The New York Public Service Commission has notified Charter Communications it won’t be the victim of an offer that promises one thing and delivers something less, giving the company 14 days to fully accept the terms of its Time Warner Cable/Charter merger approval or face the possibility of having the merger canceled, potentially throwing Charter’s business plans into chaos.

The New York Public Service Commission has notified Charter Communications it won’t be the victim of an offer that promises one thing and delivers something less, giving the company 14 days to fully accept the terms of its Time Warner Cable/Charter merger approval or face the possibility of having the merger canceled, potentially throwing Charter’s business plans into chaos.

In a move any aggrieved cable customer would appreciate, Charter’s lawyers gave the PSC a deal that looked good on the surface, only to be eroded away in the fine print. In a May 2018 response to the Commission’s “show cause” order, threatening to severely fine the cable company for breaking its commitments to New York State, the cable company effectively responded it wasn’t their fault if the Commission missed the fact the company did not actually agree to everything the state thought it did, and was in full compliance of what it unilaterally agreed to do.

The hubris of the state’s largest cable operator did not go down well in Albany, to say the least. But first some background:

Charter is coming under fire in New York State for failing to meet its obligations to extend service in a timely way to 145,000 New York homes and businesses not part of Spectrum’s service area and also lack access to broadband service. Today the Commission, in a separate action, fined Charter $2 million, to be drawn from a line of credit previously set aside by the cable company, for failing to meet its original broadband buildout targets and failing to remedy its past poor performance.

Charter’s lawyers last month protested their innocence, claiming the company was not out of compliance with its agreement — in fact it was ahead of schedule.

Both things cannot be true, so who is being honest and who is trading in “alternative facts?”

To find out, one has to turn back the clock to 2016. On January 19, Charter’s attorneys sent an acceptance letter to the Commission in response to the regulator’s offer to approve the acquisition of Time Warner Cable if Charter agreed to a series of pro-consumer benefits designed to allow New York customers to share in the lucrative deal.

Charter agreed to dramatically increase Standard internet speeds for its New York customers, first to 100 Mbps by the end of 2018 and again to 300 Mbps by the end of 2019. Charter met its first commitment ahead of schedule and is on track to again increase speeds for New York residents before the end of next year.

Charter agreed to dramatically increase Standard internet speeds for its New York customers, first to 100 Mbps by the end of 2018 and again to 300 Mbps by the end of 2019. Charter met its first commitment ahead of schedule and is on track to again increase speeds for New York residents before the end of next year.

The company also agreed to temporarily retain Time Warner Cable’s $14.99 Everyday Low Price Internet program. Although that option has since expired for new customers, existing customers can keep the package until at least next year. But regulators note Charter has frequently made it difficult for New York customers to sign up for the program. Stop the Cap! has documented multiple instances of customers being told the plan was unavailable, or representatives have confused it with Spectrum Internet Assist, a similar budget-priced internet package for those that meet certain income and benefits qualifications.

But Charter’s agreement to expand its service to unserved areas of New York is where most of the current conflict arises. Stop the Cap! strongly recommended in our testimony to the PSC that rural broadband expansion be a part of a series of deal commitments that should be imposed on Charter if the Commission saw fit to approve the merger. The Commission agreed with our recommendation. That allows us to speak authoritatively that the Commission, in concert with the New York State government, framed that expansion commitment as an adjunct to the state’s Broadband 4 All program, Gov. Andrew Cuomo’s rural broadband expansion effort.

Charter would serve an integral role in the effort by extending service to homes and businesses just outside of its current service area. That would save the state millions in costs trying to subsidize other providers to expand into these typically unprofitable areas of the state. The design and intention of the expansion program was clear from the outset, and the Commission specifically requested Charter provide detailed lists of planned expansion areas, so the state could avoid duplicating its efforts and re-target funding to other areas of the state. The goal was to achieve near-universal broadband availability in every corner of New York.

The Commission’s 2016 letter to Charter seemed clear enough:

The conditions adopted in this Order and listed in Appendix A shall be binding and enforceable by the Commission upon unconditional acceptance by New Charter within seven (7) business days of the issuance of this Order. If the Petitioners’ unconditional acceptance is not received within seven (7) business days of the issuance of this Order, the Petitioners will have failed to satisfy their burden under the Public Service Law as described herein, and this Order shall constitute a denial of the Joint Petition.

But in Charter’s response on January 19, 2016, their lawyers got too cute by half (emphasis ours):

In accordance with the Commission’s Order Granting Joint Petition by Time Warner Cable Inc. (“Time Warner Cable”) and Charter Communications, Inc. (“Charter”) dated January 8, 2016, Charter hereby accepts the Order Conditions for Approval contained in Appendix A, subject to applicable law and without waiver of any legal rights.

On May 9, 2018 the state discovered what that language discrepancy meant. Charter’s lawyers responded to the state’s charges that the company was not complying with the terms of the merger approval agreement with a classic “gotcha” letter, claiming Charter’s agreement provided only a “qualified” acceptance of language contained exclusively in Appendix A, and its obligations started and stopped there.

