially more to keep all the channels included in their original Time Warner Cable package. As a result, many customers changed providers. Others decided to “cut the cord” and drop television service altogether while retaining broadband. The franchise fee does not apply to internet or phone service — just television.

Still, the PSC wants to audit Charter’s books to verify the company’s accounting has not departed from Time Warner Cable’s interpretation of the franchise fee agreement and unfairly undercut the city.

Charter has been given 21 days to respond with clear and convincing evidence it is not in violation of its franchise agreement with New York City or its merger obligations with New York State. If the Commission does not receive satisfactory evidence by the deadline, it is likely to begin hearings on whether Charter has committed material breaches of its agreements serious enough to warrant fines and/or franchise revocation.

Subscribe

Subscribe

“They basically said that until we agree that they don’t have to contribute to our pension and health plan, they won’t talk about anything else,” Chris Erikson, business manager of Local 3,

“They basically said that until we agree that they don’t have to contribute to our pension and health plan, they won’t talk about anything else,” Chris Erikson, business manager of Local 3,  Charter Communications will have to face a courtroom to answer accusations the cable company intentionally sold internet service at speeds it knew it could not provide to its customers in New York.

Charter Communications will have to face a courtroom to answer accusations the cable company intentionally sold internet service at speeds it knew it could not provide to its customers in New York.

Charter did not restart its digital television conversion program until June of 2017, and 30% of Time Warner Cable and 50% of Bright House Networks customers are still watching analog cable television as a result. Company officials promise digital conversion will be completed nationwide by the end of this year, the first step the company will take to make dramatic broadband speed increases possible.

Charter did not restart its digital television conversion program until June of 2017, and 30% of Time Warner Cable and 50% of Bright House Networks customers are still watching analog cable television as a result. Company officials promise digital conversion will be completed nationwide by the end of this year, the first step the company will take to make dramatic broadband speed increases possible.