On May 9, 2018 the state discovered what that language discrepancy meant. Charter’s lawyers responded to the state’s charges that the company was not complying with the terms of the merger approval agreement with a classic “gotcha” letter, claiming Charter’s agreement provided only a “qualified” acceptance of language contained exclusively in Appendix A, and its obligations started and stopped there.

That is a distinction worth millions of dollars. Appendix A basically summarizes Charter’s commitment to expand to 145,000 new passings in New York, but does not explain the expansion program or its purpose. If only Appendix A did apply, it would allow Charter to count any new cable hookup, whether in a rural hamlet or more likely in a condo in Manhattan as a “new passing,” bringing it one customer closer to meeting its expansion commitment. Charter could count new wealthy gated communities, apartment buildings, offices, and converted lofts, despite the fact it would almost certainly wire those customers for service with or without its agreement with the state government. More importantly, Charter would successfully avoid spending tens of thousands of dollars to extend the cable line down a road just to reach one or two rural customers.

Charter’s lawyers seem to think that their clever loophole will win the company significant savings and avoid fines — too bad, so sad if the state’s lawyers failed to appreciate what Charter was actually willing to agree to in 2016 and what the state accepted by default by not catching the discrepancy sooner.

“Contrary to [Charter’s] assertions, however, the Approval Order accorded Charter only two explicit choices: (1) to accept unconditionally the commitments set forth in the body of the Approval Order and Appendix A; or (2) have the Joint Petition rejected, subject to Charter’s right to judicial review,” the Commission rebutted.

In short, the state is calling Charter’s possible bluff. If it truly intends not to agree to the original terms of the agreement, the state has the right to toss out the merger agreement, in part or in full, canceling the merger. Of course, Charter can always take the matter to court and hope it can find a judge that will accept Charter’s ‘partial agreement’ argument.

To say the PSC was displeased with Charter’s novel legal maneuver would be an understatement. In today’s ruling, the PSC severely admonished Charter for its bad behavior:

Charter was not free to pick and choose the conditions it would accept or the portions of the Approval Order with which it would comply, nor was Charter free to accept only some of the conditions in the Approval Order and Appendix A yet still obtain Commission approval of the merger transaction. Charter is likewise not free to rewrite the Commission’s conditions.

In effect, Charter is ripping off the people of New York, and the state’s regulators are having none of it.

In effect, Charter is ripping off the people of New York, and the state’s regulators are having none of it.

“The Commission is troubled by Charter’s position that the Commission’s Approval Order means something other than what it actually states,” the PSC wrote. “Given that many of the obligations in that Order are continuing and will need to be fulfilled in the future, the Commission believes it is critical that Charter acknowledge the obligations it agreed to undertake in exchange for the benefits it received by the Commission’s conditional approval. Anything short of an unconditional full acceptance of the Approval Order and Appendix A would deprive New York state of its fair share of the incremental benefits.”

It is likely we will know where this is headed by mid-July, because the PSC has given Charter 14 days to recommit itself to the PSC’s original merger terms, not just those in infamous Appendix A. It signaled it will no longer debate the matter, either, telling Charter “the Commission will not countenance that conduct” and wants action:

Charter is directed to cure its defective acceptance and file with the Secretary to the Commission a new letter indicating its full unconditional acceptance of the Approval Order and Appendix A thereof within 14 days.

Should Charter, however, fail to provide a new letter indicating full unconditional acceptance, the Commission may pursue other remedies at its disposal, including but not necessarily limited to the following.

First, beginning proceedings pursuant to PSL §216 to rescind, modify or amend the Approval Order, specifically, the Commission’s approval of the transfer of the Time Warner’s cable franchises and associated facilities, networks, works and systems to Charter, in whole or in part.

Second, initiate an enforcement action pursuant to PSL §26 for failing to comply with the Approval Order’s Ordering Clause 1 including an action in Supreme Court to adjudicate the dispute and/or declare the Commission’s conditional approval null and void for lack of an unconditional acceptance.

And, third, initiate a penalty action for being out of compliance with the Approval Order’s unconditional acceptance requirement under PSL §25.

It’s a teachable moment for regulators, one that cable customers have come to learn over decades of bad experiences. It’s never a good idea to trust a cable company.

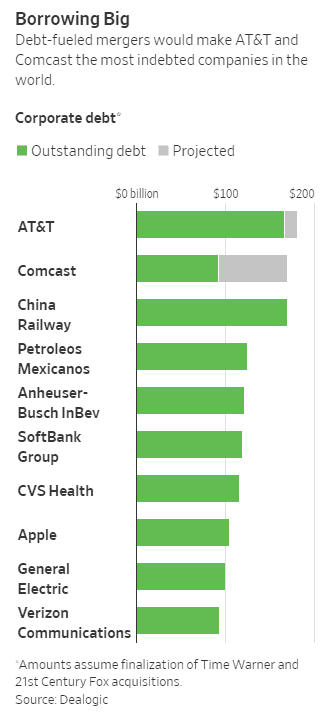

If Comcast’s $65 billion all-cash offer for 21st Century Fox is accepted, America’s largest cable operator will also be among the world’s largest corporate debtors, owing $170 billion in all.

If Comcast’s $65 billion all-cash offer for 21st Century Fox is accepted, America’s largest cable operator will also be among the world’s largest corporate debtors, owing $170 billion in all. AT&T and Comcast officials told the Journal any fears are unwarranted; they are different from most companies because their respective debts are expected to be repaid quickly with higher levels of cash generated by their businesses. AT&T claims it could apply the $8-10 billion of its anticipated free cash flow from the merger with Time Warner to reduce debts, although that could threaten shareholder perks like dividend payouts and share buybacks, as well as customer-focused network upgrades.

AT&T and Comcast officials told the Journal any fears are unwarranted; they are different from most companies because their respective debts are expected to be repaid quickly with higher levels of cash generated by their businesses. AT&T claims it could apply the $8-10 billion of its anticipated free cash flow from the merger with Time Warner to reduce debts, although that could threaten shareholder perks like dividend payouts and share buybacks, as well as customer-focused network upgrades.

Subscribe

Subscribe The New York Public Service Commission has

The New York Public Service Commission has  Charter agreed to dramatically increase Standard internet speeds for its New York customers, first to 100 Mbps by the end of 2018 and again to 300 Mbps by the end of 2019. Charter met its first commitment ahead of schedule and is on track to again increase speeds for New York residents before the end of next year.

Charter agreed to dramatically increase Standard internet speeds for its New York customers, first to 100 Mbps by the end of 2018 and again to 300 Mbps by the end of 2019. Charter met its first commitment ahead of schedule and is on track to again increase speeds for New York residents before the end of next year. On May 9, 2018 the state discovered what that language discrepancy meant. Charter’s lawyers responded to the state’s charges that the company was not complying with the terms of the merger approval agreement with a classic “gotcha” letter, claiming Charter’s agreement provided only a “qualified” acceptance of language contained exclusively in Appendix A, and its obligations started and stopped there.

On May 9, 2018 the state discovered what that language discrepancy meant. Charter’s lawyers responded to the state’s charges that the company was not complying with the terms of the merger approval agreement with a classic “gotcha” letter, claiming Charter’s agreement provided only a “qualified” acceptance of language contained exclusively in Appendix A, and its obligations started and stopped there. In effect, Charter is ripping off the people of New York, and the state’s regulators are having none of it.

In effect, Charter is ripping off the people of New York, and the state’s regulators are having none of it. (Reuters) – Comcast Corp offered $65 billion on Wednesday for 21st Century Fox’s media assets, emboldened by AT&T prevailing over the Trump administration’s attempt to block a merger with Time Warner, Inc..

(Reuters) – Comcast Corp offered $65 billion on Wednesday for 21st Century Fox’s media assets, emboldened by AT&T prevailing over the Trump administration’s attempt to block a merger with Time Warner, Inc.. Shares of Comcast, Fox and Disney were barely changed in after-hours trade.

Shares of Comcast, Fox and Disney were barely changed in after-hours trade.

With Comcast on the verge of picking up much of 21st Century Fox’s content library and studio, Comcast will be able to defend its own turf creating similar giant bundles of content to keep its customers happy. Wall Street is already putting pressure on Verizon to respond with an acquisition of its own to protect its base of FiOS and Verizon Wireless customers.

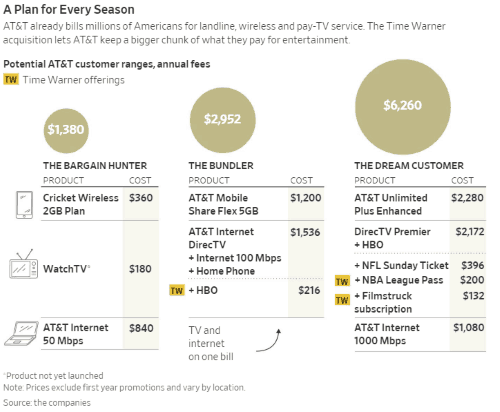

With Comcast on the verge of picking up much of 21st Century Fox’s content library and studio, Comcast will be able to defend its own turf creating similar giant bundles of content to keep its customers happy. Wall Street is already putting pressure on Verizon to respond with an acquisition of its own to protect its base of FiOS and Verizon Wireless customers. AT&T has won its $85 billion bid to acquire Time Warner, Inc., overturning Justice Department opposition in a court case and completely rejecting allegations the merger was anti-consumer and would raise prices by suppressing competition. The favorable decision is expected to signal the business community the time is right for several more multi-billion dollar media mergers.

AT&T has won its $85 billion bid to acquire Time Warner, Inc., overturning Justice Department opposition in a court case and completely rejecting allegations the merger was anti-consumer and would raise prices by suppressing competition. The favorable decision is expected to signal the business community the time is right for several more multi-billion dollar media mergers.